Contemporary Amperex Technology Co., Limited (CATL), the world’s largest electric vehicle (EV) battery maker, is reportedly offering sharp discounts on battery purchases to major Chinese auto manufacturers like NIO, Li Auto, Huawei, and ZEEKR, according to the Chinese media outlet 36Kr.

CATL, which produced 37% of the world’s EV batteries in 2022, considers these four EV makers to be “strategic clients.” Interestingly, and remarkably, CATL has not offered any discounts to Tesla Inc. (NASDAQ: TSLA), which has built a gigafactory in Shanghai and is CATL’s largest customer.

The agreements between CATL and the four Chinese auto companies apparently contain three key facets:

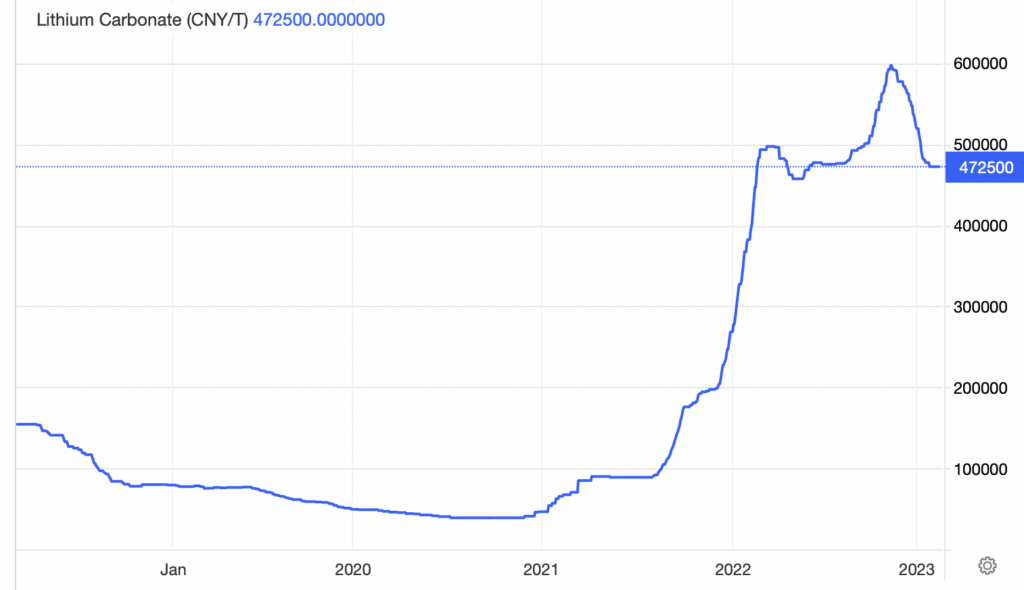

- 1) CATL will sell an undisclosed quantity of batteries to the automakers over the next three years based on a lithium carbonate price of just over US$29,000 per tonne, an eye-opening 58% discount to the current price of US$68,500 per tonne;

- 2) the strategic clients will be required to purchase 80% of their batteries from CATL (presumably over the same three-year period); and

- 3) the new pricing framework begins in 3Q 2023.

At the same time, CATL has requested that its lithium suppliers cut their prices by 10%. There is no word whether the suppliers have agreed to this request.

The jaw-dropping lithium price discount that CATL offered the four Chinese automakers raises the question of whether spot lithium carbonate prices are indicative of the actual market for the commodity. In even simpler terms, have prices risen more than the true demand suggests? Even after correcting about 20% over the last three months, lithium carbonate prices have increased tenfold since the start of 2021.

On February 17, investors in lithium stocks sold first and decided to grapple with this question later. The stocks of leading lithium miners Albemarle Corporation (NYSE: ALB) and Livent Corporation (NYSE: LTHM) each declined about 10% that day; and Lithium Americas Corp. (NYSE: LAC), which expects to begin producing in a few months, lost about 7% of its value.

READ: Sigma Lithium Said To Be In Discussions With Tesla For Buyout

It is unclear if lithium stocks will feel further pressure from CATL’s move this week. Rumors after the regular market close on February 17 that Tesla is weighing a takeover of another startup lithium miner, Sigma Lithium Corporation (NASDAQ: SGML), could potentially cause investor sentiment toward lithium stocks to improve.

It is possible that shares of startup electric vehicle makers like Lucid Group, Inc. (NASDAQ: LCID) and Rivian Automotive, Inc. (NASDAQ: RIVN) could get a boost from the CATL price cuts. If one assumes that battery price discounts will eventually be offered by all battery makers to auto manufacturers, the EV makers could bring in more customers by cutting prices without impacting unit gross margins.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.