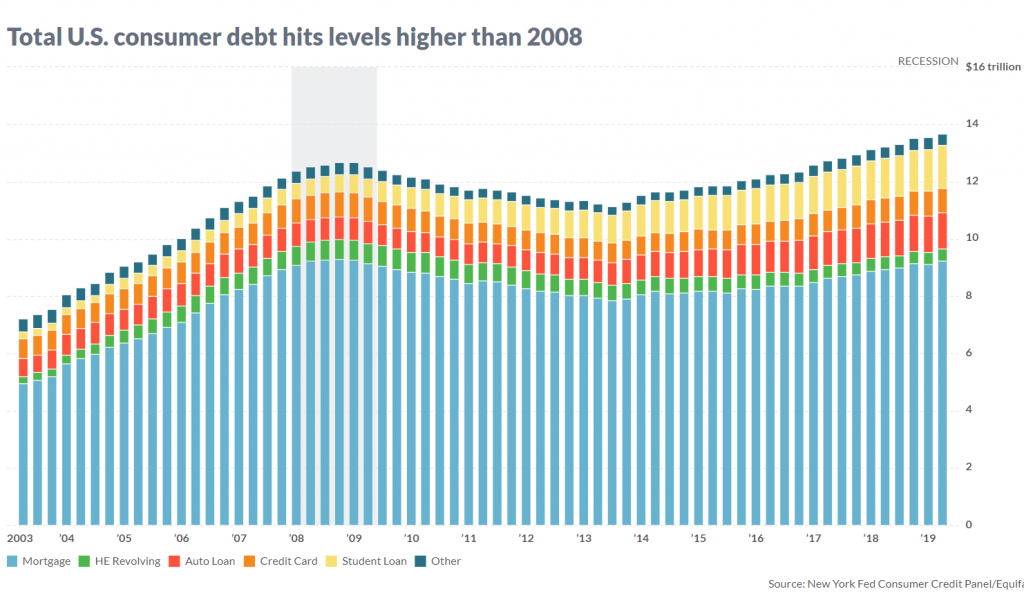

Since the onset of the coronavirus pandemic, the proceeding consequences have been dire on the already precarious US economy. According to recent data released by the New York Federal Reserve, consumer debt has been through the roof, hitting a new record of $14.3 trillion.

In March, household debt balances reached $14.3 trillion, which is $1.6 trillion more than what was observed during the peak of the 2008 financial crisis. Thus far, student loan debt has reached $1.54 trillion, with 10.8% of that debt entering the 90 days-exceeding delinquency category, bringing the overall delinquency rate to 4.6%. Furthermore, auto debt has increased by $15 billion, meanwhile mortgage balances upsurged by $156 billion.

However, a more insightful impact of the coronavirus pandemic has been the decline of credit card balances, which have fallen by $34 billion in March. Although credit limits increased by an overall total of $34 billion, there still ended up being approximately $3 trillion available on credit lines. Such a decrease of credit card balances is indicative of reduced consumer spending, whereas the increase in credit limits could suggest consumers are preparing a financial safety measure for further pandemic implications.

Information for this briefing was found via CNBC and New York Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.