In another Elon-tweets-let-there-be-light-and-there-was-light moment, Tesla (Nasdaq: TSLA) hiked its prices in US and China after its CEO tweeted a teaser for the rising inflation’s effect on the company.

In the US, all Tesla models saw around a 5-10% increase in their retail prices. The most affordable Model 3 Rear-Wheel Drive now starts at US$46,990, a jump from US$44,990.

In China, Model 3 and Model Y vehicles also increased their prices, with Model 3 Performance now retailing at 367,900 yuan from 359,900 yuan.

This is the second price increase that the carmaker implemented in less than a week.

| Tesla Model Price Increase In The US | From | To |

| Model X Tri Motor | US$126,490 | US$138,990 |

| Model X Dual Motor | US$104,990 | US$114,990 |

| Model S Tri Motor | US$129,990 | US$135,990 |

| Model S Dual Motor | US$94,990 | US$99,990 |

| Model Y Performance | US$64,990 | US$67,990 |

| Model Y Long Range | US$59,990 | US$62,990 |

| Model 3 Performance | US$58,990 | US$61,990 |

| Model 3 Long Range | US$51,990 | US$54,490 |

| Model 3 Rear-Wheel Drive | US$44,990 | US$46,990 |

While the company did not provide any reason for the price hike, Elon Musk floated the idea of how the recent rising inflation might be putting pressure on the company’s raw materials and logistics.

Tesla & SpaceX are seeing significant recent inflation pressure in raw materials & logistics

— Elon Musk (@elonmusk) March 14, 2022

This follows the Bureau of Labour Statistics report last week that saw a 40-year record-high consumer price index of 7.9% in the US.

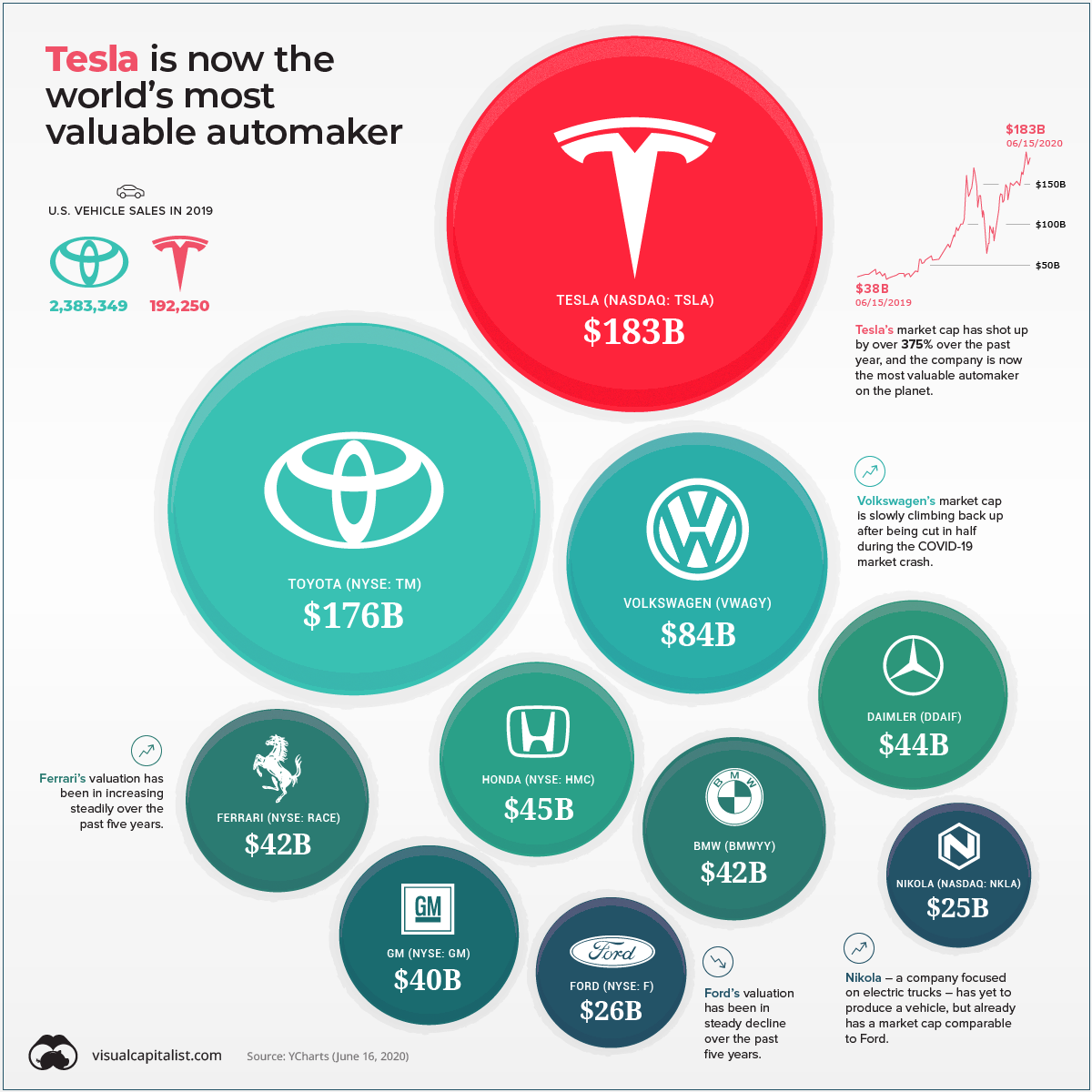

In 2020, Tesla became the most valuable automaker in the world, reaching north of US$183 billion in market cap.

Tesla prices in China are already one of the highest around the globe in terms of percentage of disposable income.

Tesla last traded at US$766.37 on Nasdaq.

Information for this briefing was found via CNBC, The Verge, Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.