US consumer sentiment fell to the lowest in 10 years, as Americans become increasingly concerned over the mounting inflationary landscape that is eroding away at their finances.

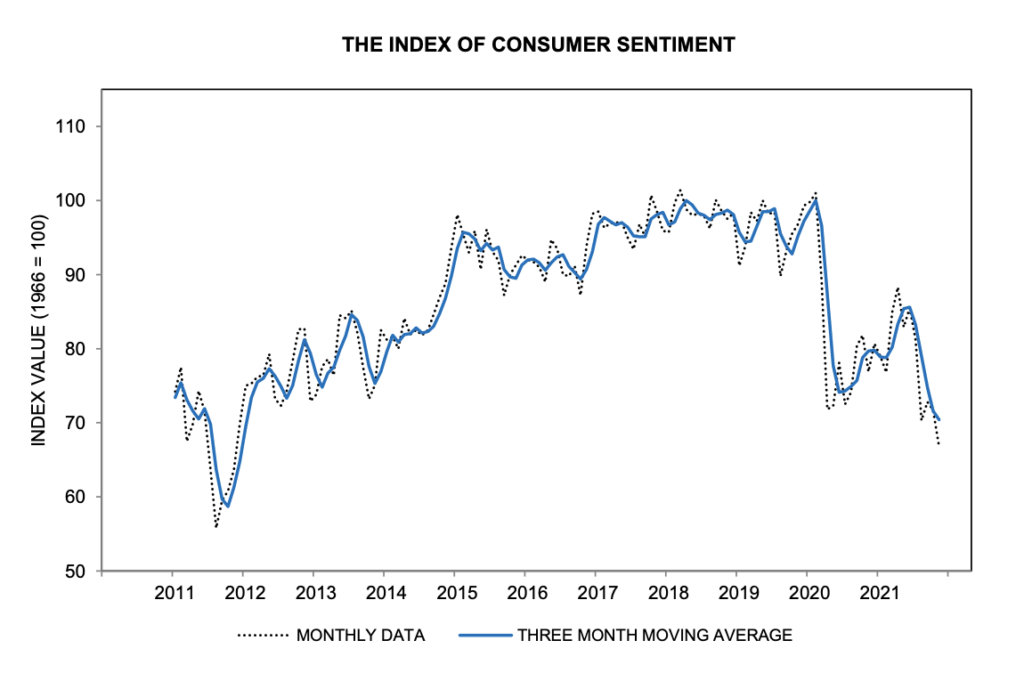

The University of Michigan’s preliminary sentiment index for early November fell from 71.7 to 66.8, according to figures published Friday. The latest reading significantly fell short of even the most conservative consensus, which called for an increase to 72.5. The gauge of current economic conditions also plummeted earlier this month, falling to 73.2— the weakest since 2011, while the measure of future expectations dropped to 62.8, also the lowest since 2013.

Skyrocketing energy, food, and household goods prices have been significantly outpacing wage growth, and disintegrating consumers’ purchasing power. “One in four consumers cited inflationary reductions in their living standards in November, with lower income and older consumers voicing the greatest impact,” said the survey’s director, Richard Curtin. To illustrate the point, the report showed that household buying conditions have substantially declined as of recent, with the gauge plummeting to 78— the second-lowest reading on records dating back to 1978.

The survey’s respondents anticipate that inflation will hit 4.9% over the next 12 months— the highest since 2008. Looking ahead into the next five to 10 years, they forecast prices will increase 2.9%, relatively unchanged from last month’s reading. The latest consumer expectations come on the heels of an explosive inflationary print, which showed prices accelerated 6.2% year-over-year in October, the sharpest increase since 1990.

The rapidly deteriorating economic picture has finally caught the attention of US President Joe Biden, who on Wednesday said he is prepared to tackle surging inflation and make it the administration’s top priority, seemingly forgetting that injecting the economy with trillions of dollars more in fiscal stimulus is likely not going to alleviate the problem. But we rest our case.

Information for this briefing was found via University of Michigan and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.