Ark Investment Management recently released a report on lithium’s prospects, essentially drawing the conclusion that an increase in prices is correlated to an increase in production supply.

“Lithium supply reacts to pricing signals, and the price it’s a signaling,” wrote Director of Research Autonomous Technology & Robotics Sam Korus.

Further, Korus explained that in 2017, the price of lithium nearly doubled to $15,000 per metric ton, and supply responded. Lithium is now worth $70,000 per metric ton, suggesting that on a high level, supply did not respond sufficiently based on basic economic principles.

1/Lithium supply reacts to pricing signals, and the price it's a signaling.

— Sam Korus (@skorusARK) February 14, 2023

The price of lithium roughly doubled in 2017 to $15,000 per metric ton and supply reacted. Now lithium is at ~$70,000 per metric ton pic.twitter.com/cUNgCb8IxP

“Albemarle says $20,000 per metric ton is what’s needed to support the projects to meet demand through 2030,” Korus added. “Well below current levels, but above historical norms.”

The investment firm’s report added that “it would only take around ~$30 billion in capex to bring the new mines online” to meet the demand expectations. This is stated to be far over satisfied by the global automakers earmarking “~$600 billion for battery investments over the next 10 years.”

Wood’s law of increased demand and increased supply?

Along came Ark Invest CEO Cathie Wood, who noted that the increase in lithium prices “is a clarion call for more production and supply.”

“Now that CATL in China, Samsung and LG in Korea, and major auto makers have committed to the [electric vehicle] revolution, odds are high that lithium will be in excess supply,” Wood said.

The 10-fold increase in lithium prices during the past two years is a clarion call for more production and supply. Now that CATL in China, Samsung and LG in Korea, and major auto makers have committed to the EV revolution, odds are high that lithium will be in excess supply… https://t.co/wBrIkQphgV

— Cathie Wood (@CathieDWood) February 15, 2023

Lithium is a critical component in electric vehicle (EV) batteries, but global supplies are being squeezed due to increased EV demand. The world could face lithium shortages by 2025, the International Energy Agency (IEA) believes, while Credit Suisse thinks demand could double between 2020 and 2025, meaning “supply would be stretched.”

Global lithium output totaled 100,000 tons in 2021, with global reserves estimated to be around 22 million tons, according to the US Geological Survey. When lithium production is divided by the quantity required per battery, it is shown that enough lithium was mined in that year to produce just under 11.4 million EV batteries.

According to the IEA, around 2 billion EVs must be on the road by 2050 for the world to achieve net zero emissions, but sales were only 6.6 million in 2021, and several carmakers have already sold out of EVs.

Using the same method, global reserves are adequate to produce just about 2.5 billion batteries. However, it is also noteworthy that not all of the world’s lithium can be used to make EV batteries. The metal is also used to produce batteries for a variety of other devices, including laptops and mobile phones, as well as planes, trains, and bicycles.

Another major impediment to getting lithium out of the ground and into electric vehicles worldwide is the concentration of these resources in a few regions. China controls roughly 70% to 80% of the global supply chain for electric vehicles and lithium-ion batteries. According to the IEA, Beijing also accounts for 60% of worldwide lithium chemical production and 80% of lithium hydroxide output.

“Five major companies are responsible for three-quarters of global production capacity,” the global agency said.

According to the US Geological Survey, Australia had the greatest output in 2021, although Chile has the world’s largest lithium deposits. The South American country is part of the so-called “Lithium Triangle,” which also includes Argentina and Bolivia. According to the 2021 US Geological Survey’s Mineral Commodity Summary, these three countries contain just under 60% of the world’s lithium resources.

Excess supply?

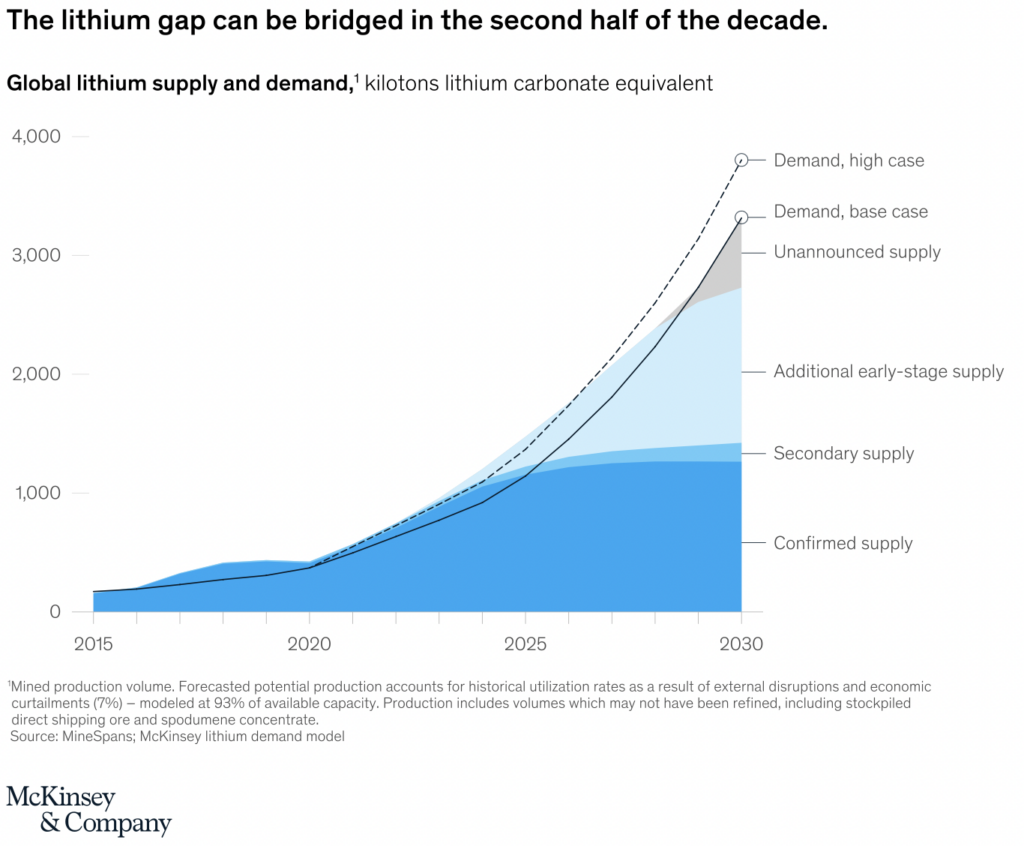

Global management consulting firm McKinsey & Company noted that their analysis sees lithium demand of 3.3 million metric tons or a compounded 25 percent growth rate.

“Due to the short lead times associated with new lithium production, we only have visibility of 2.7 million metric tons of lithium supply in 2030; we expect the remainder of the demand to be filled by newly announced greenfield and brownfield expansions,” the firm wrote in its April 2022 report.

The consulting agency also added that while forecasted demand and supply indicate a balanced industry for the short term, “there is a potential need to galvanize new capacity by 2030.”

The increase in production capacity for lithium mining isn’t also going to be as fast as the rise in demand. Korus himself pointed out that it takes 9-15 years before a lithium mine prospect gets to go online for commercial production.

He, however, noted that “battery supply chain development is being encouraged by the government.”

5/In recent history places didn't want mining, which made it difficult to get through the permitting process.

— Sam Korus (@skorusARK) February 14, 2023

Now battery supply chain development is being encouraged by the government. That's a big change. …not to mention once those big auto lobbyists get behind the cause. pic.twitter.com/rbQw494Jbg

It is undeniable that lithium production should ramp up to match the potential demand from the sector. But Wood’s prediction of seeing an excess in supply, stemming from increased prices and increased demand, is overlooking a huge step in the process–building capacity.

READ: Cathie Wood’s Big Ideas 2023 Sees Disruptive Innovation To Be Bigger Than Global GDP

Lithium carbonate prices in China plummeted to CNY 472,500 a tonne in February, the lowest since June 2022 and more than 20% below their all-time high of CNY 600,000 in November, as increased supply and projections of lower demand led industry players to forecast a market surplus this year.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.