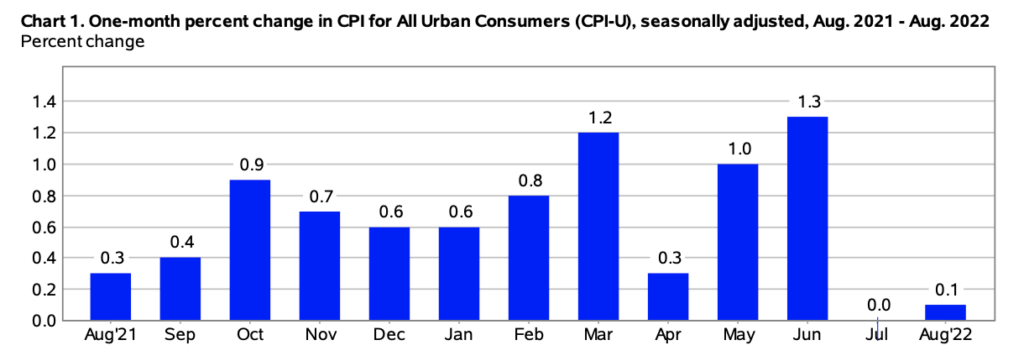

Just when the myopic Fed was preparing to declare victory over the hottest inflation in 40 years against market expectations of a 0.1% month-over-month decline, August CPI data came barreling in like a hurricane, bringing with it the 27th consecutive month of rising inflation.

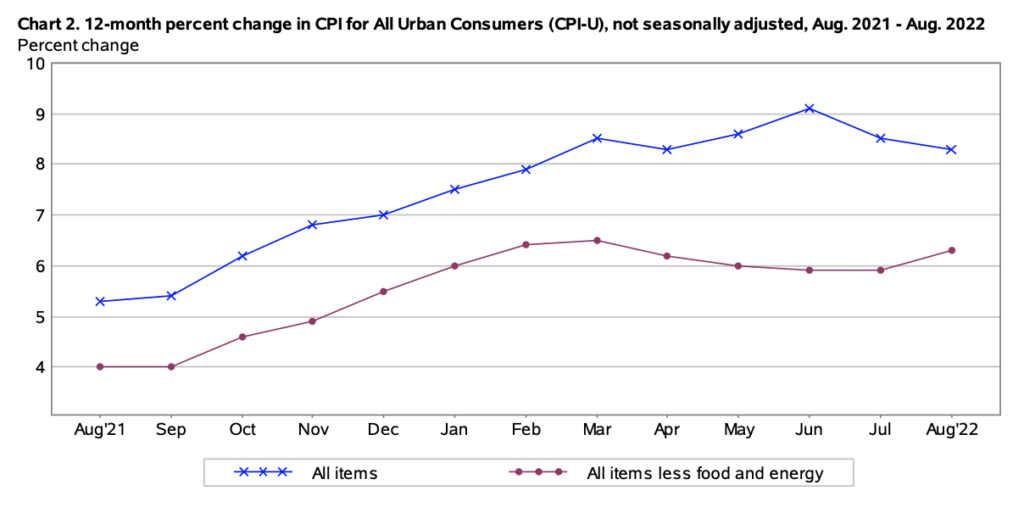

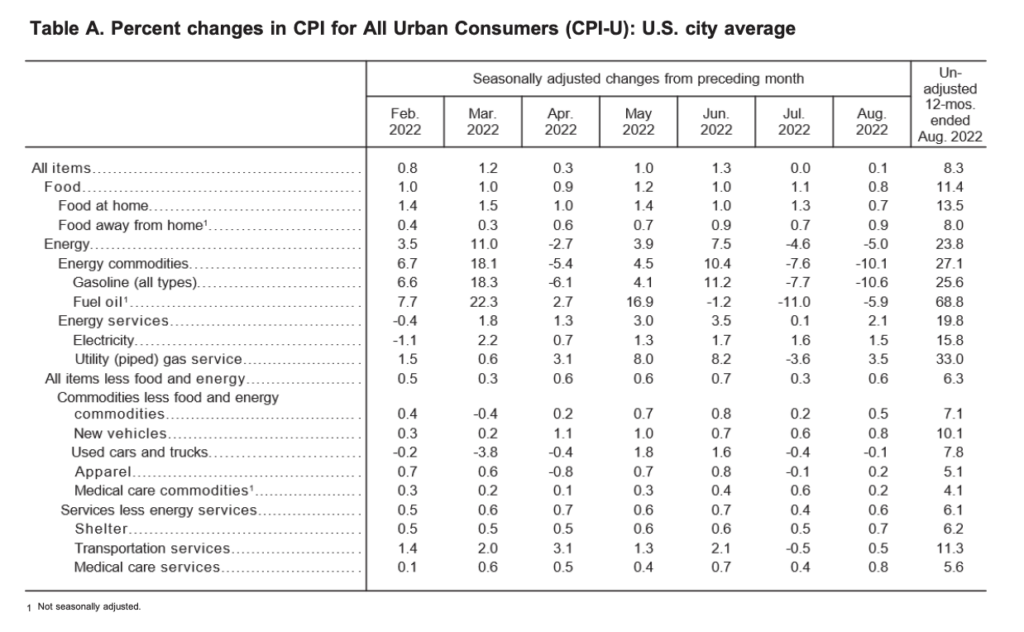

Consumer prices jumped 0.1% between July and August, cementing in an eye-watering 8.3% increase compared to last year. Core CPI, which does not include food and energy also exploded past forecasts calling for a 0.3% increase, and instead jumped 0.6% month-over-month to an annualized 6.3%. Much of last month’s increase can be attributed to a rise in food and shelter costs, which outpaced the decline in energy costs.

The BLS food index surged 11.4% over the past 12 months, while the Food at Home category jumped 13.5%— both marking the sharpest increase since 1979. Although the energy index was up 23.8% from August 2021, it dropped 5% month-over-month— the biggest decline since the beginning of the pandemic in April 2020.

The acceleration in consumer prices continues to be broad-based and rapidly eroding away at Americans’ purchasing power, even amid a slowdown in gasoline prices. Even with a Fed “forthrightly” committed to bringing inflation back to the 2% target range, policy makers still have a very long road ahead, especially if they are basing their rate decision on the “totality” of economic data, which shows a robust labour market, slowed consumer spending, soaring inflation, and the 17th consecutive month of Americans’ wage erosion.

Jerome Powell trying to fix inflation pic.twitter.com/EEWVkD2MqJ

— Not Jerome Powell (@alifarhat79) September 13, 2022

Following the CPI print, Treasury yields and the dollar exploded higher, while the S&P 500 slumped. There is now an 80% chance of a 100 basis-point rate hike come the next policy meeting, and a 20% chance of a full percentage-point increase.

Information for this briefing was found via the BLS and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.