Piedmont Lithium (Nasdaq: PLL) stated on Tuesday that it has revised its deal with Tesla (Nasdaq: TSLA) to supply the automaker with spodumene concentrate (SC6), a high-purity lithium ore with a lithium content of roughly 6%.

In the new agreement, Piedmont will deliver 125,000 metric tons of SC6 to Tesla beginning in H2 2023 and continuing through the end of 2025, with pricing determined by a “formula-based mechanism linked to average market prices for lithium hydroxide monohydrate throughout the term of the agreement.” The deal includes an option to renew for another three years.

“We are pleased to be able to partner with Tesla to supply lithium resources produced in North America,” said Piedmont Lithium CEO Keith Phillips. “This agreement helps to ensure that these critical resources from Quebec remain in North America and support the mission of the Inflation Reduction Act to bolster the U.S. supply chain, the clean energy economy, and global decarbonization.”

Spodumene concentrate production at North American Lithium (NAL) is planned to resume in H1 2023, with the first commercial shipments beginning in Q3 2023. Piedmont intends to deliver SC6 to Tesla from NAL in accordance with Piedmont’s offtake agreement with Sayona Quebec, which entitled Piedmont to the greater of 113,000 metric tons per year or 50% of SC6 output. Piedmont’s SC6 purchases from Sayona Quebec are subject to floor and ceiling pricing during the mine’s life.

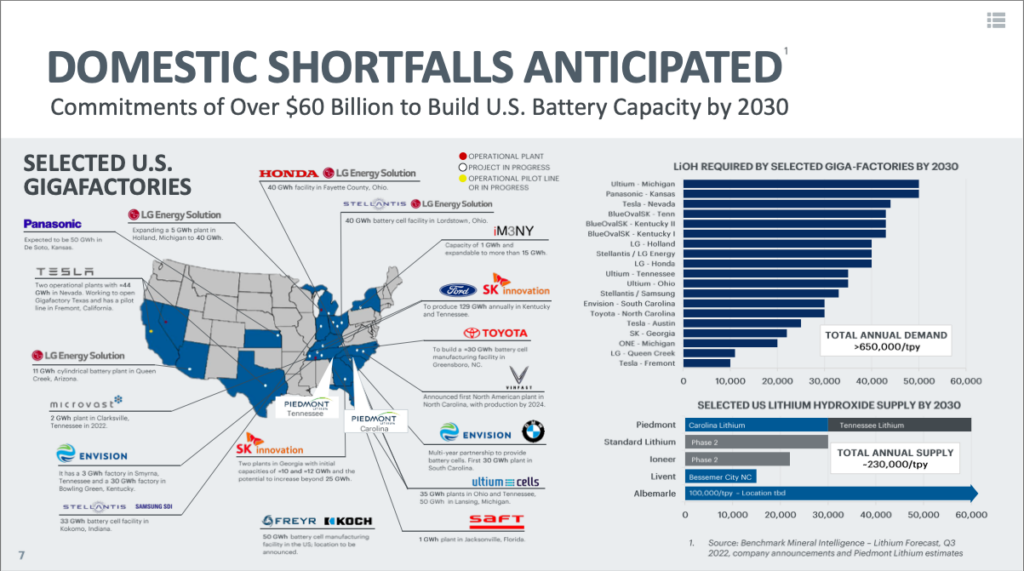

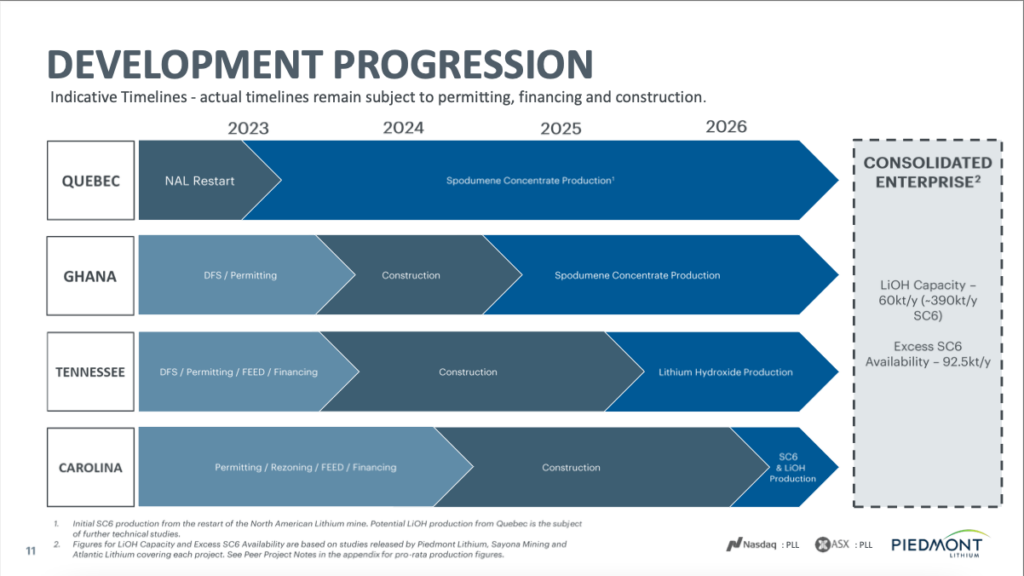

Prior to the revised agreement, Piedmont in November said in a presentation that it has garnered over $60 billion in commitments to build US battery capacity by 2030. The firm isn’t producing yet but has four projects in development: Quebec, Ghana, Tennessee Lithium, and Carolina Lithium.

At its Quebec mine, annual production yield is expected to be 168,000 tonnes of SC6.

This is a revision of the initial offtake agreement inked by the two firms in September 2020, which provided a five-year term on a fixed-price binding purchase commitment “representing approximately one-third of Piedmont’s planned SC6 production of 160,000 tonnes per annum.” The agreement then was subject to Tesla and Piedmont agreeing on a start date for spodumene concentrate deliveries between July 2022 and July 2023 based on both parties’ development timetables.

In August 2021, Piedmont identified that it will delay the first shipments of lithium chemicals to Tesla and that it does not have a definitive date for when deliveries could begin. The initial agreement was supposed to see Piedmont delivering lithium to Tesla from its Carolina Lithium mine.

According to Reuters, North Carolina officials had expressed worries about Piedmont’s project then, which would be one of the largest lithium mines in the United States, and may now block or delay it.

A class action lawsuit was also launched against the firm in the month prior of that report, alleging that Piedmont executives misled investors about the project’s development timeframe. Piedmont stated on Monday that it believes the claim is “to be entirely without merit and [it] will defend [itself] vigorously.”

The Inflation Reduction Act signed in September is boosting the lithium market with EV makers potentially receiving tax credits enough to offset more than a third of the cost of EV battery packs if the batteries are produced and packaged in the US.

READ: Is The New Tax Law About To Make US Lithium Companies Hot?

While it poses great potential, Tesla’s deal with Piedmont was marred with an insider trading case after a former Tesla executive pleaded guilty in November to the charges after purchasing stock in a lithium mine before a deal with the company was revealed.

READ: Ex-Tesla Exec Enters Guilty Plea To Insider Trading On Piedmont Lithium

The Piedmont deal is one of the few strides by the electric carmaker to solidify its supply chain for its batteries. Most EV companies have thus far refrained from taking on direct stakes in the mineral mining business, but as Western governments increasingly look to ban combustion engines, big carmakers will likely seek ties with the mining industry to secure supplies for their electric vehicles.

Piedmont Lithium last traded at $49.11 on the Nasdaq.

Information for this briefing was found via Reuters, Seeking Alpha, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.