Last week, The Green Organic Dutchman (TSX: TGOD) announced that it would be conducting an $11.0 million bought deal private placement, raising proceeds at $0.24 per unit. With the prospectus filed on Friday, several key items were revealed about the state of the company, and why specifically it’s raising the funds.

At the time of announcement, TGOD had indicated that the use of proceeds would specifically be for “general corporate purposes,” which has become a blanket statement that generally means “we need money.” While this revelation was specific enough for the news release, it was not specific enough for the prospectus that the company was required to file.

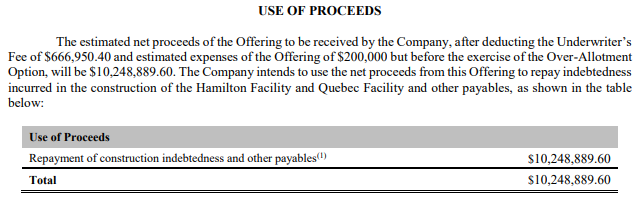

As it turns out, the entire financing is to be used for the “repayment of construction indebtedness and other payables.” With the company expecting gross proceeds from the financing (before a possible over-allotment) of $10,248,889.60, that full amount is slated to go towards payables. Based on the filed prospectus, it appears that the company has found itself in some trouble related to overdue bills that have yet to be paid.

The fine print of the use of proceeds identifies that, “the amount represents the portion of construction and other payables that the Company expects to pay in October and November 2020 using the proceeds of the Offering.” However, this is not the full amount that the company owes to its lenders in October and November, with the firm identifying that it intends to draw on its revolving credit facility and cash on hand to pay a further $1,355,777.47 in payables due over the sixty day period.

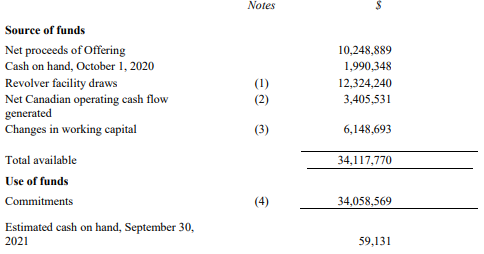

Unfortunately for shareholders, this appears to be the more rosier aspect of the prospectus as well. In outlining the financial resources and estimates of the company for the next year, TGOD reveals that it intends to draw down from its revolving credit facility approximately $12.3 million. $5.7 million of this will be drawn by December 31, with the remainder drawn by September 2021. This drawdown is based on estimated receivables to be generated during that time frame, which the facility is secured against.

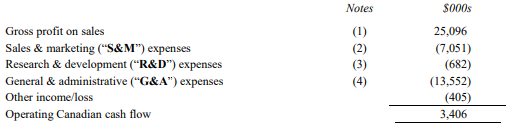

The company also outlines that it is estimating to post positive operating cash flow in its Canadian segment over the next twelve months to the tune of $3.4 million, based on gross profits of $25.10 million. Further, its cash position is down to just $1.99 million, a fall from the $18.78 million reported in cash and cash equivalents as of June 30, 2020.

Most shockingly however, is the fact that TGOD estimates that it will have just $59,131 in cash on hand as of September 30, 2021.

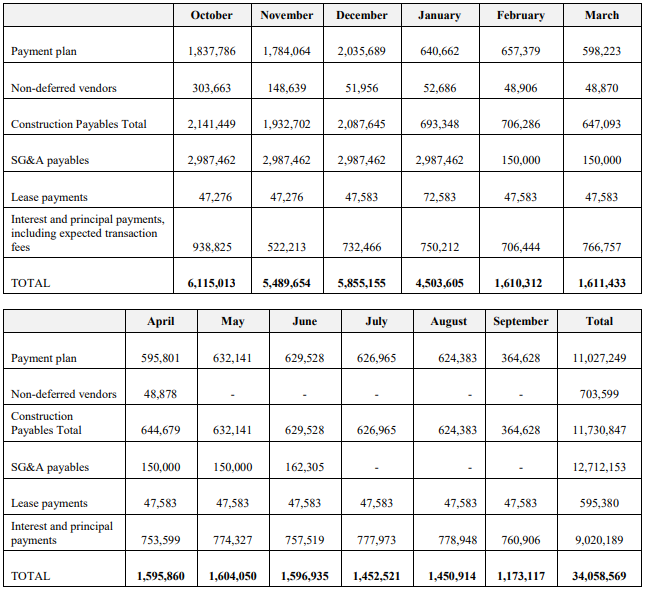

In terms of the next three months, the company is currently forecasting that it will spend approximately $17.46 million on its payables, with October, November, and December coming in at $6.12 million, $5.49 million and $5.86 million, respectively. Much of that is attributed to construction payables, at $6.16 million, suggesting certain debtors are likely getting tired of not being paid by the company.

It should also be noted here that this is likely one of the rosier scenarios put forth by the company. The gross profit on sales over the next 12 months, from October 2020 to September 2021, is far rosier than many would agree with. In the most recent quarter, TGOD managed to generate only $394,000 in gross profits before fair value of biological asset adjustments, with the six month period coming in at $1,409,000 – a long way off from the sort of run rate that the company requires for its projections.

Further, the company last quarter spent $2.24 million on sales and marketing, down from $2.46 million in the previous quarter. This suggests that unless further cuts are made to sales and marketing over the next twelve months, sales and marketing will come in higher than forecasted.

Research and development evidently is going to be all but halted based on projections as well, given that the company spent $319,000 on the cost segment in the most recent quarter, and has spent $839,000 in the six month period – far more than the projections for the next year going forward.

Unsurprisingly given the track record thus far, general and administrative expenses seems critically low. Last quarter, G&A amounted to $5.71 million, almost half the projection for the oncoming twelve month period. Furthermore, in the six month year to date period in the current fiscal year, TGOD has spent $15.50 million on G&A – again, more than the projection for the entire oncoming twelve month period.

Simply put, the twelve month projection seems unrealistic at this point unless further significant cost cutting measures have taken place, and continue to take place. Otherwise, the company will be forced to return to the trough to obtain further funding. Whether that is via the public markets, or what is estimated to be remaining on its revolving credit facility is anyone’s guess.

As for the current financing, the company is raising $11.0 million at a price of $0.24 per unit, with each unit containing one common share and three quarters of a purchase warrant. Each warrant is valid for a period of 5 years with an exercise price of $0.30 per share. A total of 46,3016,000 units of the company are expected to be sold under the bought deal, plus whatever additional units are potentially sold via the over-allotment option.

The Green Organic Dutchman last traded at $0.26 on the TSX.

Information for this briefing was found via Sedar and The Green Organic Dutchman. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.