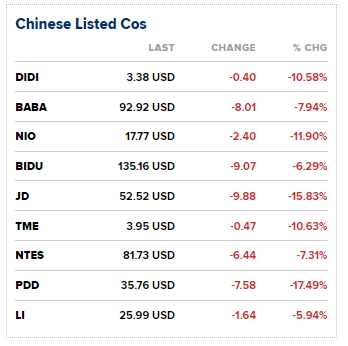

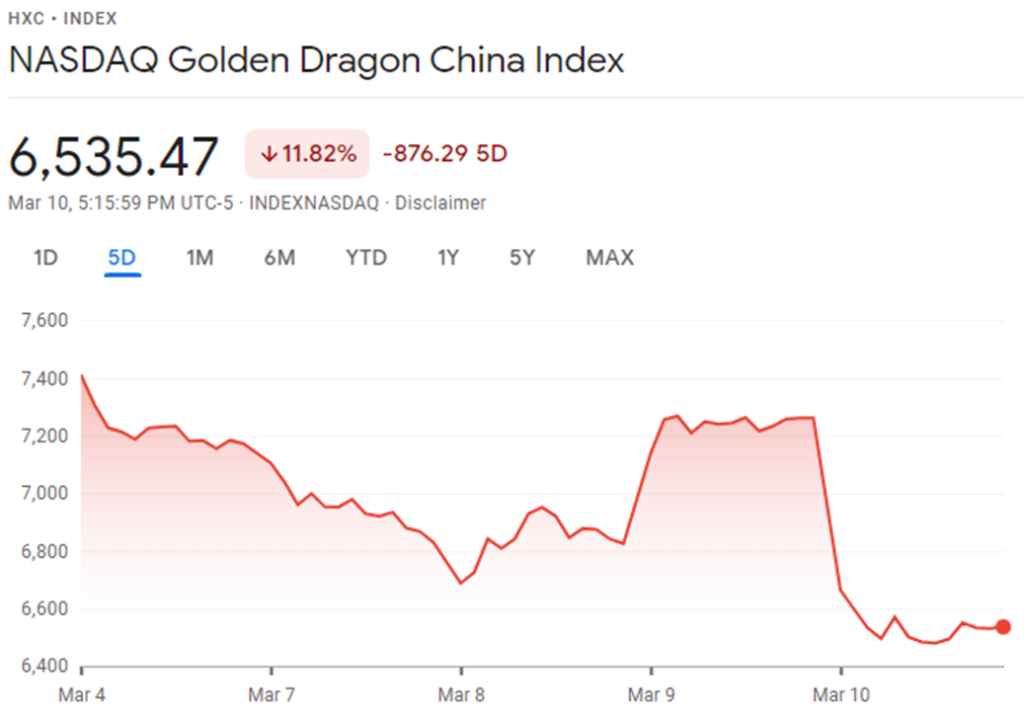

Big dual-listed Chinese tech names saw their shares fall in the respective American and Hong Kong stock exchanges following the chilling effects of regulatory crackdowns by both countries.

Chinese electric vehicle maker Nio (NYSE: NIO) saw its American depositary share price drop by 11.90% and its Hong Kong-listed shares — which only debuted a day earlier — drop by 11.64%. Tech giant Alibaba (NYSE: BABA) also fell 7.94% and 6.56% in NYSE and HKEX, respectively.

The sharp decline follows the US Securities and Exchange Commission’s announcement of five US-listed American depositary receipts failing to adhere to the Holding Foreign Companies Accountable Act (HFCAA).

The law, which was enacted in 2020, allows the American regulatory agency to ban and delist companies that wouldn’t submit their audits for review by the SEC for three consecutive years. The agency named Chinese firms Yum China, BeiGene, Zai Lab, ACM Research, and HUTCHMED for failing to adhere to this law–the first ones to be identified since HFCAA was passed.

Given the three-year prescriptive period, banning and delisting might occur only after continued non-compliance until 2024.

However, this might be a likely scenario since “Chinese law prohibits the auditor to provide their review to U.S. regulatory authorities”, according to KraneShares CIO Brendan Ahern in a CNBC interview.

This hurdle, plus the increasing rifts between the two countries, has caused US-listed Chinese firms to achieve dual listing with Hong Kong Stock Exchange. Alibaba, JD.com, Baidu, Bilibili, Trip.com, Weibo, and Nio made their Hong Kong listing debut in the last year.

However, Chinese ride-hailing firm Didi’s (NYSE: DIDI) Hong Kong listing is facing delays after failing the demands of Cyberspace Administration of China. The Chinese cybersecurity regulatory body allegedly told the firm that its plan to stop its security and data leaks is inadequate, causing bankers working on the listing to stop the work.

Didi’s American depositary shares fell by 10.8% on Thursday and further by as much as 29.1% as of this writing. The company is one of the targets of China’s recently intensified crackdown on its tech sector.

Both these regulatory actions are sending a chilling effect to dual-listed Chinese tech firms for fear of being delisted from the exchanges.

Information for this briefing was found via CNBC and Zero Hedge. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.