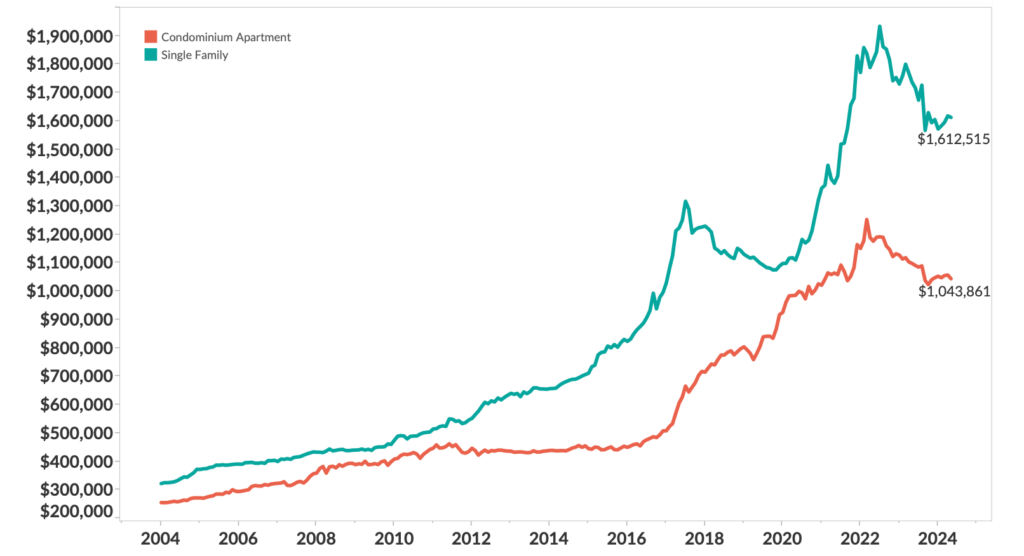

Greater Toronto’s real estate market continues to struggle, with recent data from Altus Group and BILD GTA indicating further declines in new home prices and record-low sales figures for May. The benchmark price for single-family homes fell to $1.61 million, a 7% drop from the previous year, while condominium prices decreased by 5% to $1.04 million. Despite these reductions, both segments have seen prices fall by nearly 30% from their peaks a few years ago.

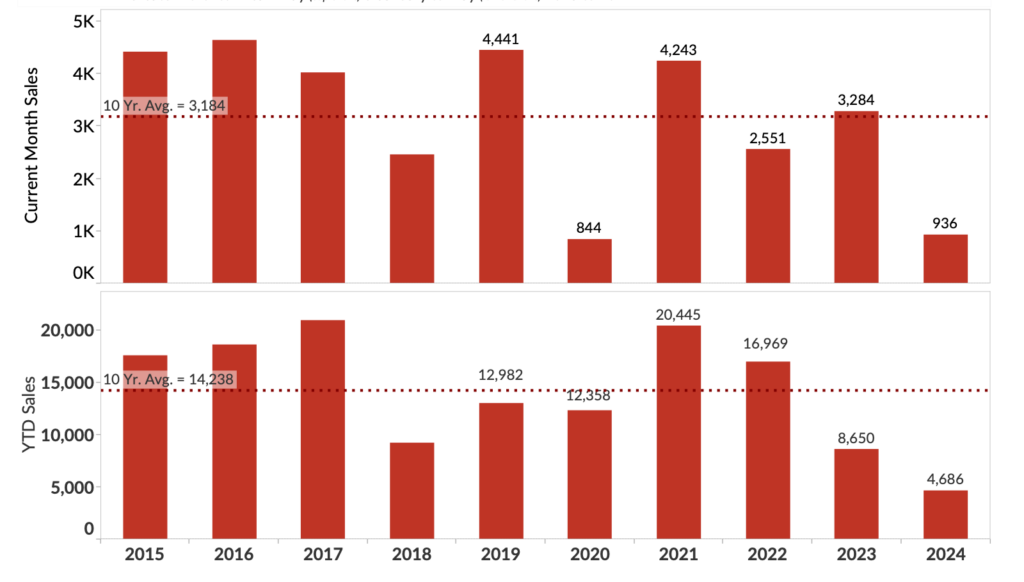

Demand for new homes has reached unprecedented lows. New home sales in May plunged by 71% to just 936 units, marking the weakest level on record. Year-to-date (YTD) sales also fell by 46%, totaling only 4,686 units, a record low and 30% below the previous low set in 2009.

This significant drop in sales is not due to a lack of inventory. In fact, new home inventory has increased by 33% over the past year, reaching 20,427 units in May. This is the highest inventory level for May since 2016, indicating a saturated market with a substantial number of unsold units despite falling prices.

The market weakness is evident across the region, with single-family home sales dropping 65% from the previous year and condominium sales falling by 75%. This widespread decline highlights a pervasive issue affecting all market segments.

According to the Canada Mortgage and Housing Corporation (CMHC), higher interest rates have made financing difficult for builders, slowing the construction of new homes and exacerbating affordability issues, especially in the rental sector. The CMHC expects inflation to ease by mid-2024, which could allow the Bank of Canada to lower interest rates and potentially improve housing affordability and demand.

The sharp increase in inventory amid weakening demand raises questions about the sustainability of the current market dynamics. The rise in apartment vacancies, which have surpassed pre-pandemic levels, further complicates the situation. This trend suggests either an overestimation of population growth or a financial strain on young adults, who may have reached the limits of their purchasing power.

Information for this briefing was found via Better Dwelling and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Definitely a weaker market. If you are a seller you need to be priced best of class for a buyer to consider the property.

Buyers -negotiate , negotiate, negotiate!