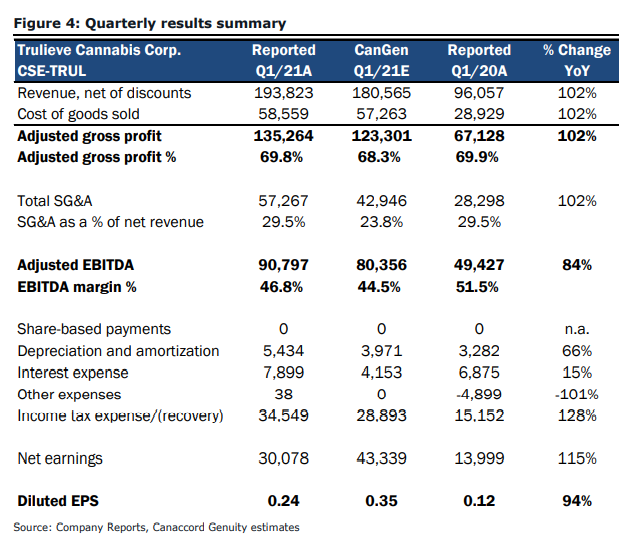

Trulieve Cannabis (CSE: TRUL) reported its first-quarter financial results on May 13th, beating the analyst consensus. The company reported quarterly revenues of $193.8 million, a 15.1% increase sequentially, and a 102% growth year over year. The company reported gross margins of ~70%, with an operating margin of 37.4%. Earnings per share came in at $0.24, with a 15.5% net margin. Adjusted EBITDA came in at $90.8 million.

A few analysts have changed their 12-month price target on Trulieve after the earnings, bringing the mean 12-month price target slightly lower to C$87.38 from $88.08 before the earnings. The street high comes from Stifel-GMP with a C$132 price target while Cantor Fitzgerald has the lowest target price at $62.25.

In Canaccord’s note, their analyst Matt Bottomley reiterates their C$97 price target and speculative buy rating after the earnings, calling the earnings a strong quarter for Top-line and EBITDA growth. Below you can see how Trulieve stood up against Canaccord Genuity’s estimates.

Bottomley says that this 15% growth was all organic, stemming from Trulieve’s key state Florida as same-store sales increased 39% during this quarter. He also notes that the company has seen an acceleration in new patients with the average new customers per week jumping from 4,800 to >6,000 new customers per week.

This quarter also was the first full quarter of Pennsylvania operations, which could have been the reason for the very slight gross margin compression Bottomley says. Trulieve is in the wholesale business which gets lower margins than a fully integrated operation.

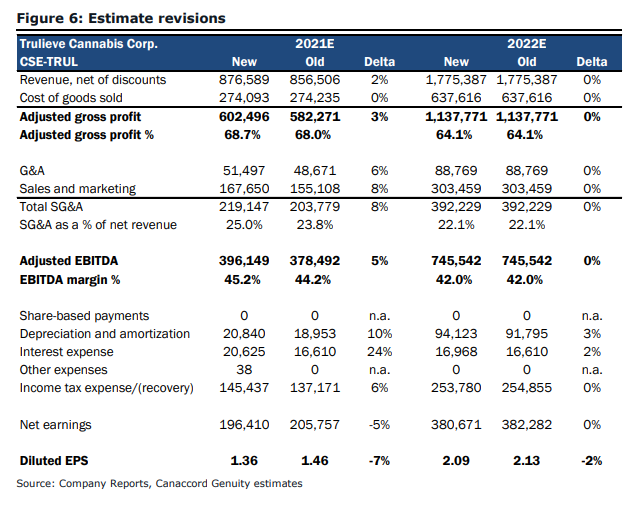

As for Trulieve’s outlook, Bottomley seems to think it’s pretty bright saying that adjusted EBITDA coming in at 47% is very high and he believes that they will stay high. On the Harvest acquisition he writes, “in our view, adding a market leadership position in one of the fastest-growing states in the US in Arizona and a deeper presence in Pennsylvania, among other state exposure.”

Below you can see the updated 2021 and 2022 estimates for Trulieve.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Trulieve… “To the moon…”