Last week, this space covered a first quarter earnings report from Uber Inc. (NYSE: UBER) that was a major disappointment to a market that is no longer interested in the growth story that built Uber to a peak market cap of $80 billion.

CEO Dana Khosrowshahi isn’t ready to admit to being a Deep Dive reader, so his letter of May 9th to Uber staff attributed a change in direction to meetings with “investors in New York,” who Khosrowshahi reminds his employees, “don’t run the company, but do own it.”

The letter uses the modern management we’re-all-in-this-together tone to explain what amounts to your basic austerity playbook. Hiring will become a ‘privilege,’ as the company shows its investors that it can serve them as a money machine just as easily as it did as a growth vehicle.

It’s too bad Uber can’t generate cash flow from cliches.

After Khosrowshahi gets through with how there’s been a “seismic shift,” and “moving of the goalposts,” and pledges that management isn’t about to “put their head in the sand,” but instead, “show them the money…” he gets around to the fact that the average Uber employee is 30 years old, and has never seen a market that wasn’t in a perpetual melt up. We’re inclined to read that as an accidental admission of this company’s core problem: it’s built around the stock market and, from that angle, isn’t a business at all; more of a banking exercise.

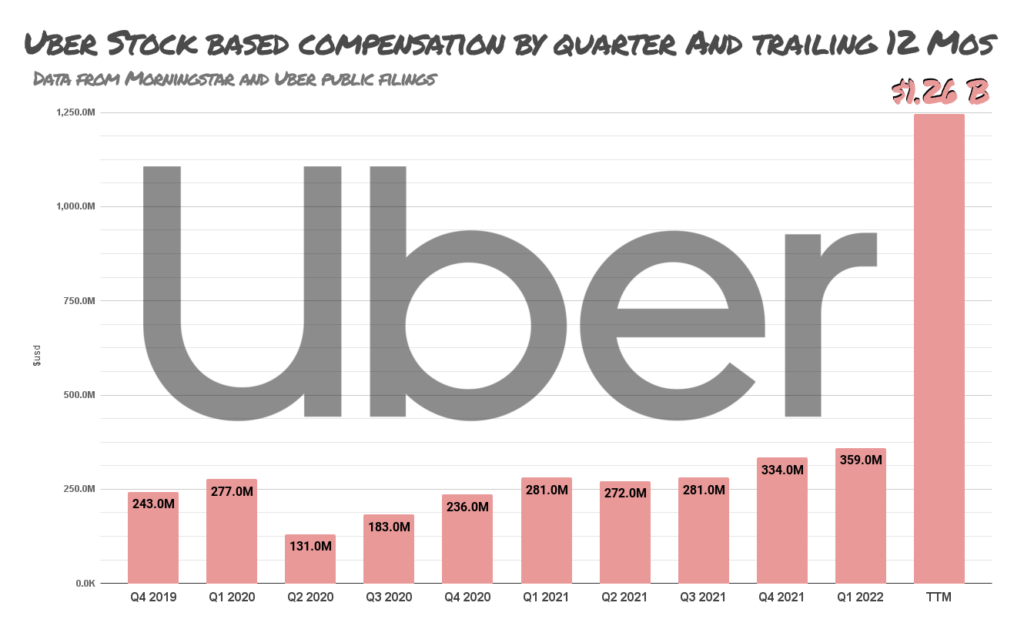

Share-based compensation was $1.2 billion in 2021, because speculative capital is part of Uber’s DNA. Its only on-paper profit was engineered with an unrealized gain from a SPAC offering. The people working at Uber have never made money any other way. To them, the stock market might as well be the set of The Truman Show.

There are around 29,000 employees on the Uber payroll as of the end of 2021. That doesn’t count the people who drive the cars and deliver the packages who, depending on how you look at it, can be classified as customers or products. We’ll get to them in a minute. This email went out to the tech employees who are accustomed to this company’s cap table producing an annual bonus that keeps two Teslas in their Palo Alto garage.

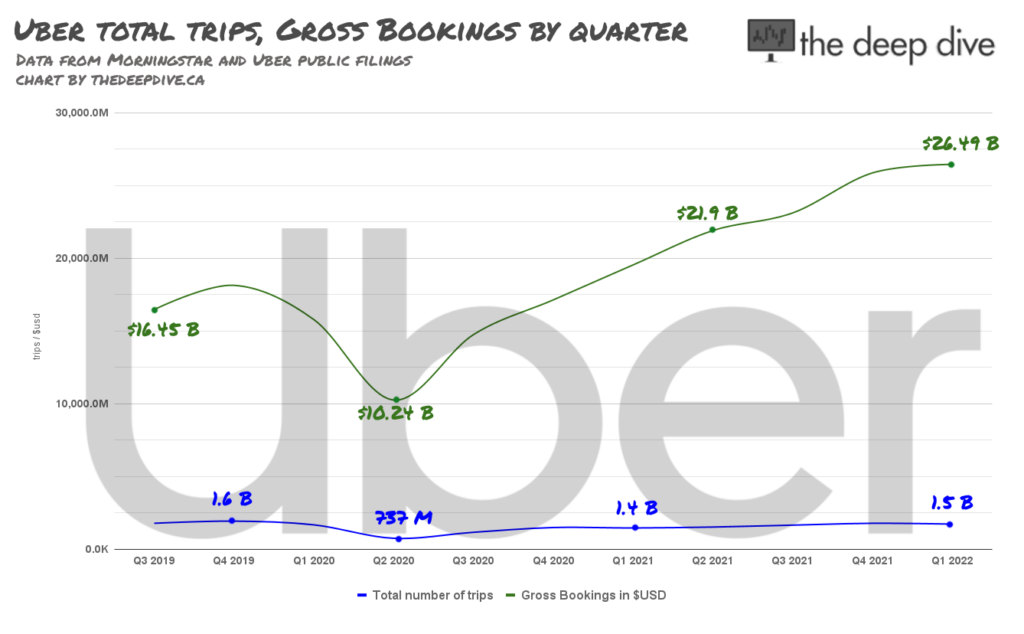

It sure isn’t coming from the income statement, because Uber bleeds money. The value in all of those stock options and RSUs was and is driven by investor appetite for the world’s biggest “rideshare platform.” And they absolutely earn it, by building and maintaining a platform that has taken over the world’s short trip logistics market like a virus. It did $26.4 billion in gross bookings last quarter!

Now here comes the boss, back from New York talking about how “the goalposts have moved,” and this thing needs to make money all of a sudden. Not because capital has dried up and it has to stand on its own two feet. That would be reasonable enough. Khosrowshahi is suddenly concerned about free cash flow because investors told him to be. Because they told him that’s what they want and he apparently lacks the brains or guts to do anything else.

The Dumbest Idea in the World

The notion that Uber or any other company exists to serve its shareholders’ interests is regressive and stupid. It’s an idea that was pioneered by Milton Friedman and extensively field-tested by long time General Electric CEO Jack Welch. By the end of his life, after he’d all but ruined a legendary American industrial institution, Welch called shareholder value maximization, “the dumbest idea in the world.” Jack was moving the goalposts himself, acting like he never really was managing GE to generate market returns, but it caused ripples because it was all he was about for decades. Frankly, “dumbest idea in the world,” may have under-sold it.

An operating company’s first priority has to be its ongoing existence as a going concern. That having been taken care of, it must then focus on its ongoing prosperity as an enterprise. This is different than the prosperity of its shareholders, and must be considered on a longer timeline. The whole idea behind investing in a public company, after all, is that it’s liquid. Why set out to maximize the value of someone whose most prudent move is to sell their interest as soon as its value is maximized?

Khosrowshahi could have stuck up to the investors. He could have told them that this largest, most pervasive, fastest growing short trip logistics brand in the world is going to continue to grow with or without them, and focus on the bottom line when it makes the most sense; and that the market pitching a fit wasn’t going to throw the company off the mission laid out in his 2019 letter to shareholders (still featured on the Uber IR page), but that isn’t what he did. He jumped up and moved the goalposts right where he was told to move them.

“Profit? Not anytime soon. Can I interest you in the next best thing?”

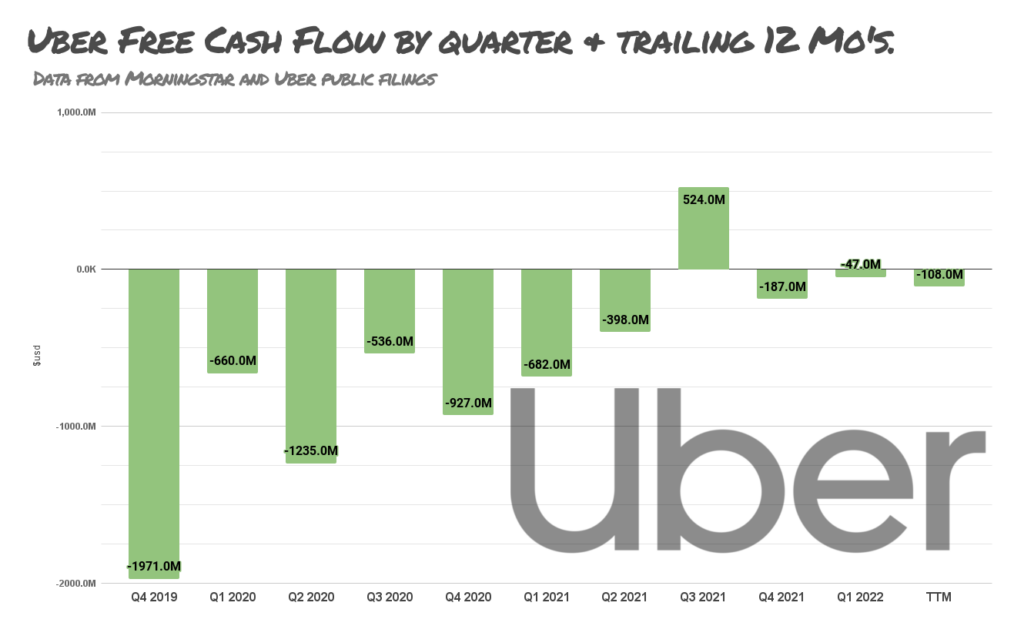

“Free Cash Flow,” is a non-GAAP metric that Uber started tracking in 2022. Its sudden relevance has everything to do with this in-process pivot from growth to income. Free cash flow isn’t a conventional kind of profit. It isn’t profit at all. It’s the hard money that the business generates in any given period.

To investors, it has a nice ring to it. It’s “free cash,” that that can be made to “flow…” to them. Regardless of whether or not this business is making money. There are a number of ways to go about it: dividends, buybacks… it could be used to support the interest and fees of a larger debt load… plenty of potential here. The trick is to anchor this leech NOW, and get it feeding off of the organism ahead of profitability. If Uber ends up succeeding despite the parasite, investors can take credit. If it ends up sinking the company, so what? They managed to get paid anyway.

The C-Suite and tech talent is fine with all of this, because it isn’t like it affects the option pool. Free cash flow is just operating cash flow less capex, and the capex has never been a problem. It’s not like the world’s largest transport company has a fleet to maintain. Employees get what they want, investors get what they want, bookings grow or stay the same, people are still getting their rides and deliveries, the free cash is a-flowin’, and everyone is happy. Everyone who matters, anyhow.

“The world’s largest platform for independent work,” is a funny way to put it. The wor- er… “contractors,” doing the driving and delivery are absolutely dependant on Uber, and not the other way around. They’re hired, fired and managed through software, and owed nothing at all in terms of committment or security. Increasingly, as traditional taxis are made extinct and commerce adjusts to on-demand delivery, the world becomes as dependant on them as they are on Uber.

Delivery drivers are the very core of the ongoing COVID lockdown in Shanghai; essential workers if ever they existed. The BBC talked to two of them who are sleeping under bridges. Their high-contact status excludes them from most housing. There’s more money in it, of course, mostly because there are more trips, and what else is there to do besides run packages and fix the bike? Nothing is open, and there’s no TV under the bridge.

The genius of platform businesses is that none of that is the company’s problem. Uber benefits from all those trips with no extra expense or effort. Nobody expects the company to demand accommodations be made for their couriers’ care and feeding, or to create places where these people can sleep and eat between shifts. And it’s a good thing, because if the government made Uber build some kind of courier leper colony, it could really run up the capex.

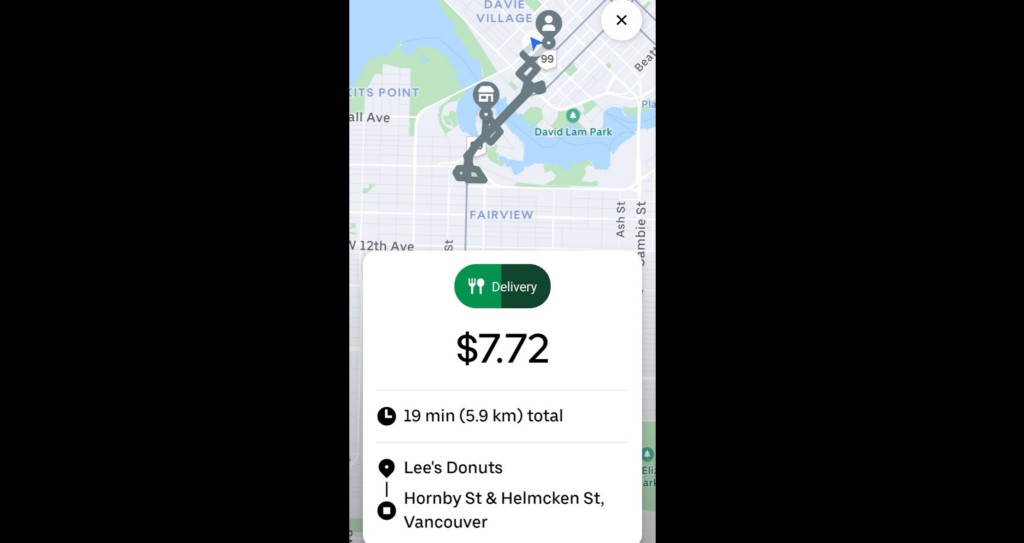

Vancouver’s own fleet of independent delivery jockeys had their worlds fall apart this past April, as the number of available UberEATS trips plummeted. For reasons unknown, the system started giving all of the orders to couriers in cars, leaving a crowd of guys on e-bikes hanging around on street corners wondering how they were going to make rent. It seemed busy enough. Kitchens were hot, orders were flying; just not to bikes. Uber said very little, and never the same thing twice. Reddit forums show some couriers received a vague response about a software issue, but nobody got any significant volume of trips.

Then, May 1st, the trips came back as quickly as they had left. Nobody knows why. It might have been anything. The company could have been feeding trips to drivers to make sure they didn’t end up underwater on the car payments and quit. It could have been a way to observe how the bikes reacted to the work drying up, see how many of them stuck with it. The advanced analytics may well have shown that the couriers are more productive in periods that follow slowdowns. The real innovation here is Uber’s ability to manage a staff that isn’t under any sort of employment contract.

To Uber, the people doing the dirty work are private contractors or customers, depending on who’s asking. A UK ruling that rejected Uber’s classification of its drivers as non-employees, entitling them to certain mandated benefits, caused the company to take a $600 million accrual in Q1 ’21, in anticipation of the eventual cost of the settlement. The true cost of settling with UK workers misclassified as contractors won’t be known until later in 2022.

There is the potential that other governments will see it the way the UK did, but Uber is committed to staying ahead of that. In California, the company used a 2020 ballot initiative to successfully secure an exemption to state employment laws that allowed delivery drivers to continue to be treated as contractors. The “yes” campaign for Proposition 22 benefited from heavy promotion through both rider-side and driver-side Uber apps.

The 70,000 or so workers who drive for Uber in the UK might be considered employees by Her Majesty’s Government, and entitled to all associated benefits, but the Queen has no say in the way Uber keeps score, and Khosrowshahi sure wasn’t writing this letter to them.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Market Moving: The Elements of the Venture Exchange’s Ongoing Resurgence

The TSX Venture Exchange is the largest regulated venture-stage equities exchange in the world. Those...