Many moons ago, before I invested in my first cannabis stock I focused on microcaps. I was no stranger to a cute microcap named Bevo Agro. Bevo essentially propagated plants, primarily vegetables; tomatoes, peppers, cucumbers, lettuce as well as bedded plants and sold the propagated plants to greenhouses growers, nurseries and other farming operations. They had a founder named Jack Benne, who appeared to really take pride in his business.

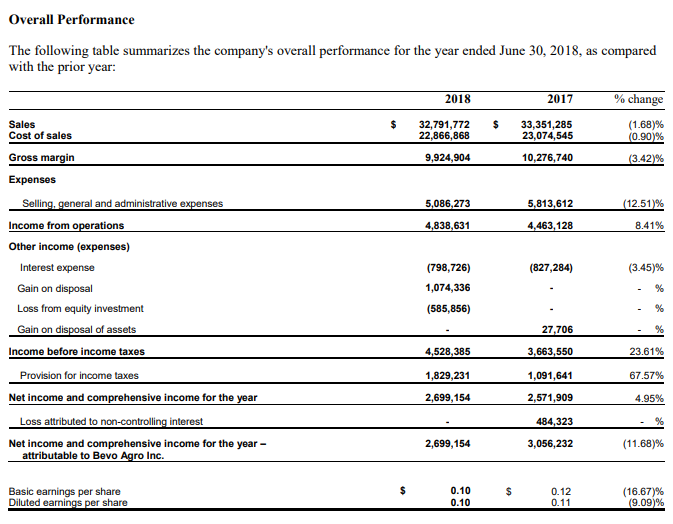

The company at it’s core was solid. And heck, even generated positive income in their last full year as a single entity.

During the Summer of 2017, cannabis stocks were beginning to enter full swing. Village Farms announced a 50/50 Joint Venture with Emerald Health Theraputics Inc and after reading the numbers I thought, “Wow, this is great. They are going to make 10x more EBITDA per square foot.” And just like that, I invested in my first cannabis stock. It went quite well. I quickly found myself in a 300% gain.

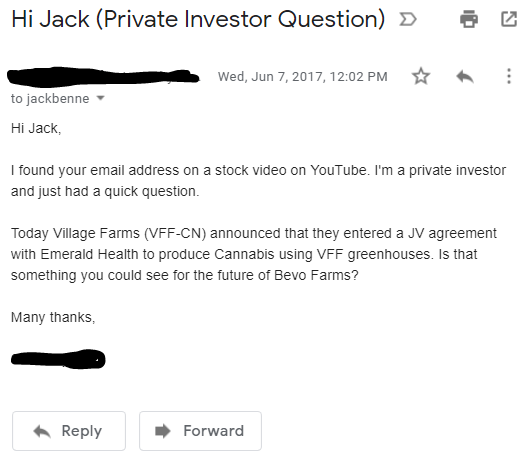

I figured, “Hey, if Village Farms is doing so well, maybe Bevo should do the same.” So I reached out to management:

The Beginnings of Zenabis

I never heard back from Jack. But I learned months later the company was looking to do a similar transaction with Sun Pharm Investments Ltd. and on October 4, 2018, the company issued a news release with the heading, “Sun Pharm and Bevo Agro to Merge as Zenabis.” We found out the company had big plans for the cannabis space with what they described as one of the world’s largest cannabis companies. They would have 660,000 square feet of indoor space and 2.8 million square feet of greenhouse space in three provinces – British Columbia, New Brunswick and Nova Scotia.

At the time, the transaction already was getting off to a confusing start, here are some excerpts from the News Release:

Committed Financings

In connection with the Transaction, Sun Pharm has secured committed or funded financing of ~$57 million, in addition to $72 million secured since the company’s founding. The $57 million financing consists of three components:

- $27.5 million of subordinated financing by way of convertible notes. This financing may be converted into shares of Zenabis at a price equal to the lower of $2.62 and a 20% discount to a financing expected to be completed concurrent with completion of the Transactions (the “Concurrent Financing”). The exchange ratio used for the Reverse Take-Over is being calculated on the basis that these convertible notes are converted and form part of 86% of Zenabis that is allocated to the shareholders of Sun Pharm;

- $25 million of convertible senior debt financing that can be drawn on an as-needed basis by Zenabis. This financing may also be converted into shares of Zenabis at a price equal to a 20% discount to the Concurrent Financing, but this conversion is not considered in calculating the exchange ratio; and,

- $4 million of common shares in Sun Pharm issued at a price of $2.82 per share.

So Bevo Agro, which was last trading at an approximate value of $64M (27.8M shares @ $2.30 last day trading price), would then add $27.5M in convertibles notes, add Sun Pharm valued at approximately $365M, and then toss in $4M shares of Sun Pharm at $2.82, followed by $25M in senior debt.

Convertible Notes? Senior Debt? Yes, you got it folks. Zenabis would be a risk taker. They had a plan. They would execute. And they would convert the debt. After all, it’s cannabis, why wouldn’t the share price go up?

Off to A Great Start!

Investors in Bevo Agro were off to a booming start. Any shares purchased in the months prior to the RTO were quickly up over 150%. From $2.30 to a high of $6.85, all in a matter of a few months.

Understanding the Capital Structure

Since the two companies have merged there has been one straight $28.75M equity raise for 12.8M shares at $2.25, plus a full warrant at $2.75, various debt deals, and two “non-dilutive” prepaid sales agreements.

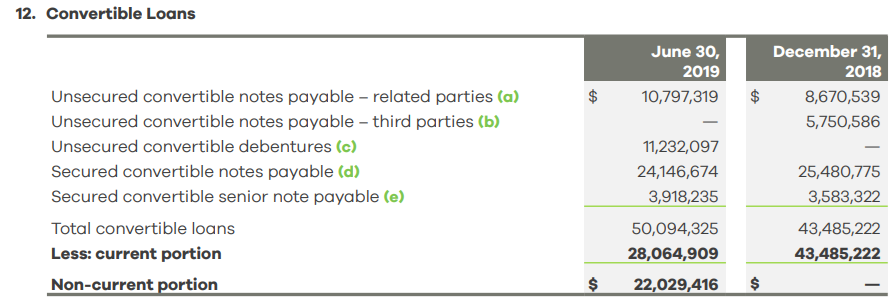

The Convertible Loans

Let’s start by looking at the convertible loans:

From the companies notes, they have 5ish notes for us to look at:

The first two, a) and b), are essentially the same note broken into related party and third party. Which is all consolidated into related party today. This consists of a 6%/annum loan, due October 2020, with a conversion price of $2.52. The total redemption value is $11.9M.

The third note was the first tranche of up to $75M total, which appears to have stalled after the first tranche at $15M (the company has later stated their desire to not go there again). This debt bears cash interest of 6%/annum, is 2.5 years long, and convertible at $3.62. It came with an 8% financing fee, making the effective interest rate more in line with typical cannabis debt deals (15-20%).

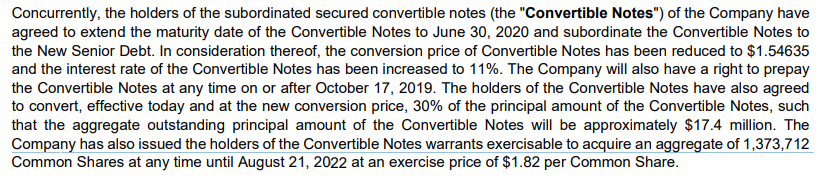

The fourth note was originally secured debt with a principal value of $27.5M bearing interest at 6%/annum due October 2019. This loan gave the lender the option to convert their shares at an exercise price of $2.52. However, on August 21, 2019, Zenabis announced this loan would be extended to June 2020 with a new interest rate of 11%, new exercise price of $1.55, and 1.4M warrants being issued. Also at the time of the announcement, the lenders agreed to convert 30% of their notes to shares at the new price. Reducing the principle amount outstanding to $17.9M.

Lastly, the fifth note started out as a $25M secured convertible note, which turned into a $4.2M convertible, plus a $20.8M non-convertible note at an interest rate of 9% plus prime. Which now is a $50M secured debt deal, at 14%/annum (payable monthly), with a maturity date of June 2020.

So based on the above deals, here is the schedule of when everything comes due:

| Due | Amount | |

| Note 1/2 | Oct 2020 | $11.9M |

| Note 3 | Sep 2021 | $15M |

| Note 4 | June 2020 | $17.9M |

| Note 5 | June 2020 | $50M |

Each of these deals came with some warrant coverage, which has been adjusted upwards since. Instead of breaking down the warrants per debt deal, here is the full capital structure as of August 21, 2019:

| Basic Shares Outstanding | 208.6M |

| Options | 19.0M |

| Warrants | 24.5M |

| Convertibles | 20.1M |

| Fully Diluted Shares Outstanding | 272.3M |

And we haven’t even got into the non-convertible debt yet!

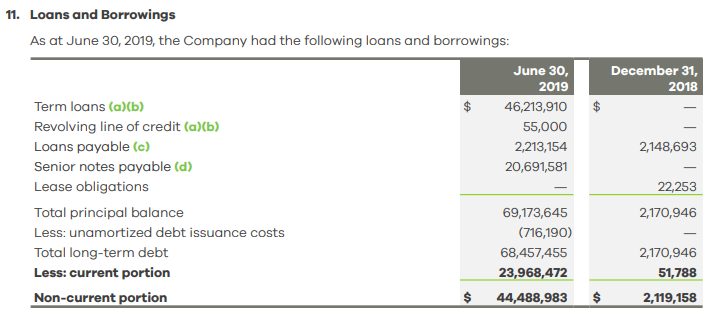

This is actually not overly complicated, here is a breakdown from the last financial statements:

The first term loan is with a major Canadian chartered bank with sub 5% interest rates. With one tranche ($33.7M) available solely for the purpose of repaying current indebtedness of the Company and for the acquisition of Topgro. And the other tranche ($13M) for the capital expenditure to convert Zenabis Langley/Topgro and for the purposes of cannabis cultivation and production. These term loans are due January 2022.

The second term loan is from the True Büch acquisition, and is for a negligible amount (<$200k ).

The revolving line of credit provides available aggregate borrowings of up to $2,000,000 at a rate slightly above prime, for working capital and corporate needs.

The Loans Payable (d), is from August 2017, when the Company entered into a loan agreement with a third party which provided borrowings of up to $2,000,000, bearing interest of 6% per annum. The company begins paying back principal in 2021 and is required to pay back the full amount by 2027.

And the Senior Notes Payable is from when part of the convertible (fifth note from above) became no-longer convertible. This line would now represent a $50M loan.

Let’s Not Forget the Subsequent “Non- Dilutive Financings”

In early July 2019, the company announced a deal to sell cannabis to Tilray for $30M cash upfront. The terms of the deal were mysteriously missing from the news release. How much will be trim? How much will be flower? What was the price? All they really stated in the NR was, “The wholesale pricing under the Supply Agreement will vary depending on the product type and format High Park (Tilray) elects to order.”

In the news release, CEO Andrew Grieve made it clear why he sought this financing. He was likely refusing to give into a possible short and cover hedge fund strategy, “This arrangement significantly reduces the requirement for potential further draws on our $60 million unsecured convertible debenture facility.”

Friend of the Deep Dive, @bettingbruiser hinted that this fund is likely Anson in a recent string of tweets, reminding us that a former Anson portfolio manager sits on the board of Zenabis.

A lot DM’s about $ZENA & Anson Funds.

— Betting Bruiser (@BettingBruiser) August 26, 2019

Anson Funds holds a boatload of converts in $ZENA that they are using to cover their short position.

They’ve had a direct hand creating chaos within management decisions. Including the listing price. How so? Anson representative! #Potstocks pic.twitter.com/eDhHyMmyIu

Later that month, the company announced a similar deal for $10M with Starseed expecting this deal to be completed within 18 to 24 months. Again, pricing terms were not disclosed.

Alright, Now Let’s Talk About Operations

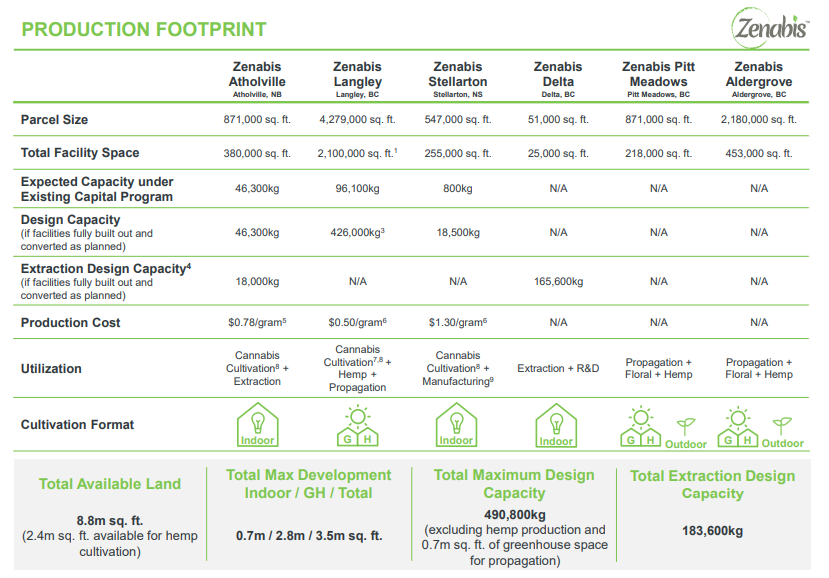

According to the company’s most recent investor deck, they currently have cannabis production capacity of 54,000kg and expect this to increase to 143,200kg under what they describe as their “existing capital program.” With facilities on the two coasts of Canada and design capacity that would bring them to a total of 3.5m sqft or approximately 490,000 kg of cannabis production. This makes them one of the largest cannabis producers in Canada.

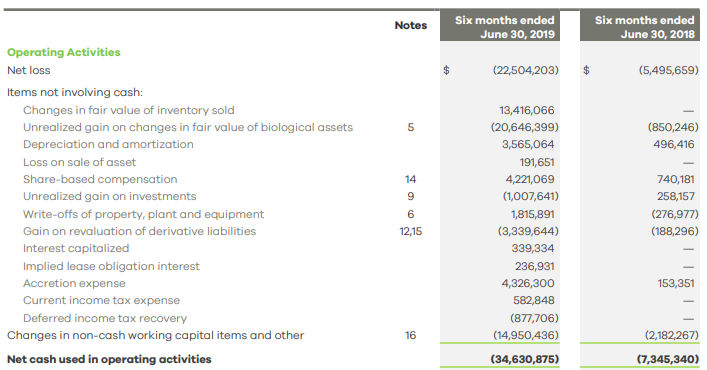

With large plans, come large cash burn. The most recent cash flow statement shows the company has a ways to go until they are anywhere near operating cash flow positive, burning through $34.6M in the first six months of 2019.

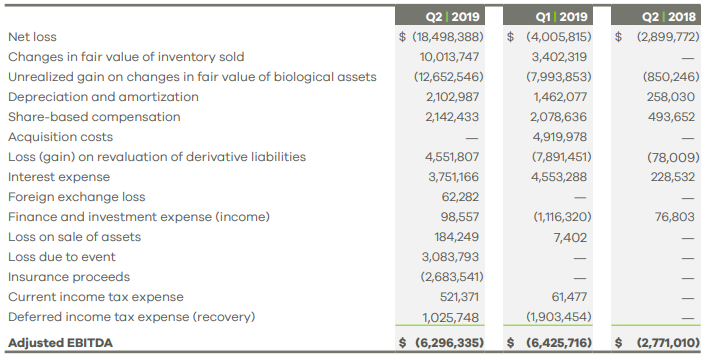

And the company has back-to-back quarters of approximately $6M in adjusted EBITDA losses:

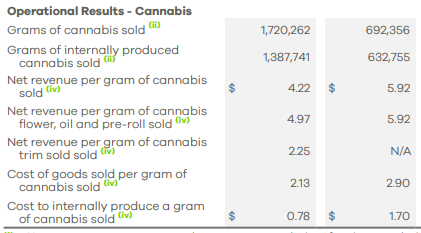

Of course, the company isn’t selling anywhere near the level of cannabis they intend to in the future, so we can largely chalk this up to “ramping.” Last quarter, the company sold around 1,380 kg produced of cannabis, a long way from the 13,500 kg/quarter they are currently licensed for.

A big operational take away from the last MD&A’s is they are able to produce cannabis with great efficiency at an internal cost per gram sold of $0.78. Something long investors likely expected with the Benne family’s involvement.

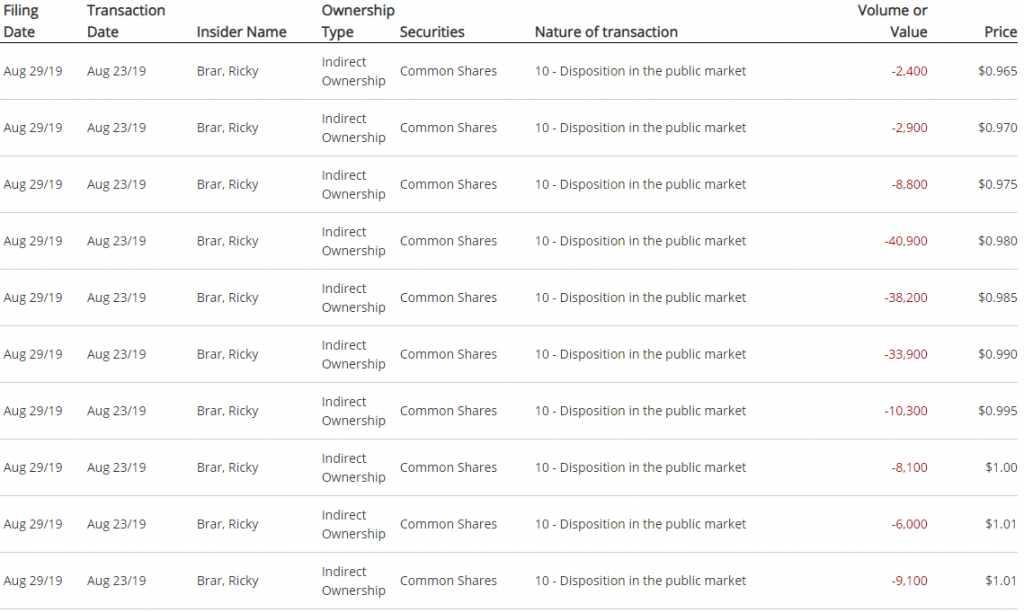

Insider Selling: Ricky “Wild Thang” Brar

If you have been following the story, it is no secret that Ricky Brar has been punishing the stock.

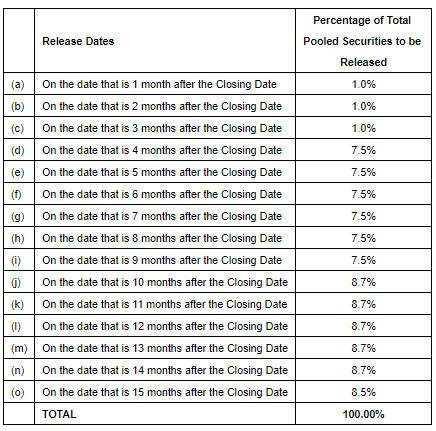

Prior to the RTO, the major holders of Zenabis stock agreed to pool their shares and unlock them on a schedule, representing 60% of the post RTO stock. Only allowing for selling of stock on the following dates from January 2019:

Meaning insiders can sell 7.5% at the end of each month and 8.7% starting in November. Keep in mind this pool includes around 111M shares. As Chris Parry points out, “that is a lot of shares.”

According to Sedi, former CEO Ricky Brar has around 23M shares left. The last few weeks he sold 1M shares and moving forward he will have the right to sell around 2M more additional shares each month. If Ricky intends to keep selling his stock, we are only getting started.

Why has Ricky been selling all these shares? According to Chris Parry, because his accountant told him to!

Talked to former $ZENA CEO Ricky Brar, who sold a lump of stock in the past few weeks.

— 🆒 Chris Parry ™ (@ChrisParry) September 3, 2019

"My accountant said to sell some at $4, $3, and $2, so I think it's fair to do some portfolio rebalancing at $1."

Fair to say how it was done wasn't ideal, however. https://t.co/YJg8Vyz4MT

Related Party Transactions, Not a Good Look!

It wouldn’t be a cannabis story if we didn’t talk about related party transactions. The company’s current CEO Andrew Grieve, makes a salary of $0 salary and his compensation is tied to EBITDA milestones and options. However, he clearly is involved in some related party transactions where he may be getting compensation through another mechanism.

When Andrew Grieve was announced as the CEO, they also let us know that Grieve’s fund would get paid for providing advisory services.

In connection with Mr. Grieve joining Zenabis as CEO, Zenabis has also agreed to enter into a separate agreement with Agentis Capital Partners in order to continue to receive financial advisory services from Agentis. The financial advisory agreement is for a term of one year and is intended to assist Zenabis in its participation in the anticipated industry consolidation over the coming year. Agentis will receive customary, market-based, success fee payments on completion of financings, acquisitions and dispositions during the term of the agreement.

It doesn’t stop there. During the last quarter, $995k service fees were paid to companies controlled by the CEO, CGO, and Chairman aside from the $226k advisory fees discussed above. If it makes shareholders feel better they note in the filings, the financial advisory services firm will reduce the number of personnel to two moving forward.

So What’s The Capital Markets Strategy?

From the last news release discussing a financing, we get an idea of what the strategy is in one quote from CEO Andrew Grieve:

“These developments ensure we have a surplus of capital to complete the expansion of our facilities to achieve an annual design capacity of 143,200 kg of dried cannabis and become cashflow positive upon completion of our current capital program. In addition, we note that Zenabis does not intend to raise incremental debt financing, raise convertible debt, or issue incremental equity capital in order to pursue the expansion of our cultivation capacity. Instead, the next priority of Zenabis is the replacement of the Senior Debt and the Convertible Notes with standard bank financing. Upon completion of a refinancing of the Senior Debt and the Convertible Notes and the transition to a permanent capital structure, Zenabis intends to publish leverage targets to provide for a predictable ongoing capital structure.”

So the strategy is for Zenabis to a) replace all the dilutive financing with standard bank financing and b) sell over 100,000 kg of cannabis a year.

Final Thoughts: They Need To Sell A Lot of Cannabis!

Zenabis has clearly gotten off to a rocky start. Simply put, management and insiders bet on the cannabis bull market to keep rockin’ through a series of convertible loans. This is a bet the company has lost thus far. Since going public, the company has had to renegotiate their debt multiple times and announced “non dilutive financings” that don’t give investors a clear picture of the terms.

Can Zenabis work out from here? Absolutely! But make no mistake this thing needs to hit scale to work and they need to get there relatively fast to avoid major equity dilution.

If we look at the top 15 facilities in Canada, they amount to nearly 20M sqft and project to produce 1.7M kg of cannabis. The Canadian legal market over the next 2-3 years likely projects to around 300,000-600,000kg of cannabis, and Europe is still in the early stages with risk looming over the possibility of European domestic producers soaking up demand.

So in full year 2021 how many companies will be producing and selling over 50,000 kg of cannabis in Canada? We would argue no more than five. For bulls of the common stock, Zenabis will have to be one of those five and they will have to clean up the capital structure without causing super dilution from here. If Grieves proves that his next priority, obtaining standard bank financing, is more than just a line in a new release and accomplishes replacing convertible debt with non-dilutive debt, it would be a massive win for shareholders.

Information for this briefing was found via Sedar, Sedi, Equity Guru, Smart Money Gains, Twitter and Zenabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.