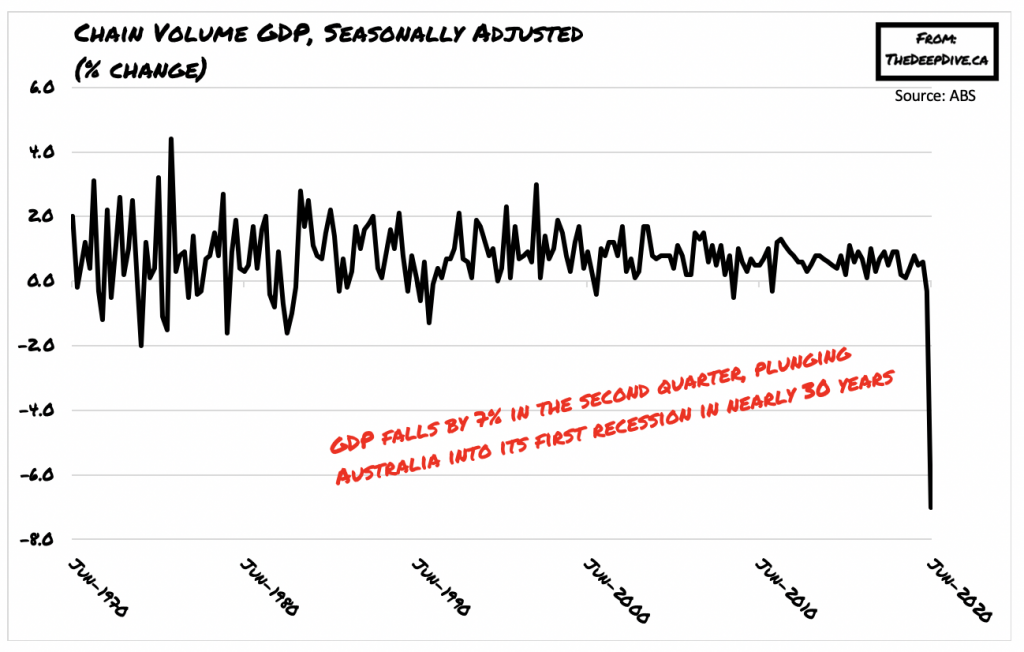

It has been six months into the coronavirus pandemic, and its path of economic destruction is becoming increasingly evident. What appeared as financial immunity from coronavirus implications is no more– as now Australia has joined the long list of countries suffering from a sudden depletion of GDP levels.

According to data released by the Australian Bureau of Statistics (ABS), Australia’s economy contracted by 7% in the second quarter of 2020, plunging the country into a recession not seen in nearly 30 years. Prior to the coronavirus pandemic, Australia has remained immune to some of the most significant financial downfalls in recent history, including the Dot Com Bubble, the Asian Financial Crisis, and the 2008 Financial Crisis. However, the resiliency has now come to an end, as the country now suffers from the largest GDP decline on records that date as far back as 1959.

The latest ABS data release also found that household spending in Australia fell by 12.1% in the second quarter, while investments into new and used dwellings declined by 7.3%. Meanwhile, government spending was on the rise with an increase of 2.9%, and most notably, the savings rate soared to 19.8% – the highest on record since 1974.

While many other countries around the world remained hesitant in reopening their economies before the peak of the coronavirus threat subsided, Australia decided to declare an early victory against the deadly virus. The country lifted its restrictions prematurely, resulting in a soaring resurgence of infection rates, which in turn lead to the city of Melbourne being locked down for nearly two months, thus reducing any hopes of a swift economic recovery.

In the meantime, Australia’s government has been rampantly pouring liquidity into the stalled economy, and even unveiled a JobKeeper wage subsidy program as a means of keeping employees connected with their firms for when activity resumes. In fact, the economic fallout is so serious that the government announced on Tuesday that it will be providing banks with a line of funding totalling A$200 billion in order to smoothen out the upcoming economic turmoil. Nonetheless, even with such unprecedented fiscal stimulus spending, the Reserve Bank of Australia still anticipates that unemployment will remain around 10% by the end of the year.

Information for this briefing was found via the Australian Bureau of Statistics and the Reserve Bank of Australia. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Hyperinflation: Remember, GDP = Money Supply x Velocity

When trying to wrap my head around economics, I like to simplify basic principles down...