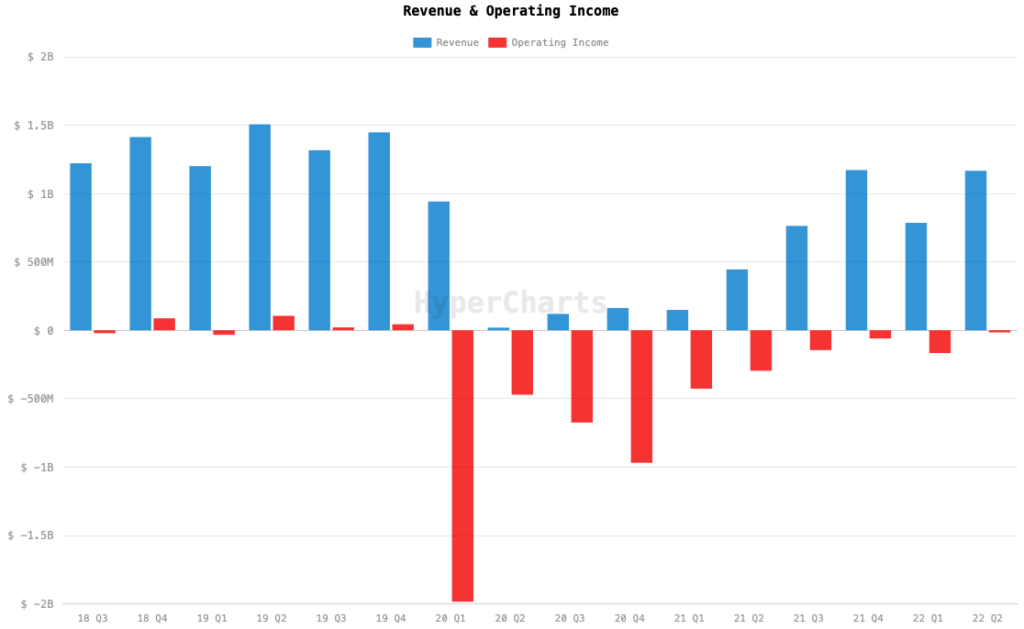

AMC Entertainment Holdings, Inc. (NYSE: AMC) reported on Thursday its financial results for Q2 2022, earning US$1.17 billion in revenue–falling behind the consensus US$1.18 billion. The figure is an increase from Q1 2022’s US$785.7 million and Q2 2021’s revenue of US$444.7 million.

“AMC just completed a spectacularly encouraging second quarter that boosts our mood and brightens our prospects as we look ahead,” said CEO Adam Aron.

But with operating expenses larger than the revenue, the firm still ended the quarter with an operating loss of US$16.1 million, compared to last quarter’s loss of US$166.9 million and last year’s loss of US$296.6 million.

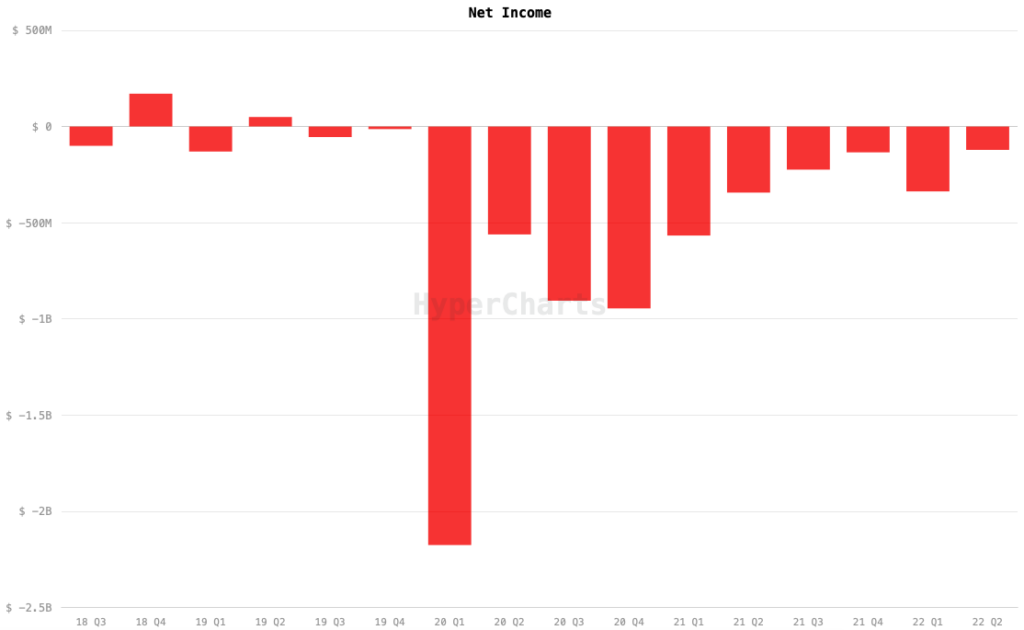

This further led the company to end with a US$121.6 million net loss compared to the net losses of last quarter at US$337.4 million and last year at US$344.0 million. This translates to US$0.24 loss per share, also failing to beat the consensus US$0.19 loss per share.

Calibrating for financial items, adjusted EBITDA came in at a gain of US$106.7 million, a huge shift from losses of US$61.7 million and US$150.8 million last quarter and last year, respectively. This also beat the analysts’ mean estimate of US$78.9 million gain.

In Q2 2022, the firm used operating cash flow of US$76.6 million while free cash flow also ended with an outflow of US$117.0 million.

APE goes to class

But complementing the relatively stronger financial performance is the launch of a new class of securities aimed at recognizing and legitimizing the nickname APE.

“Today we are announcing that later this month, AMC will be creating a new class of securities, and will

be issuing an AMC Preferred Equity unit stock dividend, PAYABLE ONLY to holders of our 516,820,595

issued and outstanding common shares,” Aron said in a statement.

— Adam Aron (@CEOAdam) August 4, 2022

The new security will result from a function similar to a 2-for-1 stock split. But instead of having two common shares, retail shareholders will own one common share and one AMC Preferred Equity, or APE. The class will also trade on the New York Stock Exchange under the symbol “APE” alongside the firm’s shares under “AMC”.

Aron emphasized that the stock dividend issuance will not in effect result to dilution since the “new APEs all go and only go to holders of company issued AMC common shares.”

“The number of issued and outstanding AMC common shares will remain at 516,826,595 after the dividend is paid,” Aron further explained.

The firm’s chief also anticipates that the dividend issue might sink the company’s share price as it functions similarly to stock split. After the announcement, the firm’s share already fell 9.65% pre-market.

Since the investors will get APE units stock dividend, these securities can still be converted to common shares. However, the company is leaving the decision to the shareholders as this move would entail increasing the authorized additional common shares for trading–a decision up for shareholders’ approval.

So basically @CEOAdam is a raging silverback who’s about to pounce all over these FUCKING CRIMINALS!! 🦍 $AMC #AMC #MOASS pic.twitter.com/UXjCp9zR5L

— WallStreetApes / MermAPE • AMC • GME 🦍💎🙌🏻🧜♀️ (@riggedgov) August 4, 2022

Aron also reasoned that the creation of the APEs will provide the firm “a currency that can be used in the future to further strengthen [its] balance sheet.”

“Given the flexibility that APEs will give us, we likely will be able to raise money if we need or so choose, which immensely lessens any survival risk as we continue to work our way through this pandemic to recovery and transformation,” Aron added.

AMC Entertainment last traded at US$17.70 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.