The housing market in the Greater Toronto Area appears to be triumphant throughout the economic effects of the coronavirus pandemic, as July breaks a new sales record with a total of 11,081 homes sold.

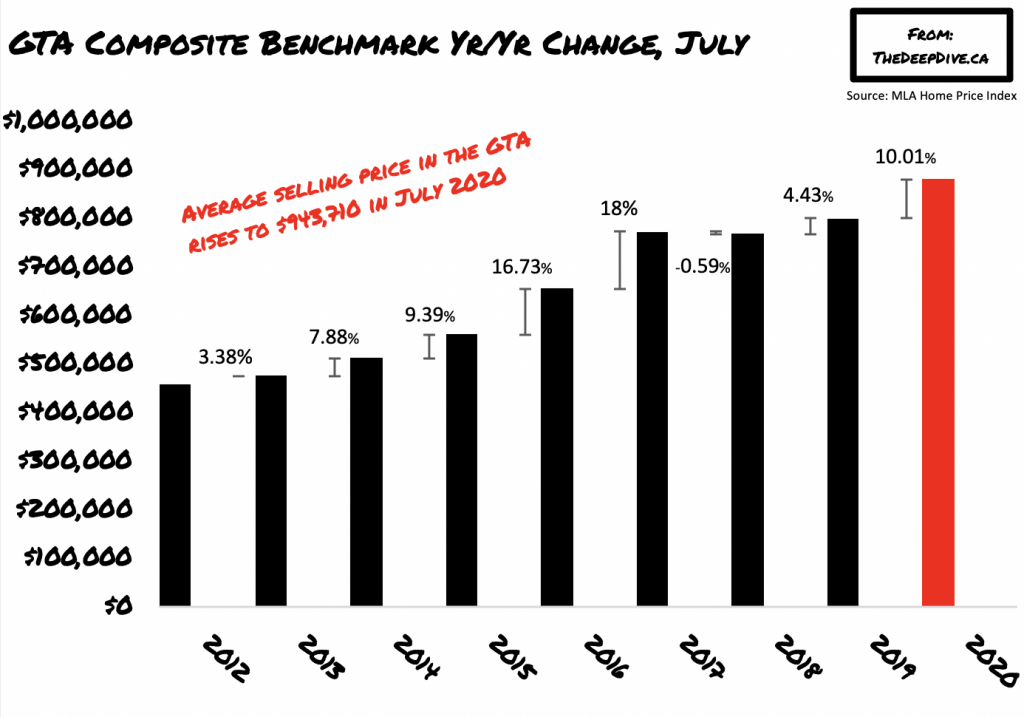

According to the latest data released by the Toronto Regional Real Estate Board (TRREB), the month of July saw a staggering 29.5% increase in home sales compared to the same time a year prior. The largest increase in sales came from detached homes, which rose by 43.7%, with their average selling price spiking by 16%. Accordingly, the MLS Home Price Index (HPI) Composite Benchmark increased by more than 10% compared to July 2019, causing the average selling price to reach $943,710.

Typically, sales activity tapers off in July given the increase in households that take vacations – especially with school being out during the summer months. However, this year was unique in the wake of the coronavirus pandemic; the pent-up demand during the spring months of April through May in response to government-mandated restrictions has led to a surge in activity in Toronto’s housing market.

Daniel Foch, who is a broker at Foch Family Real Estate, tells Yahoo Finance that the increase in housing market activity may also be due to a rise in foreign capital spending in the Greater Toronto Area. According to Foch, the significant volatility in the stock markets created by the pandemic has caused some investors to flock to Canadian real estate, given its lower liquidity risk.

Information for this briefing was found via TRREB and Yahoo Finance. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.