Title card presented with apologies to Herbie Hancock.

There might be more written about energy and climate than anything else, and why not? On-demand electric power is as much a part of post-industrial life as running water, and the fallout from generations of its generation is a collective problem; overcoming it is a generational challenge.

The latest contribution to the deforestation project that is climate literature is none other than Bill Gates, who made the media rounds last month in a promotion of his new book How To Avoid A Climate Disaster. A review of the tome in the New York Times by veteran environmental activist Billy McKibben makes it out as the work of a geek-for-industry whose tunnel vision prevents a broader appreciation of the totality of the problem.

Gates’ money and media profile, writes Mckibben, threatens to focus decarbonization efforts around nuclear tech that does not yet exist, at the expense of renewables tech that does, and battery tech that is on a much quicker development curve.

Gates’ championing of power generation methods that are built around the centralized, controllable types of industrial patterns that got him where he is are predictable, but The Times doesn’t see it that way, or at least doesn’t say so, chalking Gates’ nuclear push up to the billionaire’s tendency to look for a clear and obvious solution to something that just isn’t simple.

Meanwhile, the equities markets are exhibiting their typical response to problems of epic scale, that supposedly aren’t simple: “Hell ya it’s simple! Bill Gates is on every channel telling us that nuclear is the future. It doesn’t get much more simple than that!”

Uranium companies of all sizes have been hot action for all of February and most of March, as the narrative that advances in nuclear tech will make it the carbon-free power production choice of the future made its way through the media ecosystem. As usual, The Deep Dive is here to summarize the real world state-of-play.

Presently, nuclear power generation is the steady-eddie of grid power. In most of the places they’re used, nuclear power plants are responsible for keeping a base load on the electrical grid, because they’re such a reliable and cheap way to generate grid-scale power. US Energy giant Exelon (NASDAQ: EXC), for example, responsible for supplying power to much of Illinois, the mid-Atlantic region, and New York, uses 12 different nuclear power plants to supply materially all of its base-load power. Exelon’s 12 plants have a combined capacity of 17,780 megawatts.

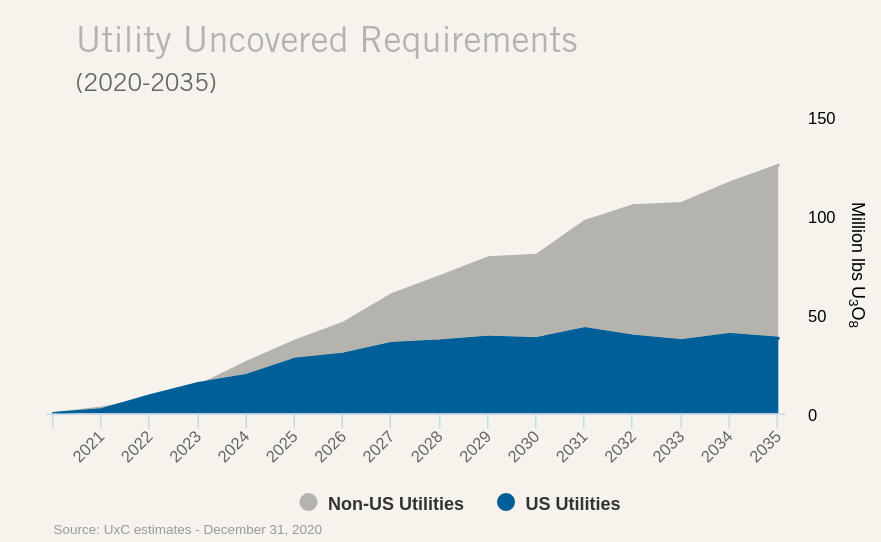

Since power companies are the largest buyers of nuclear fuel, and use it at a predictable rate, they do deals with producers for long-term supply. The rate at which those contracts are set make a sort of benchmark, and the uranium that gets bought and sold by speculators and outside of the contracts is traded on a spot market; which is increasingly where the action is.

The spot uranium market is where Cameco Corporation (TSX: CCO) went to get a hold of the uranium it needed to make delivery on its long-term supply contracts in 2020, having shut down its McArthur River/Key Lake operation for care and maintenance, and its Cigar Lake mine as a precaution against COVID.

Vertically-integrated Cameco was able to create margin in its upgrading business, despite having to use feed that it bought on the spot market for $40/lb, as opposed to uranium that it has mined for a cash cost of $16/lb (and a total cost of $31/lb). Cameco makes no mystery about its mine closures being extended to preserve price. A company sitting on 455 million lbs of uranium reserves and another 426 million lbs of uranium resources doesn’t do itself any favors flooding the market.

Meanwhile, the demand side of the market is suffering from questions of long-term consistency. The World Nuclear Association puts the total number of operating nuclear reactors in March of 2021 at 443 reactors, globally, with a total capacity of 394,078 MW, and another 53 under construction, with a total capacity of 59,856 MW.

Unsurprisingly, the largest piece of the global nuclear power demand is the United States, whose 94 nuclear reactors will consume 18,295 tonnes of uranium in 2021. Second place is China with 49 operating reactors, whom will consume 10,814 tonnes of uranium in 2021. China has 16 reactors under construction, considerably more than the two currently under construction in the US, and has planned another 39 reactors, compared to three in the US.

Meanwhile, two of Exelon’s nuclear reactors have out-lived their certification, and are slated to be decommissioned in the fall. Six more US reactors are slated for decommissioning by 2025. It could be the costly and time-consuming decommissioning process that is slowing plans and proposals for new nuclear reactors, companies preferring to not create assets that are sure to become expensive liabilities after sixty years of service.

But the trend away from broad scale nuclear power generation in the US that shows up in reactor counts isn’t as apparent politically. A bill passed by the US Senate in 2020 had broad support of nuclear energy proponents, but ended up dying in Congress. Congress has since seen the introduction of two more nuclear bills [1] [2], both of which are still in committee, one of which delighted the smaller players in the domestic extractive industry by proposing the establishment of a strategic US reserve of uranium.

Investors who have found their niche in uranium are inclined to see the US’ inability to sort out its nuclear future in much the same way as cannabis investors are inclined to see the US’ inability to sort out its cannabis future: pent-up demand caught behind a dam that’s bound to burst sooner or later. Cameco’s IR desk wrote one of the best overviews of the supply curve in the business, and managed to make it look juicy in spite of US capacity growth flattening.

Let’s Review

With the world’s largest uranium producers choking off production to preserve the market price, an increasingly electrified world is trying to drop its carbon emissions to avoid cooking to death. The law-makers governing the world’s largest consumer of nuclear fuel aren’t yet on the same page, but have a history of coming up with solutions that benefit centralized business conglomerates, and are also under pressure to drop carbon emissions. Meanwhile, one of capitalism’s modern saints wrote a practical love letter to the future of nuclear tech, and wants to talk about it with any TV station who will listen.

For the small companies, further along the growth curve, who are discovering and developing the reserves of the future, the time is now to shoot their shot.

Denison Mines Corp. (TSX: DML), operator of the under-development Wheeler River project in Saskatchewan’s Athabasca basin, announced March 15th that it would raise US$75 million in a bought deal financing, the proceeds of which would be used to purchase uranium from the spot market for keeping in a strategic reserve. A mining company purchasing reserves of its main product is rare, the object of the mining business being, generally, to turn the commodity into cash, and not the other way around. But Denison clearly knows its audience, who responded favorably with an over-subscription to the deal, which was closed this past Monday, March 22nd bringing gross proceeds of $86.27 million.

Further still down the risk curve, volume is up on exploration-stage uranium companies across the board, who are doing their best to convince the investment world that it’s time to party like it’s 2007. We expect that they’ll be making the most of upward moves in the spot uranium price, while playing up pending US demand on dips. Stay tuned to The Dive for a look at some of the names on the move.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.