Back in March when the CARES Act was put in place, the federal government earmarked approximately $25 billion of taxpayer-funded loans for the airline industry. Now however, five major airlines in the US have finally reached deals with the Treasury Department, and will soon have their pockets overflowing with cash once again.

According to a Treasury Department spokesperson, Hawaiian Airlines, Spirit Airlines, American Airlines, Sky West Airlines, as well as privately-owned Frontier Airlines have all finalized letters of intent for a portion of the $25 billion. Although the Treasury Department did not reveal specific details of the loans, it is assumed that the eligible US airlines will have to provide some form of compensation for taxpayers, either in the form of warrants, senior debt, or equity.

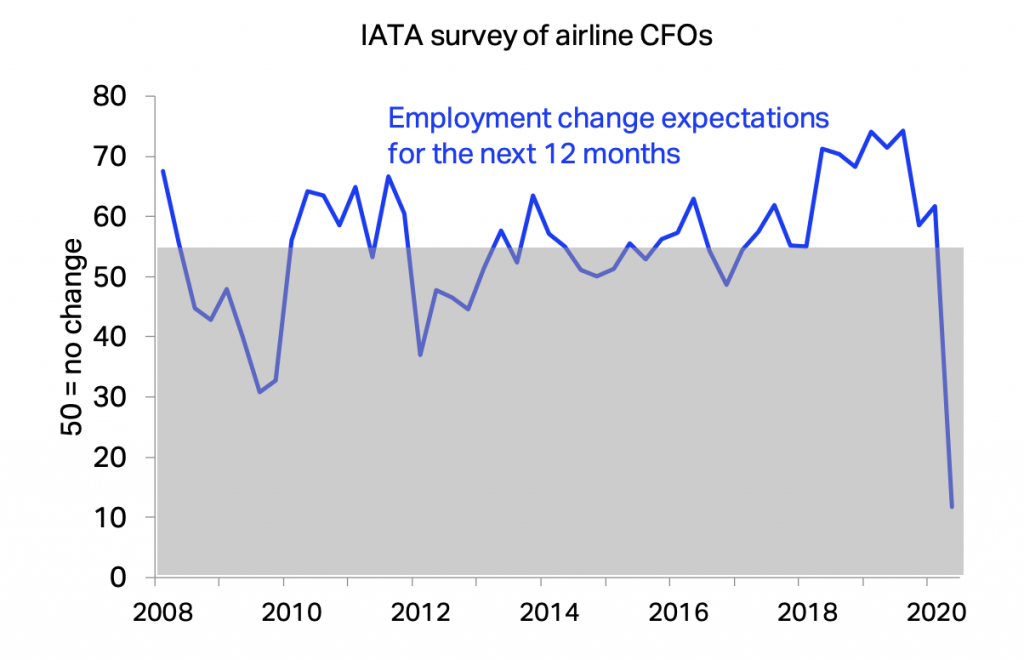

However, there is also an additional $25 billion worth of aid that was made available by the Treasury Department aimed at securing sector jobs during the coronavirus-induced economic downturn. US airlines have been receiving this aid since spring, and in return they must secure their employee’s wages until September 30. Nonetheless, airline labour unions are asking lawmakers to extend the aid to an additional $32 billion to last until the end of March, citing the continued lack of demand for air travel.

Information for this briefing was found via CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.