The Green Organic Dutchman Holdings (TSX: TGOD), through its wholly-owned subsidiary Medican Organic, announced this morning the completion of its previously announced sale of the majority of Medican’s assets in Valleyfield, Quebec to Cannara Biotech (TSXV: LOVE). The acquisition price is reported to be at $27 million, plus a $5.7 million deposit requirement per the utility pricing agreement with Hydro Quebec.

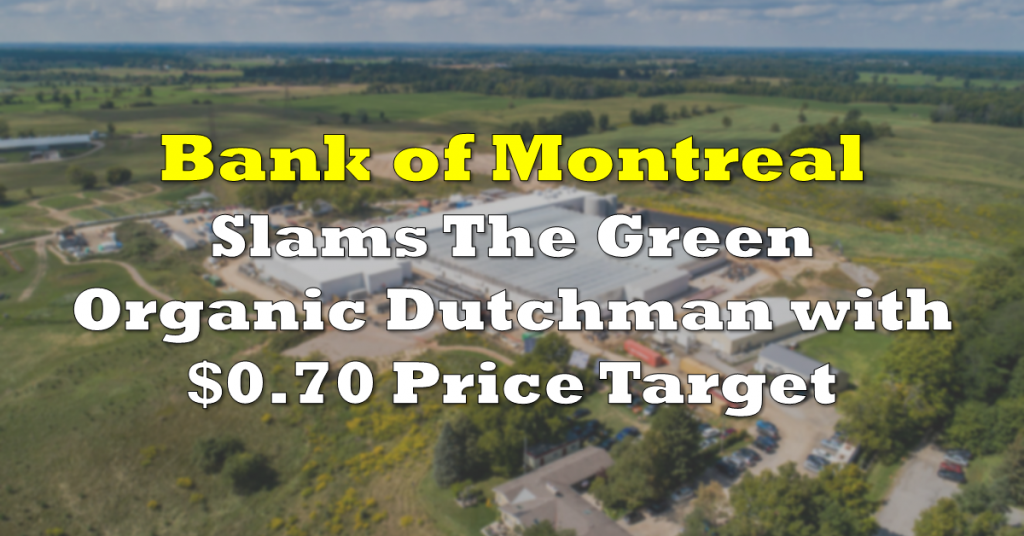

The transaction includes Medican’s one million square foot licensed cultivation and manufacturing facility, plus all industrial and agricultural land, main hybrid greenhouse, rooftop greenhouse, all support buildings, and certain related equipment.

The acquisition by Cannara was partly financed by a non-brokered private placement solely participated by Olymbec Investments. This included $19.3 million raised from issuing 107.2 million Cannara shares at $0.18 per share and $5.7 million raised from unsecured convertible debenture with 4% annual interest. Olymbec is partially owned by one of Cannara’s board members, Derek Stern. As a result of this private placement financing, Olymbec now holds a 19.98% stake in Cannara.

Following the sale of Medican’s Valleyfield facility, The Green Organic Dutchman retired a senior debt of approximately $31.8 million to one of its lenders.

After the transaction, Medican also entered into a 2-year lease agreement with Cannara for approximately 80,000 square feet of the recently sold facility at $12.50 per square foot for cultivation and processing purposes.

With the acquisition of the facility, Cannara claims an increase of its annual production capacity of cannabis by 125,000 kilograms annually.

The Green Organic Dutchman Holdings last traded at $0.335 on the TSX while Cannara Biotech last traded at $0.17 on the TSX Venture.

Information for this briefing was found via Sedar and The Green Organic Dutchman. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.