As parliament finally reconvened today and Prime Minister Justin Trudeau delivered his widely-anticipated throne speech, it appears that more federal spending is en route for Canadians.

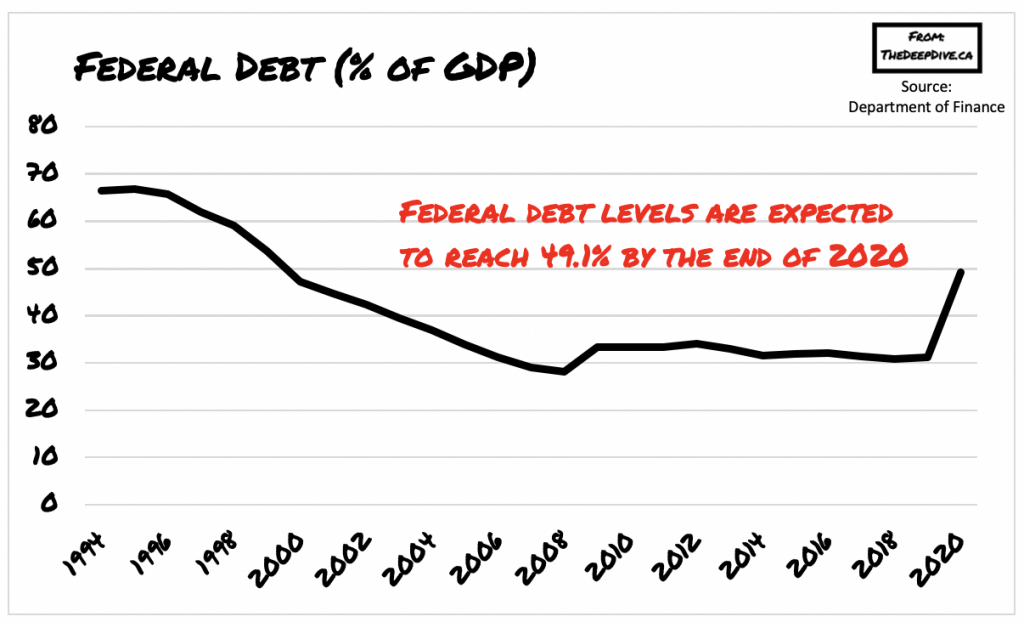

Despite the several major Canadian banks warning the Liberal government about further propelling the country into an even deeper deficit, Prime Minister Justin Trudeau vowed to do everything it takes to bring the Canadian economy to pre-pandemic levels by further expanding corporate credit facilities, as well as focusing on financially supporting some of the country’s hardest-hit sectors. Additional immediate priorities include Canada’s healthcare system, which has become overwhelmed as a result of the pandemic, as well as ensuring there is adequate financial support for both Canadian businesses and individuals.

However, the flagship portion of the Prime Minister’s speech focused on meeting its goal of creating an additional 1 million jobs, which will be predominantly achieved via an extension of the Canada Emergency Wage Subsidy into next summer. Furthermore, in order to achieve the employment target, the federal government will also focus investments towards infrastructure and the social sector, as well as allocate funding for worker training and increasing incentives for companies to hire and retain their workforce.

With respect to long-term recovery action, the Liberal government also plans on creating jobs via increasing funding for the Youth Employment and Skills Strategy program, which will offer paid work experiences for young Canadians next summer. In response to growing concerns regarding Canada’s deficit position, the Prime Minister pledged to employ fiscal responsibility, which is to be revealed in detail during the fall fiscal update.

In addition to outlining the government’s plan in terms of lifting Canada’s economy out of the recession, Prime Minister Justin Trudeau also promised to focus on digital giants and ensuring that revenues are shared proportionately across film, media, art, and music. The government plans to address corporate tax avoidance by digital giants, in addition to exploring additional ways to tax some of the country’s wealthiest.

Information for this briefing was found via the Government of Canada and the Department of Finance. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.