It finally happened folks. Elizabeth Holmes is now officially in jail. She is set to serve 11 years in a minimum security prison, while somehow dating a rich guy and raising two kids. If that’s not the American Dream, I don’t know what is.

Ladies, gentlemen, and tech gurus, buckle up because we’re about to embark on a journey through the valley. Our tour guide? None other than Elizabeth Holmes, the woman with a voice deeper than the Mariana Trench and a knack for bamboozling billionaires. Sorry I should say, had a deep voice because apparently she has recently dropped that act, since starting to rebuild her image.

And folks if you’re new to this, we’re going to get into all of it.

In quick summary, she raised money from the likes of Rupert Murdoch, Betsy DeVos, and the Walton family, all while wearing a Steve Jobs-esque turtleneck and using a voice that sounded like Hulk Hogan doing a Kermit the Frog impression.

But it turns out what she was raising money on, her revolutionary blood testing gadget Theranos, was about as real as my chances of becoming shortstop for the Toronto Blue Jays. Today we’re going to dive into this whole mess which was ultimately a masterclass in groupthink, where everyone wants a piece of the pie and no one wants to ask if the pie even exists.

Spoiler alert: it didn’t.

There was never any peer-reviewed research on Theranos tech. I mean, would you buy a car without checking under the hood first?

The girl behind the turtleneck

Let’s dive in.

Our protagonist — or should we say antagonist — is Elizabeth Holmes.

Born in 1984, in Washington, D.C, she spent her formative years shuffling from the capital (Washington) to Houston. She was, you could say, from a pedigree of high stakes and big dreams.

She had a father, Christian Rasmus Holmes IV, who had his fingers in many pies; including the bankrupt Enron, the U.S. Environmental Protection Agency, and USAID, among others. Her mother, Noel Anne, was a Congressional committee staffer.

There is no dream you can’t achieve. Don’t let anyone tell you otherwise. #ILookLikeAnEngineer pic.twitter.com/RxiAhXdP89

— Elizabeth Holmes (@eholmes2003) August 20, 2015

High school for Holmes wasn’t about homecoming queens and football games; it was the perfect breeding ground for developing her salesmanship. While some teenagers were flipping burgers or delivering papers, she was selling C++ compilers to Chinese universities. Because, why not, right?

Stanford was the next stop in her journey, where she dabbled in chemical engineering. Like many wannabe moguls of the early 2000’s, Holmes decided that degrees were overrated and dropped out of school, turning her tuition money into seed funding for a consumer healthcare tech company.

And just like that, her voice went all Louis Armstrong and she began donning the iconic black turtleneck. Now all she needed was the billion-dollar idea to match the billion-dollar wardrobe. Little did the world know, it was brewing.

Dreaming of Theranos

In 2002, Holmes had a lightbulb moment while collecting blood samples for SARS testing at the Genome Institute in Singapore. This could’ve been inspired by anything, a prick of the needle, the slow collection process, or maybe she just hated the clinical smell. But one thing was certain: she wanted a medical testing system as integrated as her ambitions.

Upon her return to sunny California in 2003, Holmes had devised a wearable patch. Imagine a Fitbit that can also play doctor. It could test microscopic blood samples for diseases, adjust medication dosage according to variables in the patient’s blood, and send updates to doctors as if it was updating its Facebook status.

One part James Bond gadget, one part Star Trek tricorder, and voila! Her first patent was filed.

In no time, this brainchild blossomed into Theranos – a linguistic lovechild of “therapy” and “diagnosis.” The central claim? No more vials of blood for testing; a few drops would be enough to detect cholesterol, and a range of other diseases, with the test reported to be completed in a matter of seconds. It even had a ‘menu’ offering more than 240 tests, including celiac and cocaine.

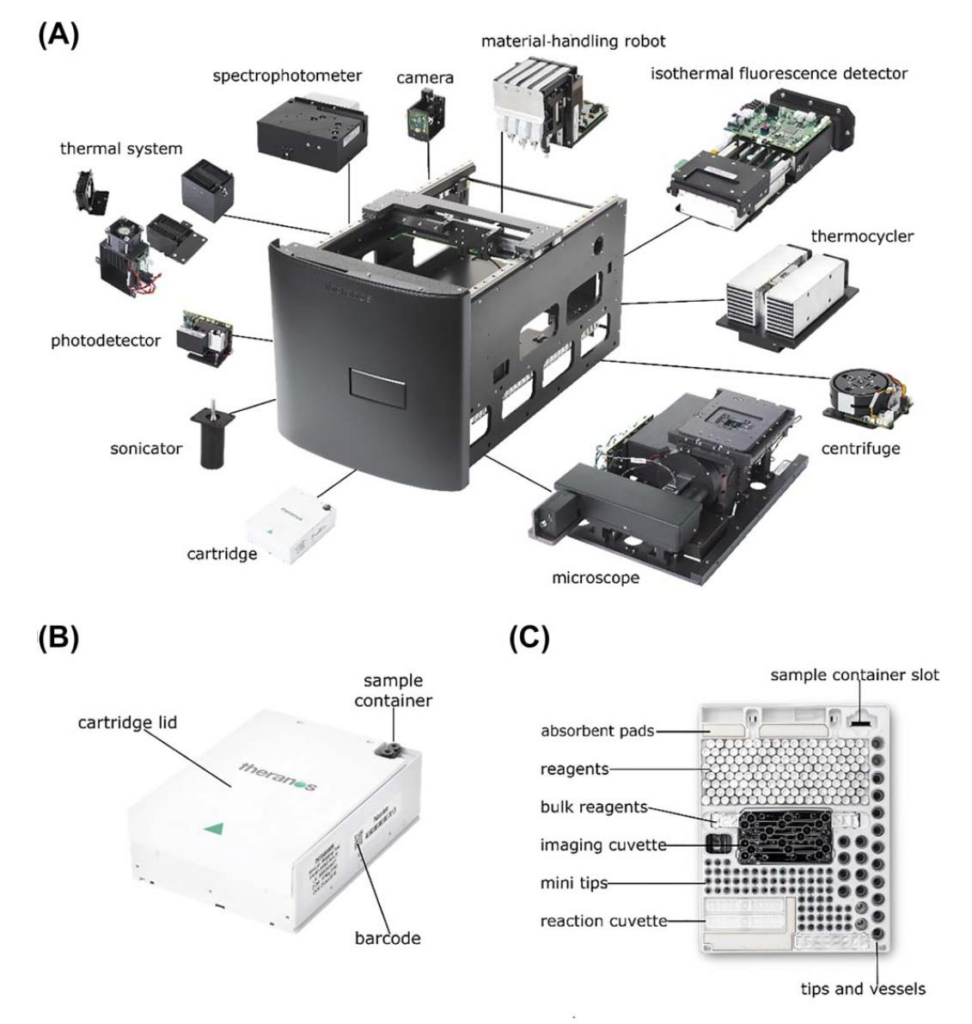

And the mechanism? A specially designed blood collection pen and the mini-laboratory device known as “Edison.”

Money talks, billionaires listen

All right. We’ve got the egotistical founder. The questionable tech. What do we need next? A major investor.

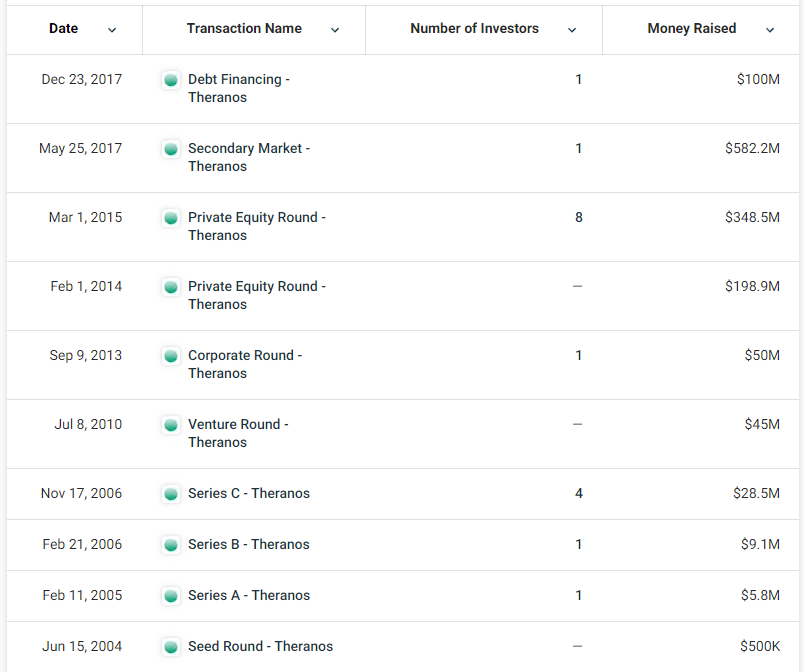

Holmes’s first major investor entered the picture in mid 2004, when Tim Draper, the venture capitalist with a nose for unicorns, stepped up to the plate. Crunchbase reports that this round amounted to $500k in proceeds, and this was just the start – the high-rolling didn’t stop there.

Over the years, the A-list of investors in Theranos would grow to include media mogul Rupert Murdoch, the Walton family of Walmart fame, and even Betsy DeVos, the former U.S. Education Secretary. Collectively, this would push Theranos’s total fundraising to a staggering $1.3 billion.

But what really baked their noodles was the star-studded board of directors Holmes assembled. Ever heard of Henry Kissinger; a former secretary of state? How about the former U.S. secretaries of defense William Perry and James Mattis? And we can’t forget the retired U.S. Navy admiral Gary Roughead and former Wells Fargo CEO Dick Kovacevich. The company’s boardroom sounded more like a cabinet meeting, and these high-profile names lent the venture a veneer of credibility that was hard to ignore.

So why did these powerful figures buy into Theranos’s vision? Let’s break it down.

They saw a disruptive potential that could transform healthcare, a high-growth market with enormous profit margins. And they were seduced by Holmes’s charisma, as crazy as that sounds, plus the secrecy surrounding the technology, and the glowing endorsements from influential figures.

The burst of the bubble

Lets cut to the chase. How did it unravel?

Well if it were up to Ian Gibbons, former chief scientist for Theranos and a tragic hero in the timeline, the bubble would have never happened. Gibbons was behind 23 patents at the company, but was increasingly frustrated that the technology, the backbone of Theranos, wasn’t up to scratch. In 2006, he warned Holmes: “Our technology is not ready for public use. It’s not accurate.”

But instead of heeding his warning, the higher-ups gave him the boot, enabling the fraud to continue. In 2013, Gibbons tragically took his own life after a legal battle over patent theft, leaving behind a trail of unanswered questions.

Now lets fast forward to Silicon Valley 2015.

Theranos is on top of the world, or so it seems. Underneath, it’s more like a scene from “Jenga” – all it takes is one wrong move, and the whole tower comes crashing down.

Cracks first began to appear under the surface in February, when a Stanford professor wrote in the Journal of the American Medical Association that no peer reviewed research on the tech behind Edison had been published in medical research. Months later to dispel rising concerns, Holmes went as far to bring then Vice-President Joe Biden to their facility – which later turned out to be a fake facility created specifically for the vice presidential tour.

And then there was the arrival of whistleblowers in the building.

Erika Cheung and Tyler Shultz, former Theranos employees, played this role when their moral compasses pointed them straight to the Wall Street Journal. Almost overnight Theranos went from a poster child of Silicon Valley innovation to a cautionary tale of deception and hubris. The FDA, following up with its own investigation, added fuel to the fire. Suddenly, the scrutiny was too much to bear.

Holmes, however, wasn’t going down without a fight. In October 2015, she went on “Mad Money” and other media outlets, claiming to be “shocked” by the allegations, playing the misunderstood genius card.

But as she went on her damage control tour, the Centers for Medicare & Medicaid Services (CMS) released a damning report on Theranos’ lab, forcing them to suspend operations at its Wellness Centers.

The cost of ambition

And thats when the trouble really began.

In 2017, the State of Arizona slapped Theranos with a lawsuit, accusing the company of peddling over a million blood tests to Arizonans while playing fast and loose with the facts about these tests. Theranos agreed to pay back the consumers and cough up $225,000 in civil fines and attorney fees. A total hit of $4.65 million – not exactly pocket change, even for a once tech darling.

That same year, about 99% of Theranos shareholders chose to take the blue pill, agreeing to put down their legal pitchforks in exchange for shares of preferred stock. Holmes, in turn, forfeited some of her equity to make sure the value dilution didn’t hit non-participating shareholders.

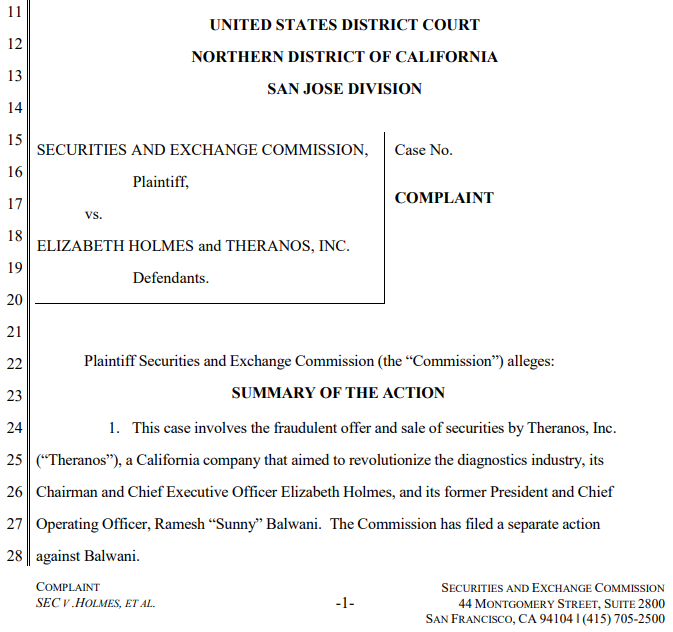

A year later, the SEC charged Holmes and Theranos’s former president, Ramesh Balwani, with defrauding investors to the tune of more than $700 million while parading a product that was about as real as unicorns. And what did Holmes do? She settled with the SEC – effectively exchanging her control over Theranos, her shares, and her right to be an executive in any public company for the next decade for a $500,000 fine.

Even as Theranos crumbled under allegations of fraud, some backers stood by Holmes. Tim Draper, for example, doubled down on his defense of Holmes on CNBC, saying that she had created an “amazing opportunity” and was “bullied into submission.”

But as the facts rolled in, the reality of the situation sank in: they had backed a losing horse. These titans of industry, drawn in by the allure of revolutionizing healthcare, had instead walked straight into one of the biggest scandals in tech history. So much for the golden touch, huh?

Meanwhile, the company wasn’t faring much better. By April 2018, 105 employees were given their walking papers, leaving Theranos running on a skeleton crew. The company was finally put out of its misery in September of that year when it began formal dissolution.

The trial of the century

Enter: the courtroom.

When the dust settled among government agencies, Holmes and Sunny Balwani, her ex-boyfriend and former Theranos chief operating officer, found themselves up against nine counts of wire fraud and two counts of conspiracy to commit wire fraud in June 2018. The defense? Well, let’s say it’s like trying to build a house of cards in a wind tunnel.

Holmes took the stand, spinning a yarn of being misled by her staff about the technology and being under the undue influence of Balwani. It’s not every day you get to play both the victim and the villain in the same story, but Holmes managed to walk that tightrope.

After seven days of this courtroom drama, the jury started deliberating. Were they buying what Holmes was selling? The verdict: a mixed bag. On January 3, 2022, she was found guilty on four counts of defrauding investors but not guilty on four counts of defrauding patients. The sentence: 11 years and 3 months.

She did however make out better than Balwani, whom was found guilty on 10 counts of wire fraud and 2 counts of conspiracy to commit wire fraud, resulting in a prison sentence of nearly 13 years. Collectively, the two were ordered to pay restitution of more than $452 million, for which they are jointly and severally liable.

One might think that after such a fall from grace, Holmes would lay low, but oh no. Prosecutors allege she tried to abscond to Mexico, which her defense rebutted as just a holiday plan gone wrong. Holmes then appealed her conviction, claiming that she was barred from referring to Balwani’s testimony, a plea that fell on deaf ears in the court.

In conclusion

So let’s wrap it up.

As we sail away from the wreckage of Theranos, there’s a message in this bottle for Silicon Valley. When ‘fake it till you make it’ gets a little too real, the bubbles in your champagne might quickly turn into an exploding soda can. A once-billionaire CEO is now a jailbird, and all it took was a trail of over-embellished truths, a secretive medical device, and a throng of investors blinded by dollar signs.

It’s hard to know how Holmes thought this would play out. Perhaps, she thought she could fool her patients? Perhaps she thought she could turn it into a Ponzi? Perhaps she thought that eventually she’d be able to figure out this tech? Perhaps it was always just about figuring out how to live another day? I don’t know.

If Elizabeth Holmes had a superpower, it wasn’t disrupting healthcare. It was making people think they found their next golden goose. Triggering that part of her potential investors brains that say “I’m going to get rich.” But, when you invest in technology that’s as thoroughly reviewed as a sketchy Yelp restaurant, you shouldn’t be surprised when the soufflé collapses.

The cherry on top? Holmes got caught for defrauding investors, not patients. What’s the moral here? Screw with the money, you’re toast. But risk the health of innocent patients and it’s just another Tuesday in the Valley.

That’s capitalism, where investors are like children who eaten too much candy and say “It wasn’t me, I swear, the candy tricked me into eating it.” Yet, when the dental bill comes, they’re the first to point fingers.

Theranos was the train wreck we couldn’t look away from. Elizabeth Holmes story received a slew of documentaries’ and even a mini-series. I guess it’s easier to focus on the dazzling conductor than question why the train is heading off the cliff.

Today Holmes is eating prison grub and unless she gets out early on parole, she won’t get out of jail until she’s post menopause. Bringing children into this world, right before serving an 11 year prison sentence is exactly what a sociopath would do in this scenario.

Disgraced Theranos fraudster Elizabeth Holmes seen for first time in prison https://t.co/rqtyuqgO7Z pic.twitter.com/B6cZpXVWjb

— New York Post (@nypost) June 3, 2023

Back in 2021 Holmes became a mother in light of the inevitable outcome. Her son’s birth was followed by a second pregnancy announced just weeks before her sentencing hearing in 2022. Perfect timing, right? It’s almost as if she planned it… But I digress. During her appeal in 2023, she lived on a rather plush estate, costing a cool $13k a month.

Well, at least she’ll be able to tell her kids she once lived the life of a Silicon Valley mogul. And I’m sure the tabloids will let us know how life is after prison.

As for investors like Rupert Murdoch, Betsy Davos and the Walton Family, something tells me they will all be just fine. Like one of us going down to the local casino and dropping $20 on a slot machine. Just a slight hiccup in the grand scheme of their fortunes. If only we all could be so resilient.

And there you have it, folks, the tale of Theranos. A billion-dollar house of cards that fell faster than you can say ‘due diligence’. Let’s remember the next time Silicon Valley starts crying for a bail out and acting like they are smarter than us, that this is the same crowd that rushed to invest in a pie and didn’t even check to see if the pie existed, which is pretty much your only job as an investor.

So here’s to Silicon Valley! And the ridiculous stories of failure you will bring us in the future, ones that only demonstrate gross negligence on the community, but still leave you with the courage to blame anyone but yourselves.

Information for this briefing was found via the New York Times, Time, Wall Street Journal, Washington Post and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.