The Turkish stock exchange suspended trading on Wednesday, following market turmoil in wake of two devastating earthquakes that wreaked massive damage and casualties across the region.

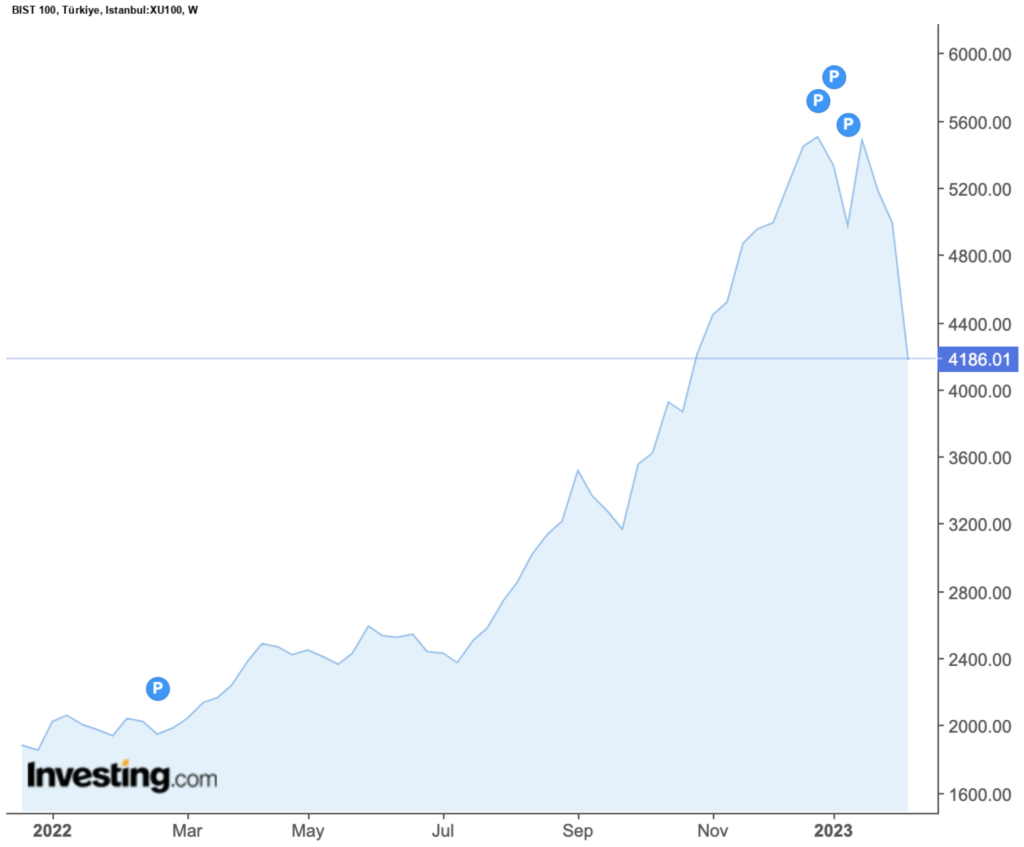

The benchmark Borsa Istanbul 100 Index was halted for the first time in 24 years, after dramatically sliding over 7% at the start of Wednesday morning’s trading session. “Our stock exchange has decided to halt trading in equities, futures, and options markets,” the stock exchange said in a statement, failing to provide a timeline of when trading would resume.

The index is slated for its poorest performance since the 2008 financial crisis, losing approximately $35 billion in value thus far. Likewise, Turkey’s banking sub-index (.XBANK) also dropped a whopping 6% in the midst of the trading suspension. “At times of catastrophes like this, suspending trading in the stock market is a better decision in order to protect investors,” explained Haydar Acun from Marmara Capital to Bloomberg.

The trading suspension comes in light of a 7.8-magnitude earthquake that shook Turkey and Syria on Monday, followed by a second earthquake on a fault line in close proximity. The seismic event caused catastrophic destruction whereby buildings collapsed, killing tens of thousands of people.

Turkish President Recep Erdogan declared a three-month state of emergency for the ten Turkish regions most affected by the quake, and a seven-day mourning period for the victims that succumbed to the natural disaster. So far, the death toll sits at nearly 10,000, and is expected to increase as rescue workers find more casualties.

Information for this briefing was found via Bloomberg and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.