The massive February storm that shut down numerous oil refineries has significantly impacted petrochemical plants, causing extensive disruptions in the global plastic supply.

The rolling blackouts that wreaked devastation across Texas have brought production at petrochemical plants to a standstill. Now, a month later, many of those facilities have yet to resume production, and manufacturers are bracing for the worst: it could be months before they are fully restarted.

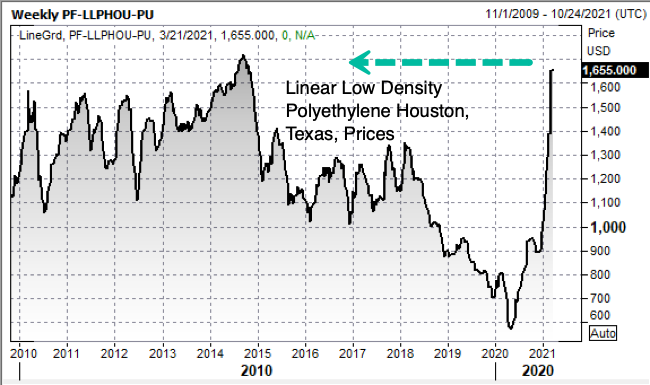

As a result, prices for numerous chemical compounds such as polypropylene and polyethylene have been sent soaring to the highest level in years. Prices for low-density polyethylene film, which is used to make bread bags, shipping sacks, and paper towel overwrap, have almost doubled since the onset of the pandemic. Similarly, prices for linear low-density polyethylene, which is used for plastic wrap, containers, and flexible tubing, have surged to levels not witnessed in over 15 years.

Although the plastic shortage in the Gulf Coast has sent individual plastic prices soaring, demand continues to add overwhelming pressure on continued supply disruptions. Cost increases— which will ultimately be passed down to consumers— are likely going to result, especially as automakers, home builders, and various other businesses experience delays in production.

On Wednesday, Honda Motor Co. announced it would cease production at several of its Canadian and US plants this week, citing supply-chain disruptions as the reason behind the move. Toyota Motor Corp also revealed that production at its factories will be affected by the petrochemical shortage, while PPG Industries Inc, a US-based paint supplier, also said its inputs have been adversely impacted by the Texas storm.

The large-scale impact of the Texas freeze is compounding many of the ongoing problems facing global supply chains in wake of the Covid-19 pandemic. Countless producers have been struggling to meet demand and eliminate bottle-neck shortages, but ongoing Covid-19 infections and enhanced social distancing measures continue to curtail the effort.

Information for this briefing was found via S&P Global Platts. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.