While the US economy is not hitting its target growth, Treasury Secretary Janet Yellen believes the cooldown of the growth is necessary amid the rising inflation rate.

However, Yellen believes that the downturn isn’t likely headed for a recession.

“This is not an economy that is in recession,” Yellen said in an interview. “But we’re in a period of transition in which growth is slowing and that’s necessary and appropriate.”

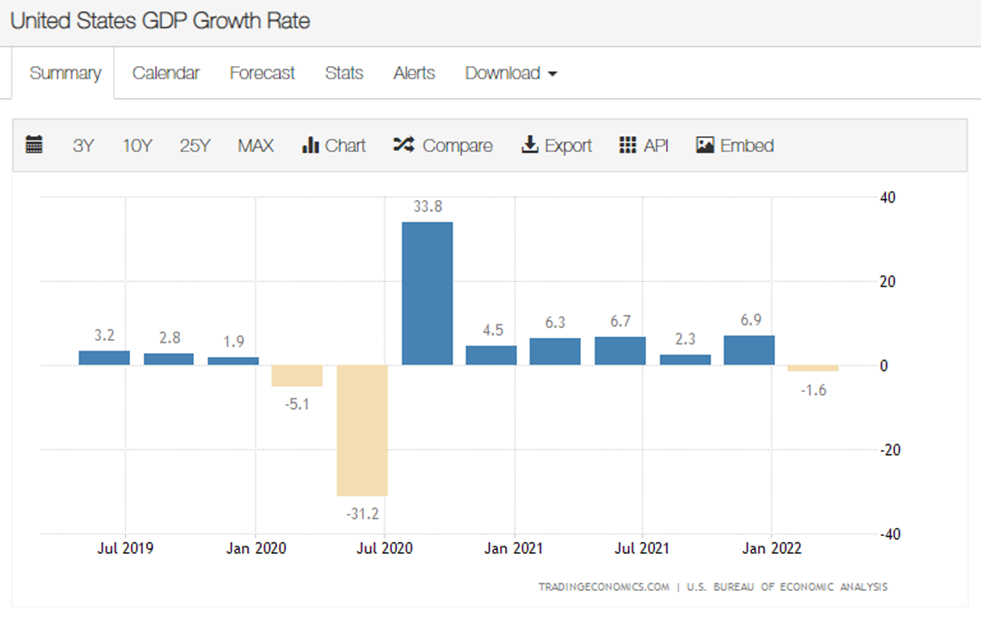

The country’s gross domestic product shrank by 1.6% during the first quarter of the year. A Reuters poll among economists also predicted a measly 0.4% growth for the second quarter.

However, Yellen said that even Q2 2022 records a negative growth, it wouldn’t spell recession for the country. “Recession is broad-based weakness in the economy. We’re not seeing that now,” she said.

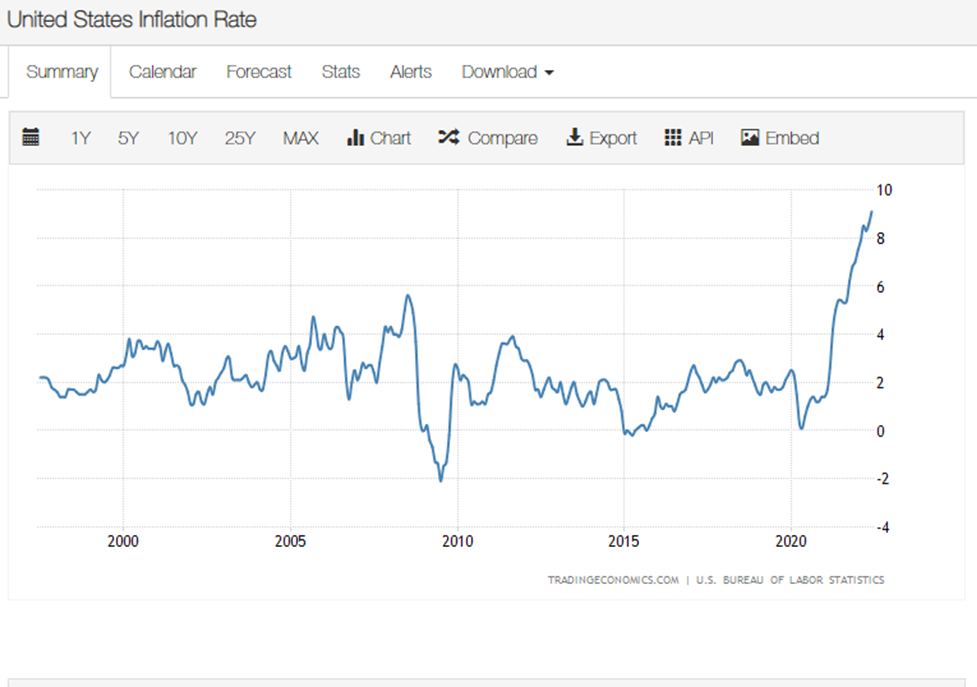

The US inflation rate hit a record high of 9.1% in June 2022, the country’s highest rate gain since 1981.

The Federal Reserve also hiked the interest rate to 1.75%–the biggest hike since 1994–signalling it is “strongly committed” to tackling inflation.

“I’m not saying that we will definitely avoid a recession,” Yellen added. “But I think there is a path that keeps the labor market strong and brings inflation down.”

Earlier in June, Yellen admitted that she was “wrong about the path that inflation would take,” claiming back then that the inflation hike was just transitory.

“There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that I didn’t, at the time, fully understand,” Yelllen said.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.