On September 13, Research Capital Corporation initiated coverage on Trillion Energy (CSE: TCF) with a C$1.35 12-month price target and a buy rating, saying that the company’s primary focus is on “the continued development of its SASB natural gas project, located offshore in the Black Sea of Türkiye.”

The company currently holds a 49% interest in the South Akcakoca Sub-Basin gas field or SASB, which includes four natural gas fields and five additional gas discoveries “that are ready for production, and multiple appraisals and exploration prospects.”

There has been over US$600 million invested into the construction of four different production platforms, and Research Capital says, “Nearly all of Trillion’s reserves are associated with the SASB field, which is one of the Black Sea’s largest natural gas development projects and has produced approximately 42 Bcf to date.”

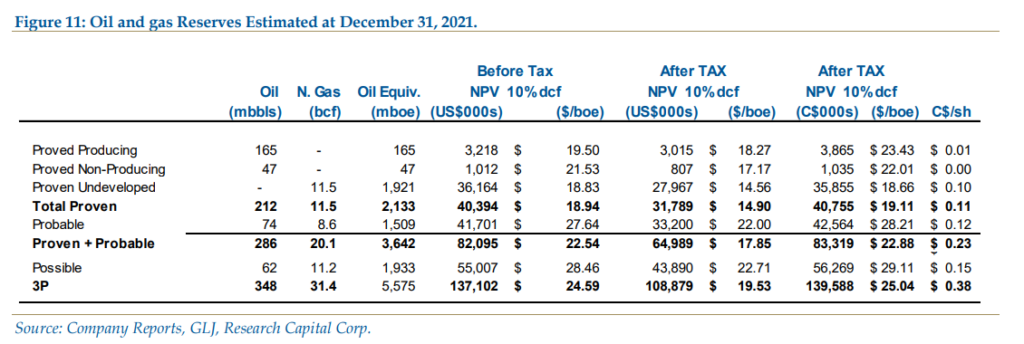

An independent reserve evaluator said that effective December 31, 2021, the estimated remaining proven plus probable reservees net to the company were 20.1 bcf. Research Group estimates that the pre-tax net present value of the reserves discounted 10% is US$82.1 million, or C$0.28 a share – with the price used for the evaluation being between US$8 – US$10/mcf, far below the current price of US$31/mcf.

Additionally, Research Capital says that the SASB Gas Field has “low-risk resource upside from six appraisal prospects,” of which five have been drilled and tested but are not developed yet but have a net risked prospective resource of 23bcf, which would equate to a net present value of US$93.6 million. Exploration upside also exists, with 13 additional prospects identified, which have “an estimated unreskied resource of 100 bcf.”

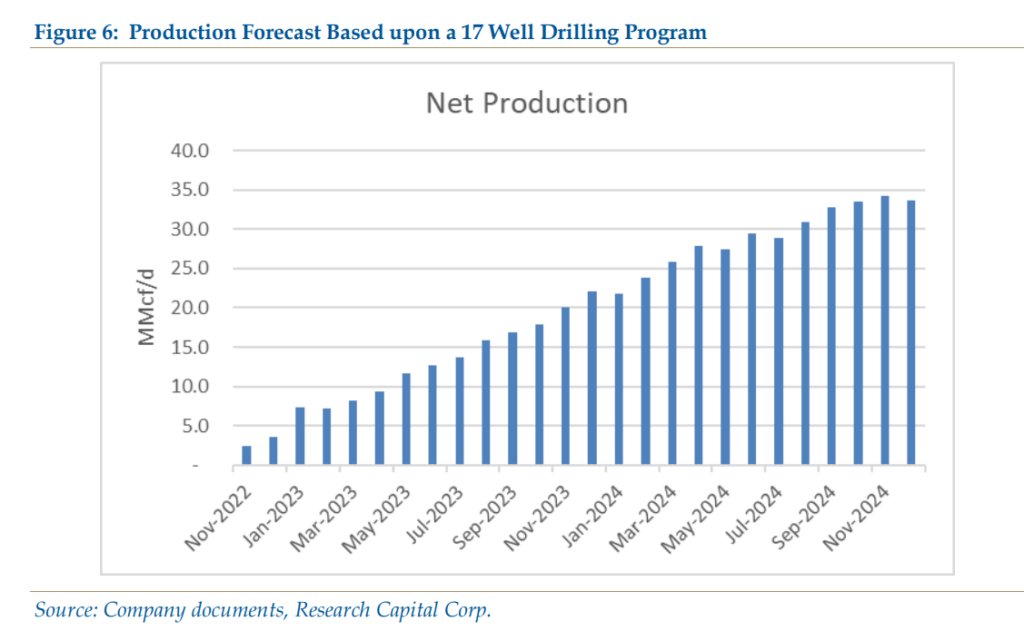

This month, Trillion Energy will start a seven well development drilling/recompletion program that is fully funded and that already has extensive infrastructure in place. The drilling will continue into 2023, and initial production rates are expected to be in the 5 to 10 MMcf/d range, with payout in an estimated 3 months.

Research Capital also says that the company has a fully funded capital program from 2022 to 2024, as the company currently has US$27.6 million in working capital and no debt. The company expects the program to cost US$30 million, with the company already contributing US$4.2 million during the first half of the year.

Research Capital expects net production to rise to 13.6 MMcf/d in 2023 and 29.2 MMcf/d in 2024, as they assume Trillion will complete the full 17 well drilling program.

FULL DISCLOSURE: Trillion Energy is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Trillion Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.