On October 1, Trulieve Cannabis (CSE: TRUL) announced that they completed their $1.75 billion acquisition of Harvest Health (CSE: HARV). Harvest shareholders received 0.1170 shares of Trulieve for each subordinate voting share held. Trulieve issued a total of 50.9 million shares. The pro-forma second quarter revenue would have been $317.6 million.

A number of analysts raised their 12-month price targets off the back of the completed acquisition. This brought the average 12-month price target up to C$84.80, or a 137% upside. There are 17 analysts covering the stock, with 5 analysts having strong buy ratings and the other 12 have buy ratings. The street high sits at C$132 from Stifel-GMP while the lowest comes in at C$54.

In Canaccord’s note, they elected to just revise their estimates while keeping their Buy rating and C$97 price target the same. They say that beyond the attractive assets in Florida and Arizona, Pennsylvania is one of the key reasons why they like this transaction. They write, “Florida and Pennsylvania also offer potential significant adult-use upside beyond what we have included in our estimates.”

Canaccord also commends Trulieve on raising $350 million at 8% with no warrant, saying that this has been the most attractive term in the space. This, combined with the $55 million they got from selling Harvest’s Florida license, makes Trulieve’s balance sheet “well-positioned to fund organic growth in these key markets.” Canaccord believes that it will use its balance sheet to focus on its adult-use markets, specifically Arizona and Massachusetts as well as keeping its eyes out for acquisitions.

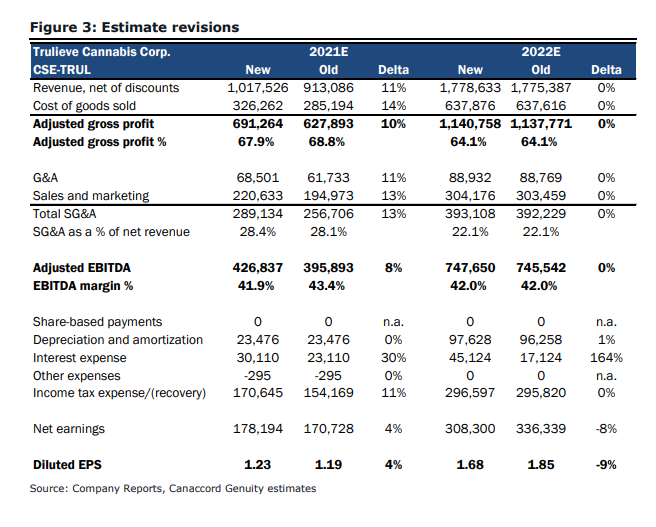

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.