Jefferies lowered their price target on Tilray Brands (TSX: TLRY), after updating their outlook, saying excluding all the Canadian headwinds, the overall outlook looks compelling. Jefferies lowered their 12-month price target from $17.00 to $15.60 and reiterated its buy rating on the stock.

Tilray currently has 20 analysts covering the stock with an average 12-month price target of US$8.47, or a 33% upside to the current stock price. Out of the 20 analysts, 2 have strong buy ratings, 2 have buy ratings, 13 analysts have hold ratings and the last 3 have sell ratings. The street high sits at US$23, which represents a 260% upside to the stock.

Jefferies says that the company saw Canadian sales continue to struggle but “there are signs for optimism,” because share losses have slowed and Tilray has seen market share gains in vapes and pre-rolls. They add, “What also needs to be remembered is that Canada adult-use is only around 25% of group gross profit.”

For Tilray’s Canadian segments, Jefferies says that the company saw continued struggles in its recreational segment as they estimated sales were down 13% quarter over quarter. This comes after a 27% drop last quarter. Additionally, Tilray saw its overall market share drop from 12.8% to 10.7%. Though they do see some signs of optimism in these quarterly results, mainly that the market share losses have slowed and that the company is now taking market share in both vape and the pre-roll categories.

Though, Jefferies says that the rest of Tilray’s business is doing well, with their international cannabis segment sales up 15% sequentially while wellness sales were up 6% as well. Beverage alcohol sales were also up more than 40% sequentially.

Jefferies also notes that Tilray is “very well-positioned” in the key German market, by having a 20% market share. While also have its US THC optionality, which they say “is key for material re-rating of all cannabis names.”

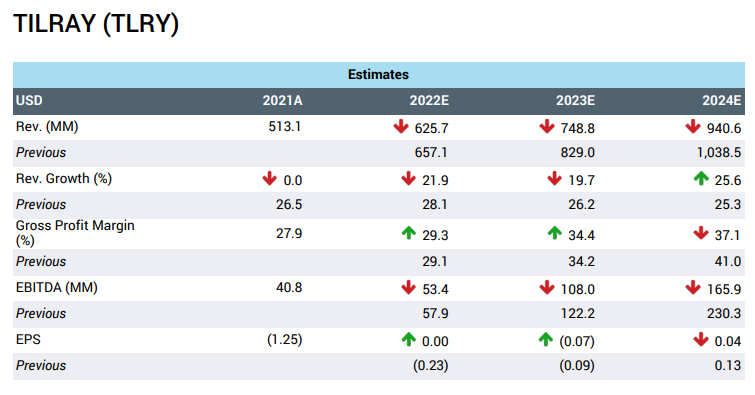

Below you can see Jefferies update estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.