Taiga Motors Corporation (TSX: TAIG) announced its fourth quarter and full-year financial results earlier this week, wherein the company reported that its pre-order bookings increased 161% to 2,356 units as of December 31st, 2021, with fleet operators accounting for roughly 20% of the order book. They also said that production of its electric snowmobiles started during the quarter, with the deliveries starting in the middle of March.

Taiga Motors ended the year with $87 million in cash, while the company announced that due to the global semiconductor shortage, it has only sourced chips for 1,000 of its units and expects 2022 production to be limited by further factors, “including the availability of raw materials and other components, manufacturing process optimization and volume-related cost efficiencies. For 2023, Taiga has strategically procured certain long-lead components in line with its expected production ramp-up.”

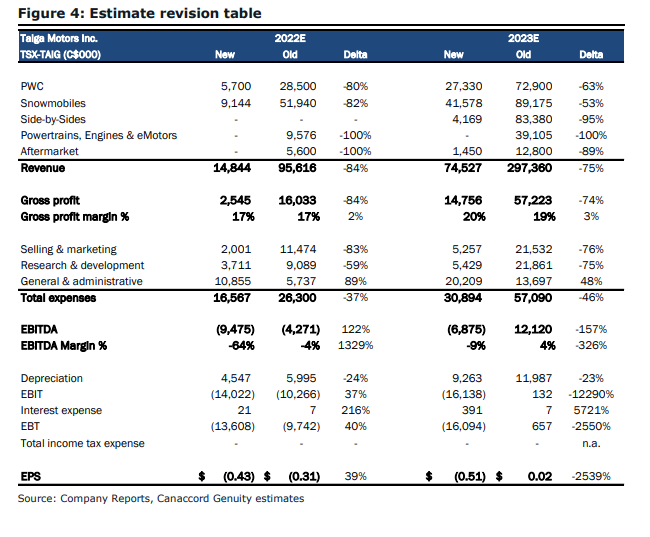

In Canaccord Genuity Capital Markets note on the results, they reiterated their buy rating but slashed their 12-month price target from C$22 to C$9, saying that they remain optimistic for the company in the long-term, but they do realize “the semiconductor shortage has led to a challenging operational backdrop for Taiga, leading to a more muted outlook for near-term growth.”

They say that the company’s 2,356 orders in their book are down from their third-quarter number of 2,490 units, but say that the company has now shifted towards a hybrid direct-to-consumer model and that’s why the order book has been lowered. The decline is due to the company canceling 345 pre-orders by dealers and will instead use them as points of delivery and service. Netting those out, Taiga saw an increase of 211 new orders during the fourth quarter.

Canaccord adds that Taiga’s rollout of its off-road charging network has “progressed during Q4/21.” The company expects to have 1,100 total charging locations by 2025.

Going forward Canaccord expects Taiga to focus on ramping up its production facility as well as getting more products shipped to customers. Though they write, “widespread raw materials shortages, including the well-documented semiconductor shortages worldwide, have dampened Taiga’s outlook for production in 2022.”

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.