The Financial Industry Regulatory Authority Inc. (FINRA) cautions that initial public offerings (IPOs) by international small-cap issuers are increasingly being exploited in manipulative trading schemes like pump-and-dump strategies.

“FINRA has observed significant unusual price increases on the day of or shortly after the IPOs of certain small-cap issuers, most of which involve issuers with operations in other countries,” the self-regulatory organization said in a statement.

These are often minor IPOs (less than $25 million) with a small number of shares issued (less than 20 million). Many of the issuers are Chinese, with Hong Kong-based broker-dealers receiving the majority of the IPO proceeds, restricting the number of publicly available shares.

“Some of the investors harmed by ramp-and-dump schemes appear to be victims of social media scams,” the organization added.

FINRA advises investors to exercise caution and urges that “underwriters, as gatekeepers, must continue to be vigilant in this regard, particularly when dealing with offshore participants in the underwriting and foreign broker-dealers receiving allocations of shares.”

Earlier in October, the Nasdaq stock exchange halted the preparations for at least four small Chinese companies’ IPOs while it probes short-lived stock rallies of such firms following their debuts.

According to attorneys and bankers that work on such stock launches, the big board decided to stay the pending IPOs amid a boom in the shares of Chinese companies that raise tiny amounts, often $50 million or less, in their IPO. These companies will then see stocks rise up to 2,000% in their IPOs, only to plummet in the days that follow, punishing investors who are brave enough to wager on penny stocks.

Small Chinese firms have been drawn to Nasdaq’s exchange rather than the New York Stock Exchange because the former has traditionally been the site for red-hot technology startups – an image these firms frequently aim to create.

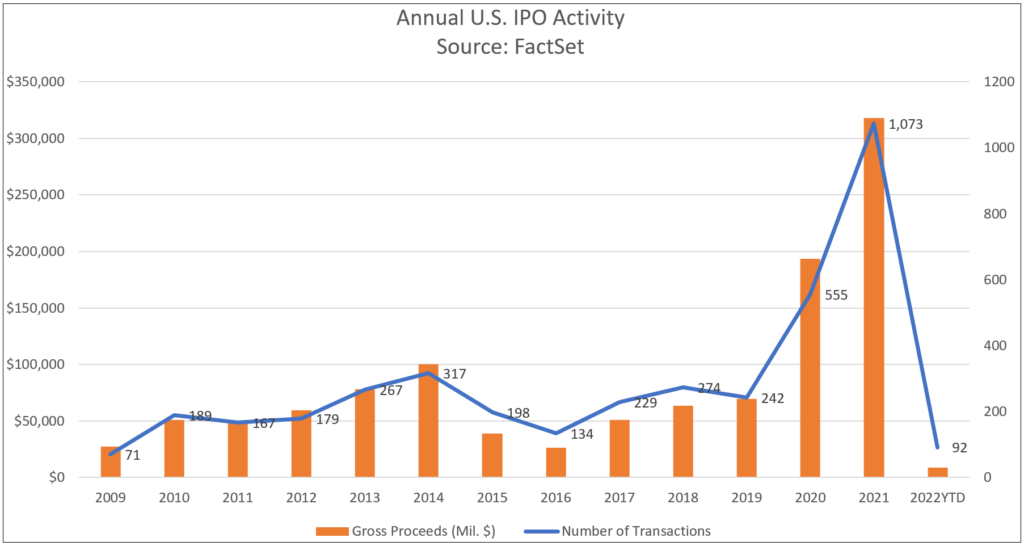

So far this year, nine such listings have occurred, despite the fact that the US IPO market is experiencing its worst drought in almost two decades due to market instability caused by the Federal Reserve boosting interest rates to combat inflation.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.