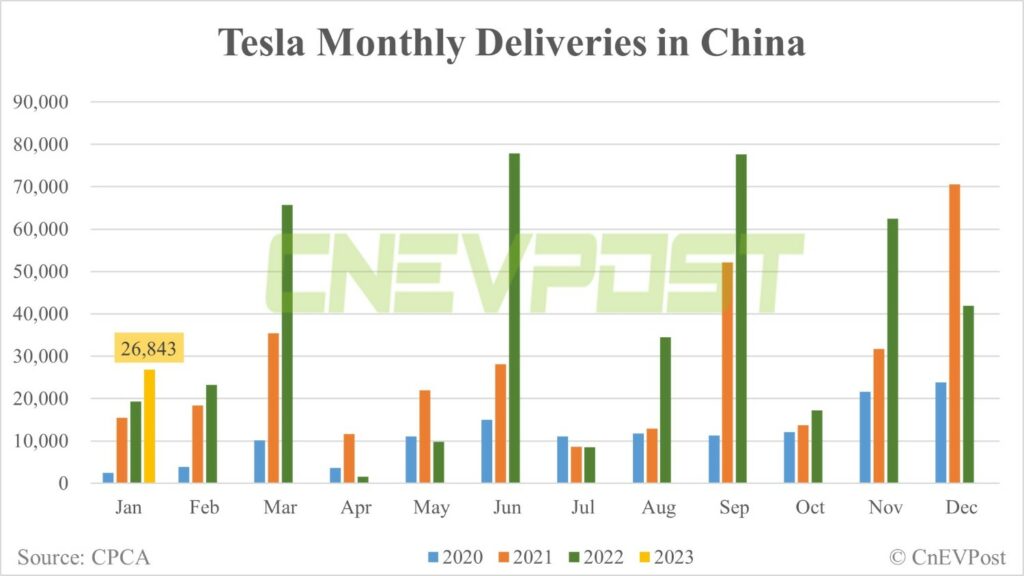

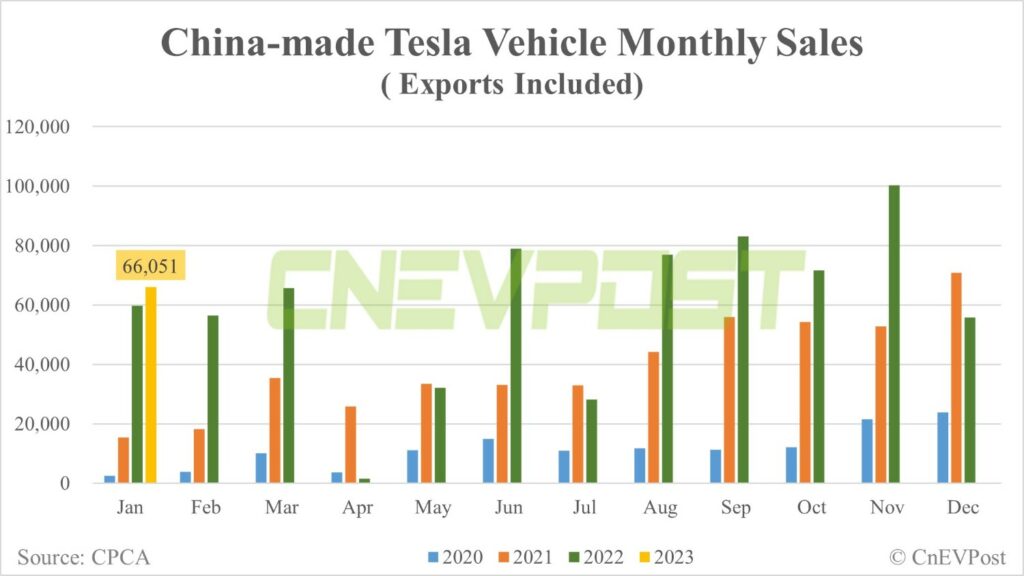

Tesla (Nasdaq: TSLA) sold a total of 66,051 vehicles made in its China plant in January, according to data from the China Passenger Car Association (CPCA). Of these vehicles, 39,208 were exported while 26,843 were delivered in China.

The January figures show that deliveries in China dropped by 35.98% coming from 41,926 units delivered in December 2022, but the January 2023 performance was 38.75% better than the year before.

The numbers also show that Tesla’s market share in China was at 8.09% in January, out of 332,000 new energy vehicles (NEVs) that were sold — a bump up from the 6.55% market share in December 2022.

Total January sales are up 18.38% from December and 10.37% from the year before. These figures reflect sales after Tesla slashed the prices for the full Model 3 and Model Y lineup in China.

The Shanghai plant makes the Model 3 sedan and the Model Y crossover. The company sold, including exports, 40,903 Model Y units and 25,148 Model 3 units from the plant in January.

It was previously reported that the company paused its production at the Chinese plant before Christmas last year as demand for vehicles slowed following massive surges in Covid infections when Beijing relaxed its years-long zero-Covid policy. Production at the plant was on-and-off for most of 2022 coming from Covid restrictions and supply chain shortages.

Notably, in January, total passenger car sales in China, at 1.29 million units, was down 40% from December, and 38% from the year before.

Information for this story was found via CPCA, CnEVPost, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.