US consumer prices remained elevated in October, albeit at a moderate pace after a drop in used car prices and a moderation in energy costs.

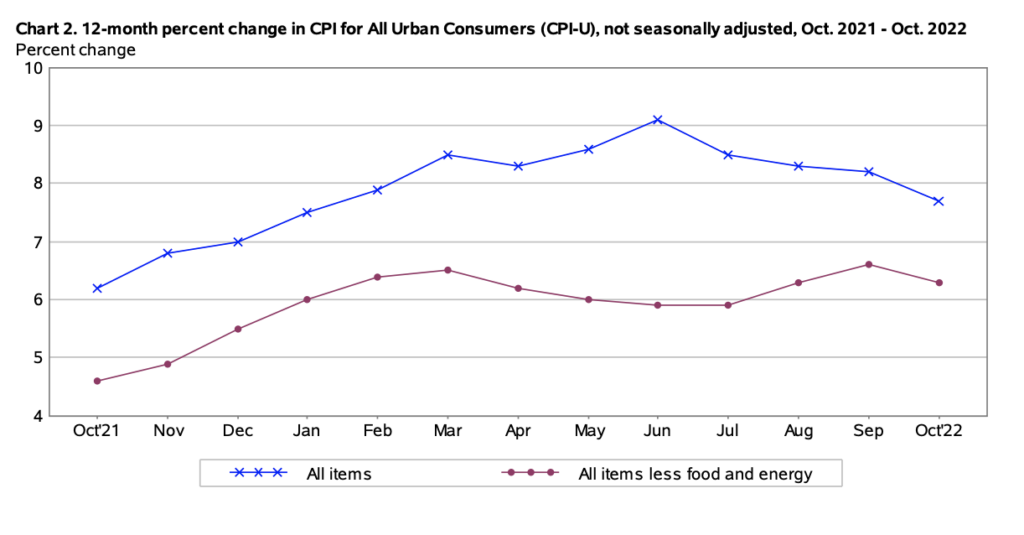

Latest data from the BLS shows headline CPI cool from September’s annualized 8.2% to 7.7%, marking the lowest print since January 2022 and slightly below the 7.9% consensus forecast by economists. Core CPI, meanwhile, jumped for the 29th consecutive month, rising 6.3% year-over-year, but is nonetheless finally below 40 year-highs and lower than the estimates of 6.5%.

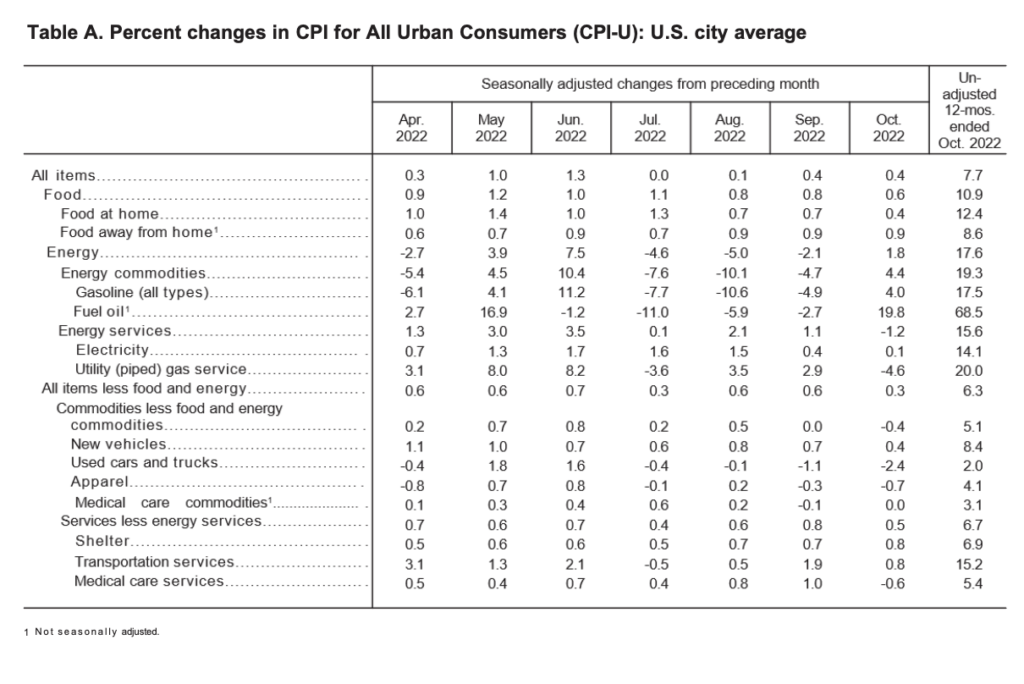

Looking under the hood, shelter accounted for 40% of last month’s increase, rising 0.8% from September to an annualized 6.9%— the sharpest monthly jump since August 1990. Likewise, the closely-watched energy index rose 1.8% to register a year-over-year gain of 17.6%, and, despite the Biden administration’s Hail Mary attempts to bring down fuel prices ahead of midterms— Americans still paid 4% more for gasoline in October. Meanwhile, the food index continued to increase, rising another 0.6% to register a 10.9% jump from October 2021 as four out of the six categories reporting price gains.

In contrast, the index for used cars and trucks slumped 2.4% following a drop of 1.1% in September, while the medical care index slumped 0.5% after rising 0.8% the month before. Prior to this morning’s CPI reading, markets were bracing for a 30% chance of a 75 basis-point rate hike come December— will that materialize? Well, for starters, despite President Joe Biden insisting inflation is down and real wages are rising across America, the BLS reported otherwise, with data showing Americans’ wages actually fell 2.8% from October 2021…

Information for this briefing was found via the BLS and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.