After rallying in late summer and again in October on pledges by western nations to increase nuclear plant spending, uranium spot prices have fallen back to US$48.50 per pound, levels last seen in late July. It appears that confidence in the nuclear power sector — and therefore in uranium prices — has been hit by corrosion problems found in the nuclear plants of Electricite de France (EDF).

EDF, which is 84%-owned by the government of France, is one of the largest nuclear power producers in the world. Nuclear power represents about 70% of France’s electricity fuel mix. President Emmanuel Macron announced plans in July to fully nationalize EDF by purchasing the remaining 16% interest.

In late 2021, while performing maintenance on an aging nuclear reactor that had been delayed by the COVID-19 lockdown, EDF inspectors found corrosion and micro-cracks in systems that cool the reactor’s radioactive core. That unsettling discovery prompted the company to look for the same issues in other facilities.

EDF ultimately found that 16 reactors, most of them fairly young, had similar flaws. In turn, EDF closed the facilities down. At its peak, 26 of EDF’s 56 reactors were offline for maintenance and repairs.

EDF believes that modifications made to newer reactors from older units designed by Westinghouse Electric appeared be the source of the problems. The design changes caused abnormal corrosion and stress on cooling pipes. Scores of welders have been tasked with repairing the cooling circuits.

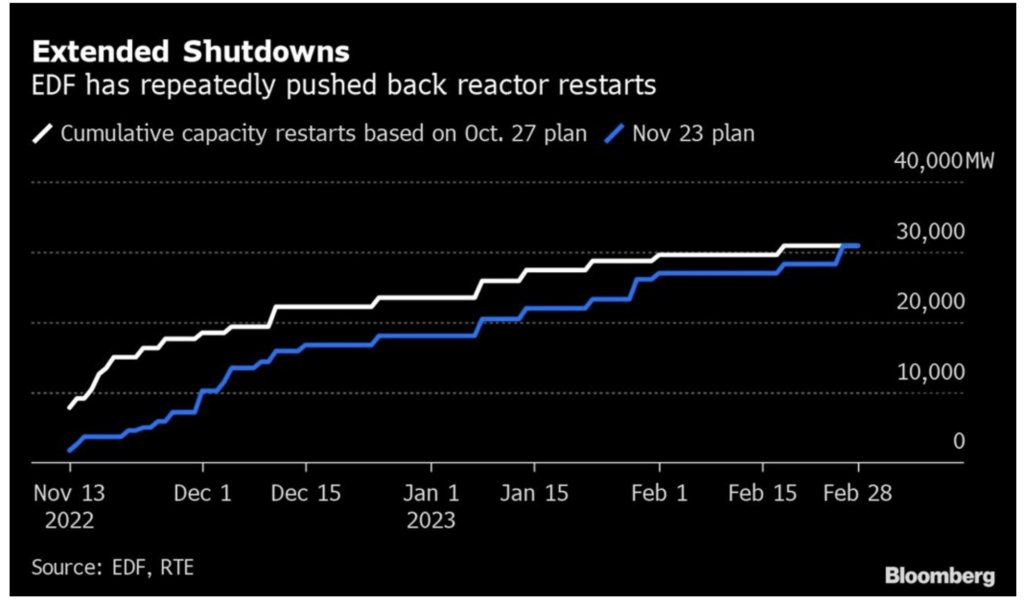

In mid-November, EDF announced a plan whereby only 10 reactors would be offline by January 2023. However, just a week later, confidence in the full achievement of this timetable was dented when the company was forced to extend maintenance outages at three planned early-returning reactors.

None of this has inspired confidence in the nuclear industry. Skeptics wonder if similar problems could be found in reactors in other countries. In particular, speculators of the uranium commodity appear to have adopted a cautious outlook as they “wait and see” whether similar corrosion issues are found at other nuclear plants.

Another drag on spot uranium prices: it appears a numbers of utilities signed long-term uranium supply contracts earlier this year after Russia invaded Ukraine, limiting current spot market demand. For example, Energy Fuels Inc. (NASDAQ: EFR.TO) announced in early August that it had signed three long-term contracts with U.S. nuclear utilities for delivery of up to 4.2 million pounds of uranium between 2023 and 2030.

Information for this briefing was found via the link provided and the NASDAQ. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.