Tesla Inc. (NASDAQ: TSLA) is likely losing one source of its regulatory credit revenues, which have been recently critical to the company’s bottom line. This comes after Stellantis NV (NYSE: STLA) announced that it expects to achieve its European CO2 emissions targets this year without environmental credits bought from Tesla.

Stellantis was formed in January on a 50-50 cross-border merger between the Italian-American Fiat Chrysler Automobiles and the French PSA Group. Before the merger, Fiat Chrysler bought European and US carbon dioxide emission credits from Tesla for approximately US$2.40 billion. The credit allocation was to cover regulatory requirements between 2019 – 2021.

The newly-formed merger announced yesterday that the electrical technology PSA brought to Stellantis aided in meeting the CO2 emission regulatory targets for the year. “Thus, we will not need to call on European CO2 credits and [Fiat Chrysler] will no longer have to pool with Tesla or anyone,” said Stellantis CEO Carlos Tavares.

European regulators set 95 grams per kilometer as the target maximum CO2 emissions for private vehicles this year.

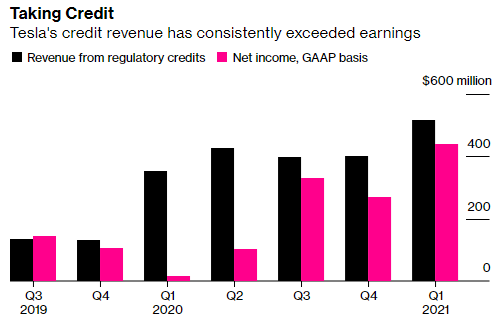

Tesla earns significant revenue from selling its environmental credits from exceeding emissions targets to rival automakers that need help achieving the same. The California-based electric car maker has been steadily increasing its sales from its regulatory credits which helped the company avoid recording net losses.

Stellantis said that it is still open to secure regulatory credits from Tesla in the future should other regions of operations need help in complying with the respective emissions targets.

Tesla Inc. last traded at US$673.60 on the Nasdaq while Stellantis NV last traded at US$16.76 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.