On July 27, Trican Well Service (TSX: TCW) reported their second-quarter financials. The company reported revenues of $93.7 million and a gross loss of only $0.2 million. The company’s adjusted EBITDA came in at $14.2 million, while the firm also reported $58.9 million in cash and cash equivalents for the period ending June 30.

All throughout July, analysts have been raising their 12-month price target on the company. This has brought Trican’s 12-month consensus price target to C$3.26, up from $2.67 at the end of June. The street high comes from ATB Capital with a C$3.50 price target, while the lowest comes in at $2.75 from TD. Out of the 10 analysts covering Trican, 1 analyst has a strong buy rating, 5 have buy ratings and 4 have hold ratings.

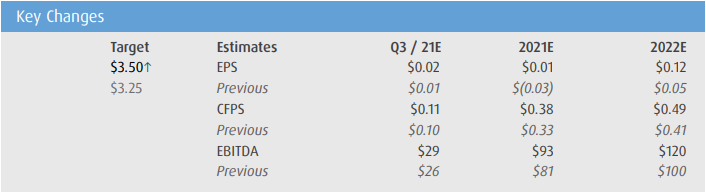

BMO raised their 12-month price target on Trican to C$3.50 from $3.25 and reiterated their Outperform rating saying that the results were impressive. Specifically, Trican’s $14 million in adjusted EBITDA was more than triple BMO’s $4 million estimates, while revenues nearly tripled year over year.

BMO says that cash is king and that Trican has almost $60 million in cash, “which should allow the company to pursue additional awards, particularly as customers look for upgraded equipment.”

Below you can see BMO’s updated third quarter, 2021, and 2022 estimates. They close the note by commenting, “Trican remains our preferred pressure pumping name in Canada, particularly given its high spec fleet and strong balance sheet.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.