The Green Organic Dutchman (TSX: TGOD) is looking to sell its Ancaster, Ontario facility based on a copy of an offering memorandum obtained today by The Deep Dive. The document outlines that the firm is looking to initiate a sale leaseback arrangement, similar to what numerous US-based competitors have entered as of late with firms such as Innovative Industrial Properties (NYSE: IIPR).

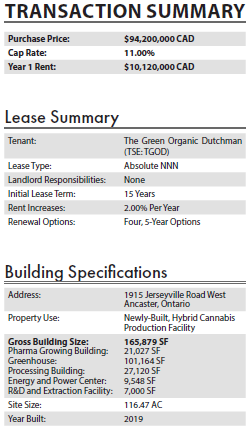

The brochure for the facility outlines that it is looking to collect C$94.2 million for the firm, with a corresponding triple net lease being signed for the facility. The proposed rent for the first year of operations is $10.12 million, with rent increasing by 2% per annum. The proposed lease is to include four, 5 year renewal terms.

The Green Organic Dutchman is essentially looking to acquire book value for the asset, which the circular indicates cost $94.2 million to construct for the licensed producer. Additional break downs are also provided for the facility itself, which the issuer reveals contains 101,164 square feet of greenhouse space, with the remainder of 165,879 square foot building being allocated for various processes required for a producer, including a power generating center almost 10,000 square feet in size.

The circular itself is somewhat rosy when it comes to some figures and statements. Case in point is the fact that it labelled itself as a “well-financed company with a robust market cap”, despite recent news indicating a cash crunch at the issuer. The firm also highlights a dated Deloitte survey, which indicated that the market size of recreational cannabis could be up to $8.7 billion – while figures put out yesterday by StatsCan suggest a much smaller figure, with recreational retail sales to date only totaling $806.6 million.

The news of TGOD looking to sell its Ancaster facility comes on the heals of the firm revealing that it has significant financing issues, resulting in drastically reduced 2020 production targets. In a news release issued last week, the firm indicated that it needs approximately $70 – $80 million in additional funding before it can begin to post operational profits, which is forecasted for the second quarter of 2020.

With unfavourable terms being provided by other lenders, a sale leaseback arrangement is one of the few options remaining for the troubled organic grower.

The Green Organic Dutchman closed today’s session at a price of $1.16 on the TSX Exchange.

Thanks to twitter user @YounggJustin for the scoop.

Information for this briefing was found via Sedar and The Green Organic Dutchman. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.