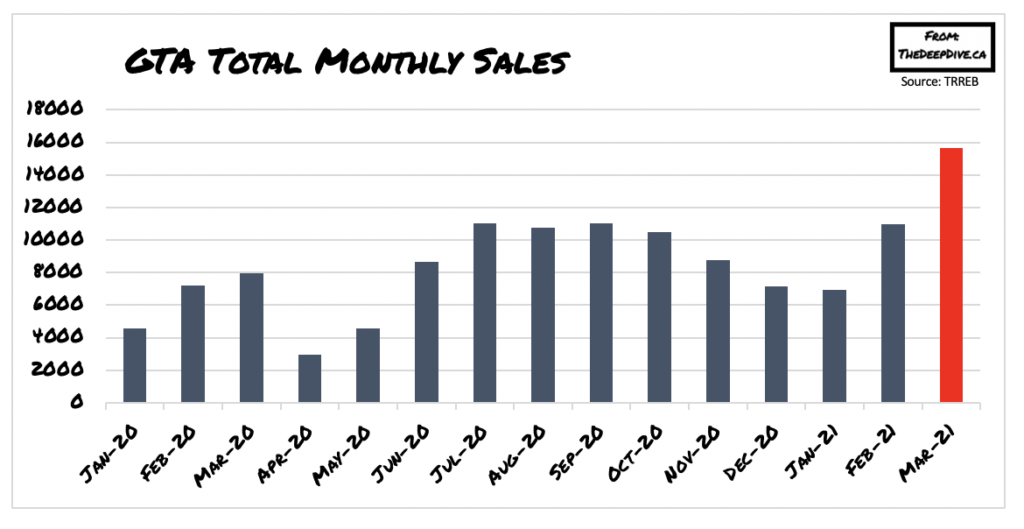

The largest housing market in Canada was the subject of yet another record-breaking month, as home sales in March soared by almost double from year-ago levels, and average prices exceeded the $1 million mark.

According to the latest report from the Toronto Regional Real Estate Board (TRREB), there were a total of 15,652 properties that traded hands in March, marking an increase of 97% year-over-year. In fact, sales activity in the second-half of March was even more pronounced, as sales rose by 174% compared to the same period a year earlier.

In the meantime, the average selling price increased by 21.6% from March 2020, rising to $1,097,565. New listings in Toronto totalled 22,709— an increase of 57% from year-ago levels; however, they still remained significantly below sales levels. With sales growth significantly exceeding the increase in listings, competition between buyers continues to heat up. As TRREB Chief Market Analyst Jason Mercer notes, this could lead to double-digit price gains in some regions, even in the absence of a meaningful rise in housing supply.

The latest data illustrates the strong impact that historically-low borrowing rates— coupled with the ongoing work-from-home trend— can have on the real estate market. As housing demand continues to push prices upward, a number of prominent analysts have called on policy makers to interfere via demand-side interventions in order to prevent a housing market crash.

However, according to TRREB, policies that focus on the demand-side of the housing market, such as capital gains tax on primary residences, may have a short-term impact, but could also create unintended consequences. Instead, TRREB CEO John DiMichele suggests that policy makers should focus on increasing housing supply for the long run, in order to account for a growing population and higher future demand.

Information for this briefing was found via TRREB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.