Twitter (NYSE: TWTR) will be reporting its second quarter financial results on July 22 before the market open. Analysts have a consensus $45.84 12-month price target on the company, via a total of 37 analysts, with one analyst having a strong buy rating.

Two analysts meanwhile have buy ratings, 32 have hold ratings, while two analysts have sell ratings on the stock. The street high comes from Evercore ISI with a $60 price target, and the lowest target sits at $30 from Wedbush Securities.

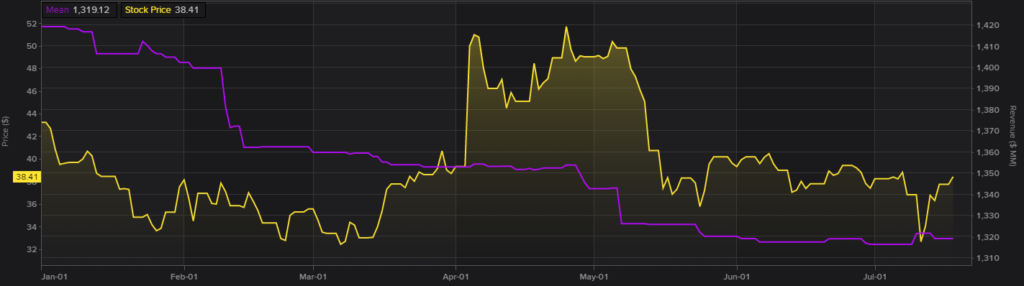

23 analysts have revenue estimates for the second quarter. The mean revenue estimate between all 23 analysts is $1.31 billion; this number has gone down from $1.42 billion at the start of the year. The highest revenue estimate is $1.43 billion, while the lowest is $1.22 billion.

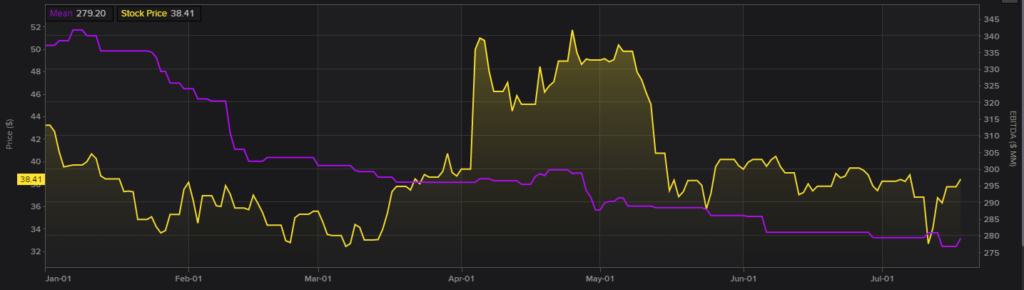

Onto EBITDA estimates, there are currently 21 analysts who have second-quarter EBITDA estimates. The mean is currently $280.8 million, with this number coming down from $337.1 million at the start of the year. The street high estimate currently sits at $382 million in EBITDA and the lowest is $156 million.

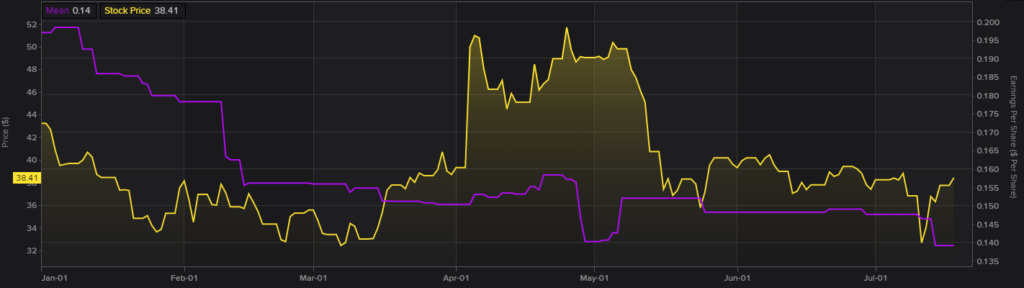

Analysts estimate that quarterly earnings per share will come in at $0.14, with this number coming down since the start of the year. Street high is $0.20 and the lowest estimate is $0.03 per share for the quarter.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.