Toronto’s housing market presents a paradox: rents are rapidly rising while home prices and sales are still falling.

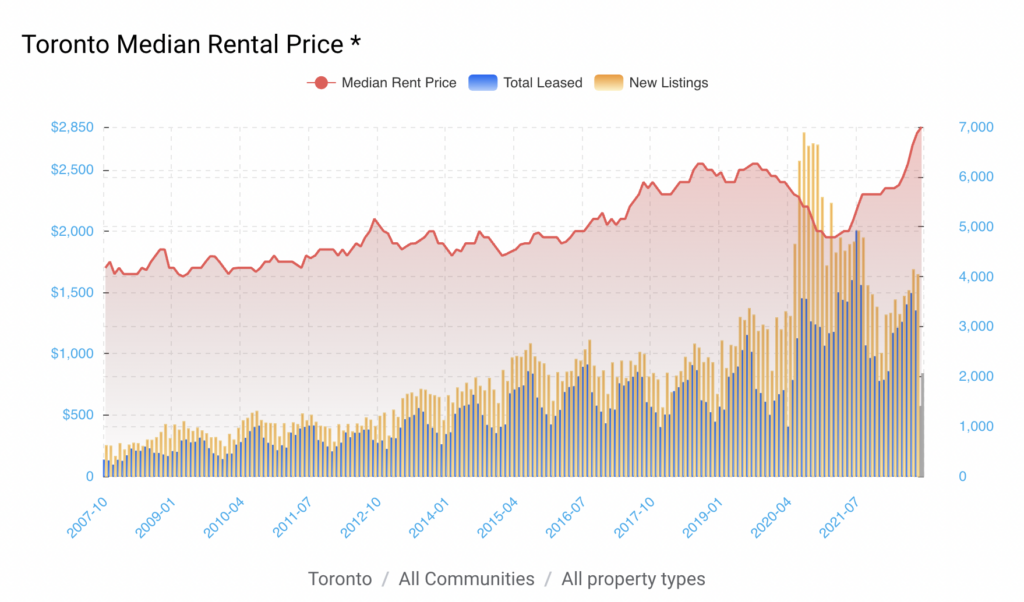

A report from HouseSigma shows that median rental rates are up almost 22% year on year in August, climbing to $2,800 per month. This is the highest rental rate has ever been in 15 years, based on available data.

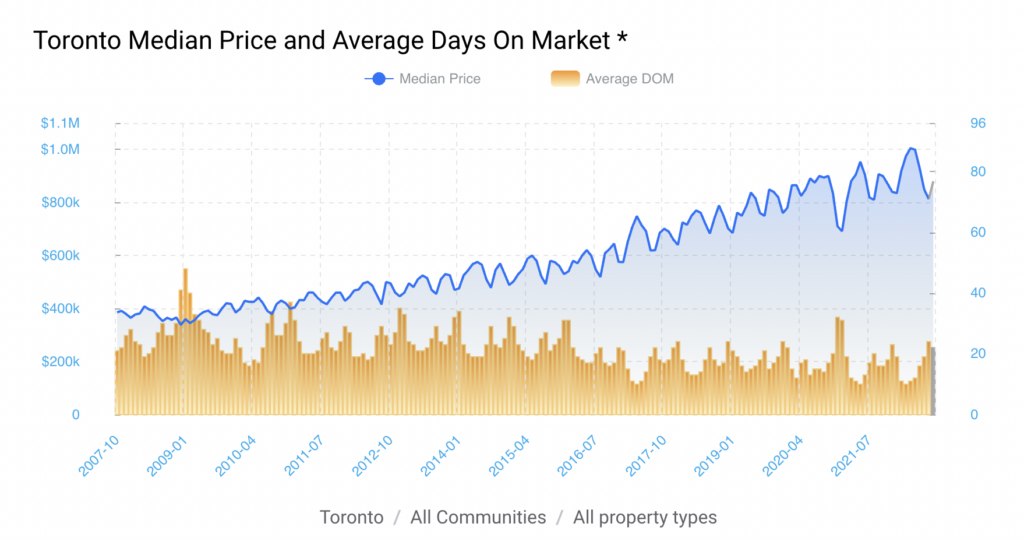

House prices, meanwhile, are down 19% from the April median peak of $1,005,000, but still slightly higher than the median amount year on year.

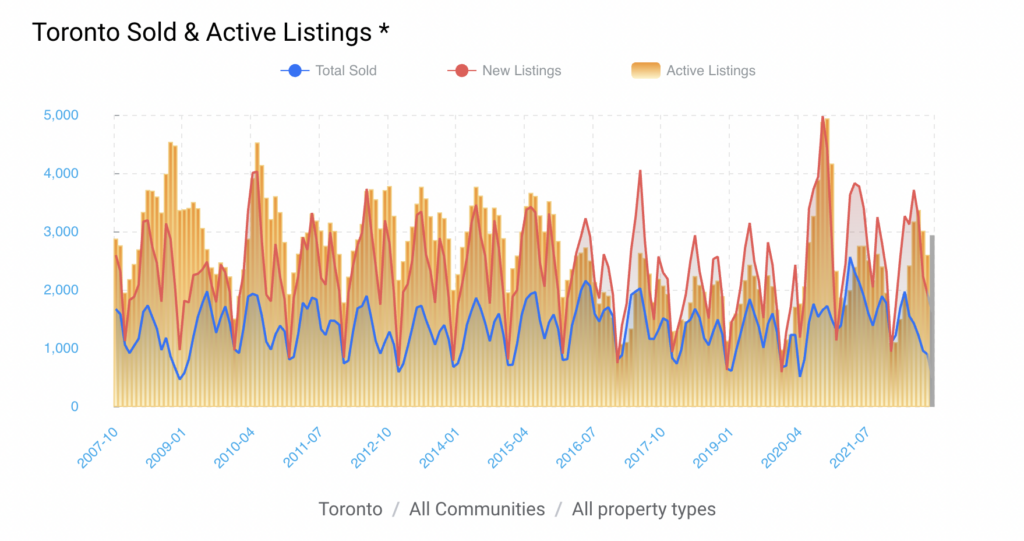

Supply is also falling, with a sharp decline in new listings coming from a peak in May. While sales are at their lowest since a month after the beginning of the pandemic in 2020.

Figures from the last decade and a half show a gradual but consistent decrease in home sales supply, disrupted only by a short period during the pandemic when supply was up and home prices were down. The number of listings for lease, meanwhile, showed the inverse, with sharper increases, peaking during the early pandemic right before rental rates dropped to their lowest in five years.

When home prices are down, potential homebuyers tend to not want to buy. Analysts observe that this is either because they’re waiting for the market to bottom out, or they hold out from not wanting to acquire an asset that’s losing value. Thus, when home prices are down, home sales go down sharply, as can be seen from the charts.

This means that potential homebuyers stay longer as renters, and new renters will need to compete especially as the rental supply goes down. To add to that, rents will be pushed even higher as demand grows from people returning to work and the anticipated arrival of new immigrants.

The only real, long-term solution seems to be that Toronto needs to construct more rental housing, and both provincial and federal governments need to do more in terms of luring developers into building new rental housing.

Information for this briefing was found via HouseSigma and the Financial Post, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.