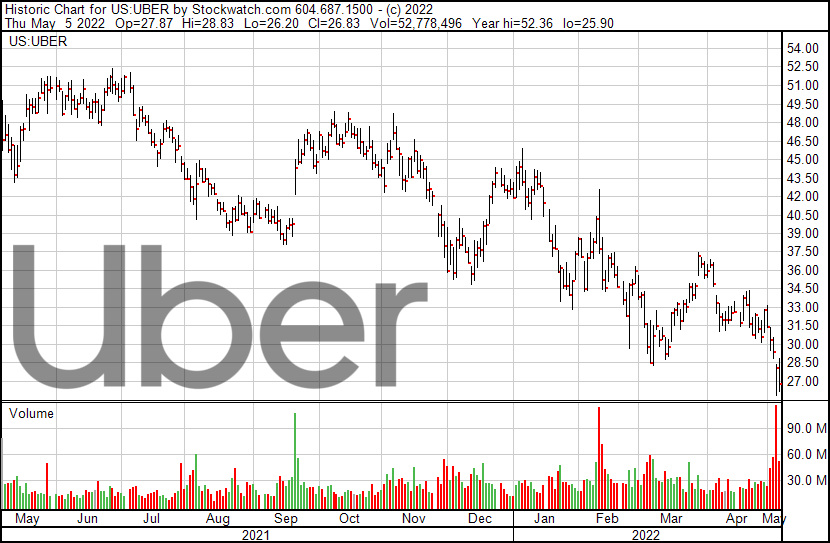

The last time this column covered Uber Technologies (NYSE: UBER) (August, 2021) we wrote about how the world’s largest transportation “platform” company was effectively a growth-phase startup, more focused on the top line than the bottom, and that a company capable of maintaining such a posture at an $80 billion market cap was a hell of a thing.

Uber shed $23 billion worth of market cap between then and Tuesday, then another $1.3 billion Wednesday, following a Q1 2022 earnings report that made the overbuilt tech startup look a long way out of touch.

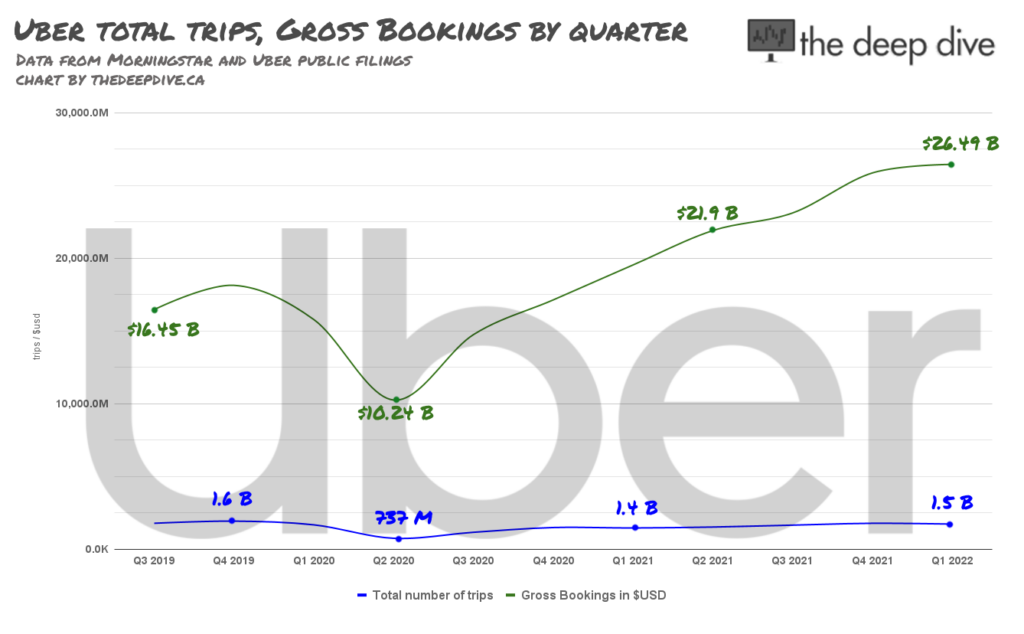

Uber’s earnings reports feature the gross bookings and total trips, metrics of the company’s own design, right up top, telegraphing the aforementioned identity crisis. Both numbers were up year over year, and have been growing steadily for the past eight quarters.

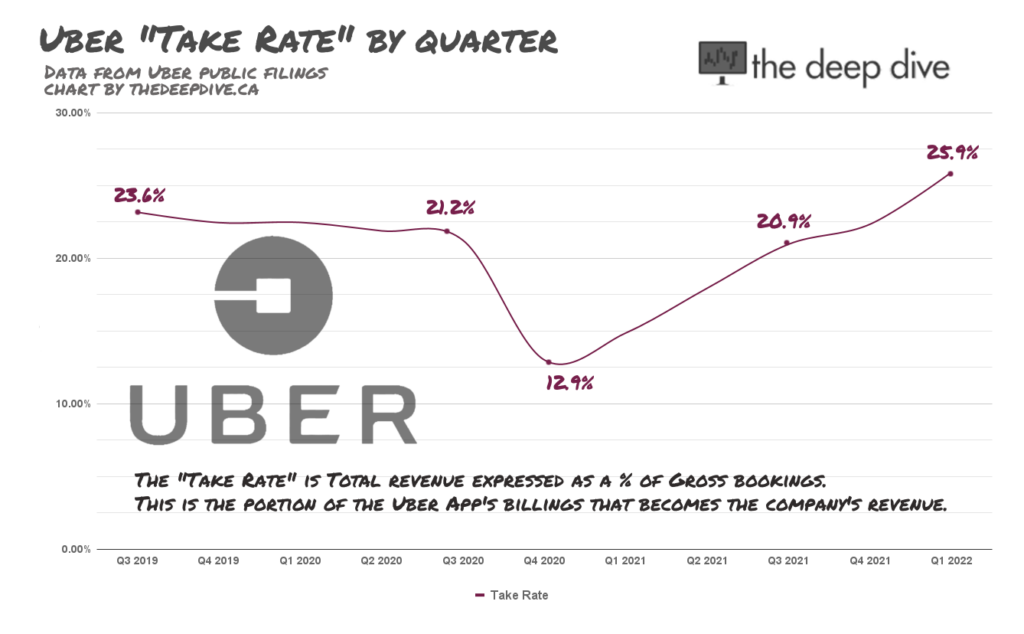

Uber’s “take rate,” the portion of the platform’s gross bookings that make their way into revenue, were up in both delivery and mobility verticals (18% & 23.5%, respectively), and in the aggregate, indicating that Uber is maintaining its pieces of the pie through its expansion.

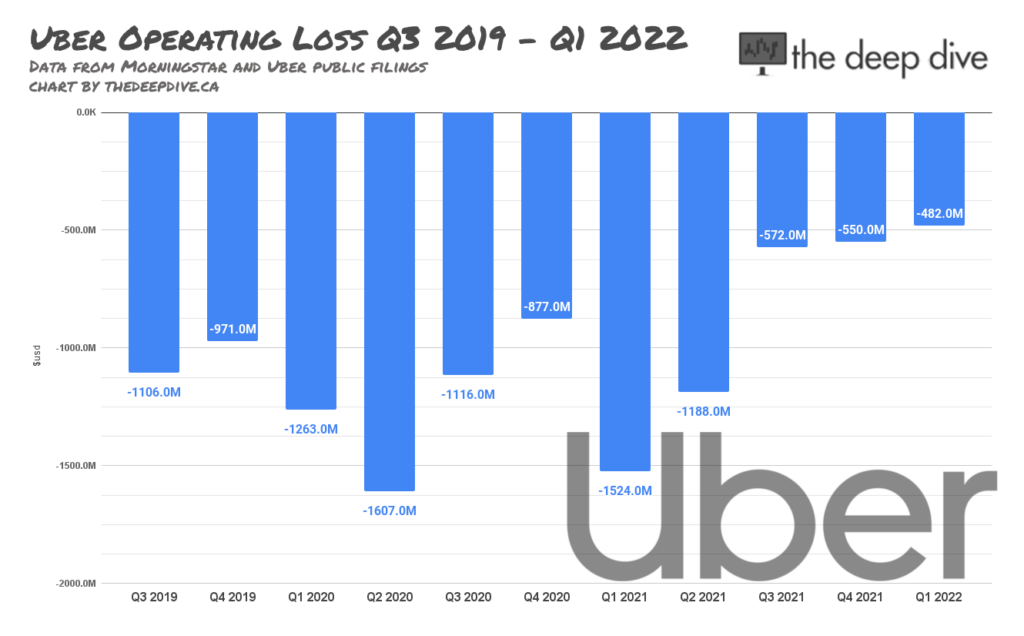

The selloff that followed a very strong showing in Uber’s custom top-line metrics seems like the market telling Uber that the mega-growth story is wearing thin. It doesn’t believe in Uber’s ability to generate bottom line earnings from any amount of trips or gross bookings, no matter the take rate. The company may have handicapped its own ability to build that type of confidence in investors by delivering its earnings through an absolute pigsty of a P&L.

Uber’s conventionally calculated operating loss was “only” $482 million in Q1, extending a gradual but steady improvement over three quarters. If it were a trend that the company could pledge to accelerate, it might look like Uber was on its way to being a consistent, cash-generating business. But management chose not to feature or even discuss its operating loss in its earnings release, possibly because it was small, and wasn’t going to matter in the face of the big, ugly net loss.

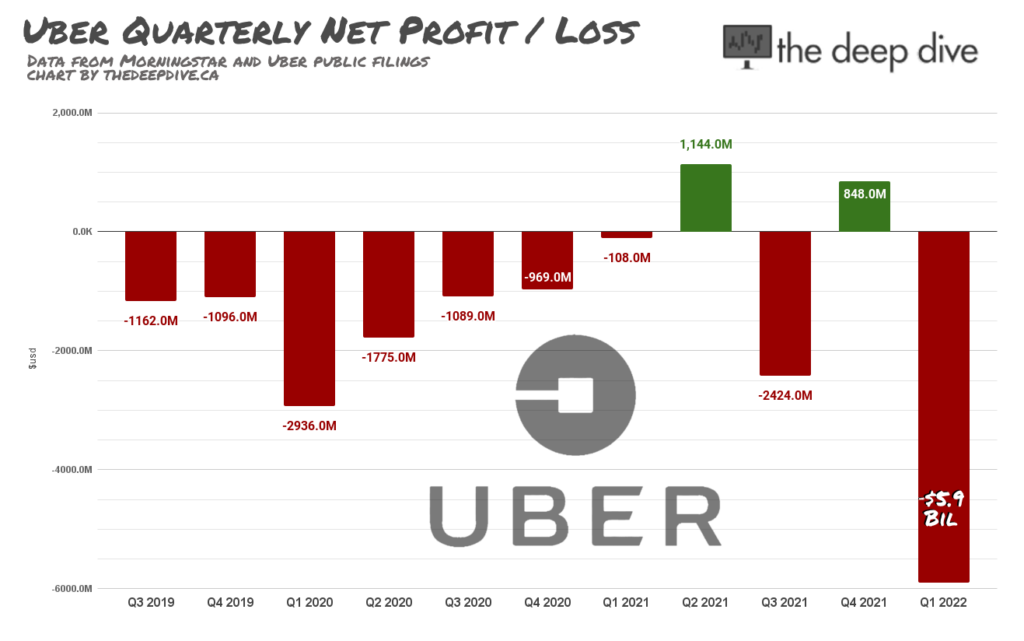

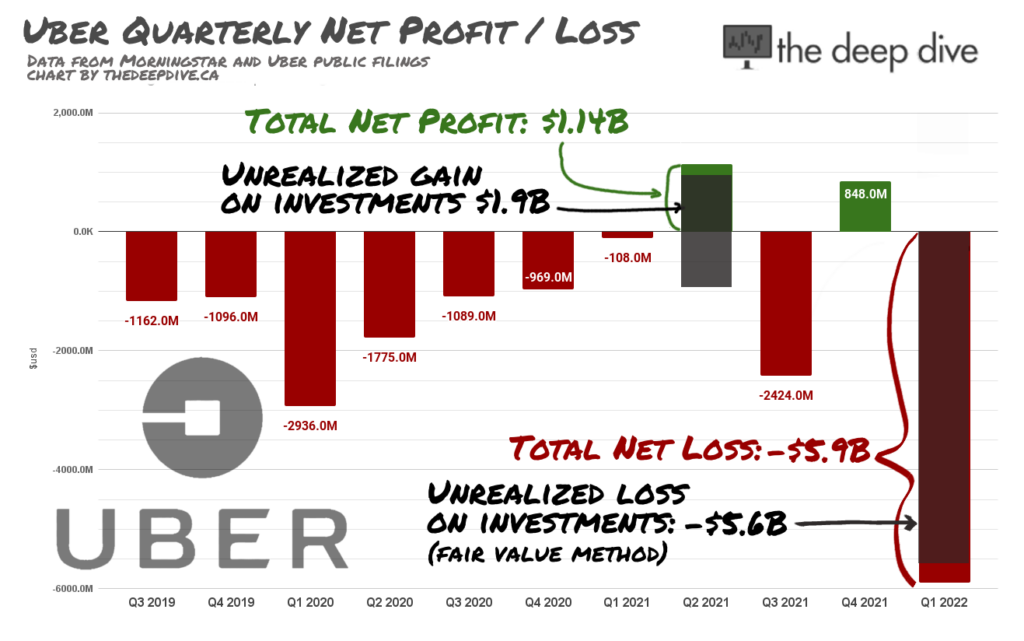

Uber served up a $5.9 billion GAAP net loss that included a $5.6 billion “headwind” from unrealized losses on investments in various companies that it has acquired as part of its ongoing expansion. Uber has elected to use the fair value option of accounting for financial instruments, living and dying by the sword of the equities markets, which have been doing some bloodletting lately.

In a market environment where money was flooding in to growth equities, the fair value method allowed Uber to take the inflation in the value of businesses that were bought for practical purposes, like delivery apps Didi and Grab, and put it directly on their bottom line, which probably seemed like a good idea at the time.

In 2021, Uber sold its self-driving research division to Aurora Innovation (NYSE: AUR) (a private company at the time) in an all-stock transaction that valued Aurora around $6 billion, and made concurrent $400 million cash investment to re-capitalize Aurora that set its fair value at $9.6 billion. It was a move right out of the Vancouver small cap playbook that, from a fair value perspective, was defensible. 2021 was the peak of the SPAC boom, and blank check companies were practically elbowing each other out of the way to take Aurora public. The investment produced a $1.9 billion unrealized gain for Uber, and allowed it to book a $1.4 billion net profit in the June quarter, its first.

But all gunslingers get shot eventually.

The post-SPAC Aurora presently has a market cap of $2.6 billion, and its re-valuation will surely be among the $5.6 billion in “headwinds” that sent Uber’s bottom line through the floor.

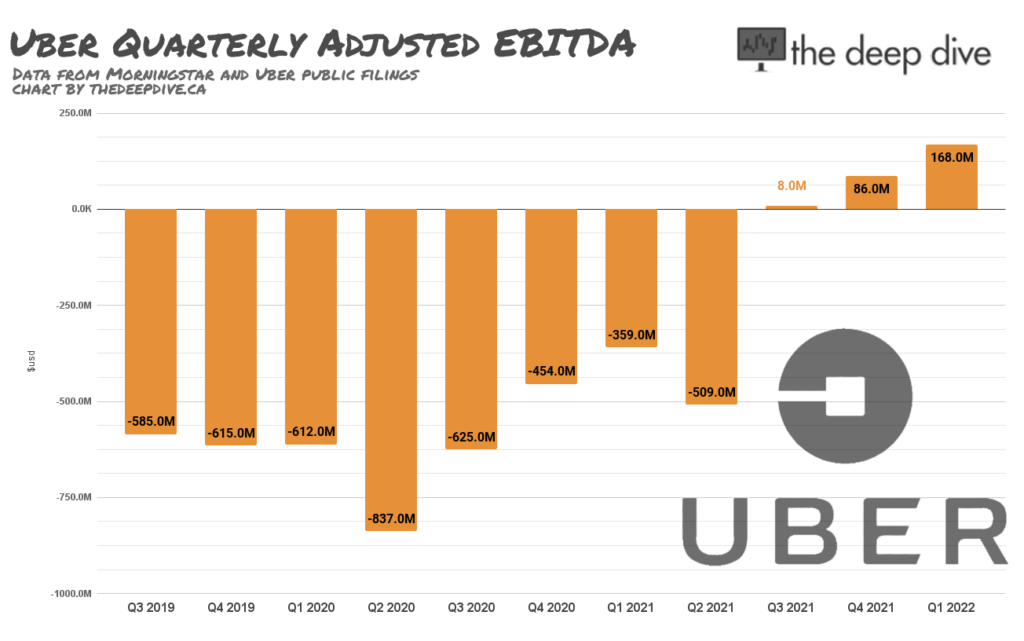

Uber’s adjusted EBITDA metric strips out the paper gains and losses, making it less volatile but, like most adjusted EBITDAs, it’s mostly a masking of the company’s earnings weaknesses. We’re including it here under protest.

The company further throws mud on it all by expressing this adjusted EBITDA as a percentage of gross bookings – 0.6%, up from (1.8%) in Q1, 2021.

This is a capital markets landscape that is much less willing to speculate on potential, and increasingly fearful of being caught holding on to potential that has little or no chance of becoming kinetic. The party is over, at least for the moment, but Uber doesn’t know how to take it down a notch, and act like they’re just having a few people over and getting loose.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Brilliant, very good read

Thanks for reading!