As was widely expected, Bank of Canada Governor Tiff Macklem opted to keep the overnight rate unchanged at 4.5%, gripped with confidence that inflation levels will keep receding quickly over the next several months.

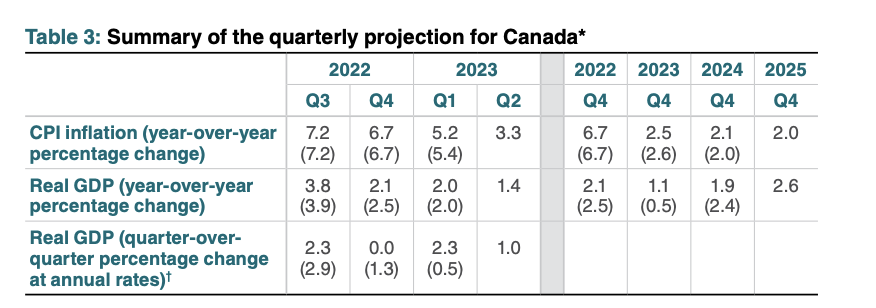

Despite acknowledging there is still excess demand in the economy and employers are continuing to more hire workers, the Bank of Canada still opted to forego a rate hike for the second consecutive policy meeting. Policy makers said they’re confident high interest rates are filtering through the economy, and will keep economic growth capped at 1.4% in 2023 and 1.3% the following year.

In fact, Macklem is so confident in his preceding monetary policy, that he now expects inflation will “fall quickly” to around 3% by the second half of the year, before declining more “gradually to the 2% target by the end of 2024.” Still, the bank noted that bringing price pressures down to the target range “could prove to be more difficult because inflation expectations are coming down slowly, service price inflation and wage growth remain elevated, and corporate pricing behaviour has yet to normalize.”

Macklem reiterated that he hasn’t forgotten about restoring price stability, and is prepared to raise interest rates further in light of forthcoming economic data.

Information for this story was found via the Bank of Canada and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.