The continued near-exponential increase in COVID-19 cases across the US directs one of the world’s biggest economies towards more volatility and collapse.

According to a CNBC interview with Stephen Roach, the former Morgan Stanley Asia chairman, veteran economist, and Yale University senior fellow, the probability of the US economy going through a double-dip recession continues to increase amid the out-of-control coronavirus infections and impending health safety concerns. A double-dip recession, or a W-shaped recession occurs when a country’s economy momentarily recovers from a shock, but then relapses from the growth period into another recession.

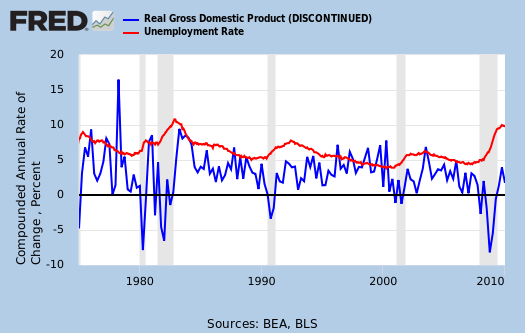

Roach warns that the continued lack of pre-pandemic demand could spell trouble for businesses looking to recover from the coronavirus recession. Although the Federal Reserve has been steadily increasing the money supply in a bid to stir spending, reduced consumer demand may continue to persist until the growing health concerns surrounding the virus are mitigated. As a result, the US may soon see a wave of bankruptcies and a further collapse of the job market, which would evidently be reminiscent of the 1980’s double-dip recession.

When the deadly virus first began to spread to various countries around the world, the economist warned that the oncoming pandemic would be significantly worse than the 2003 SARS epidemic. As foreseen, the COVID-19 pandemic caused incomparable economic destruction, with possibly the worst yet to come.

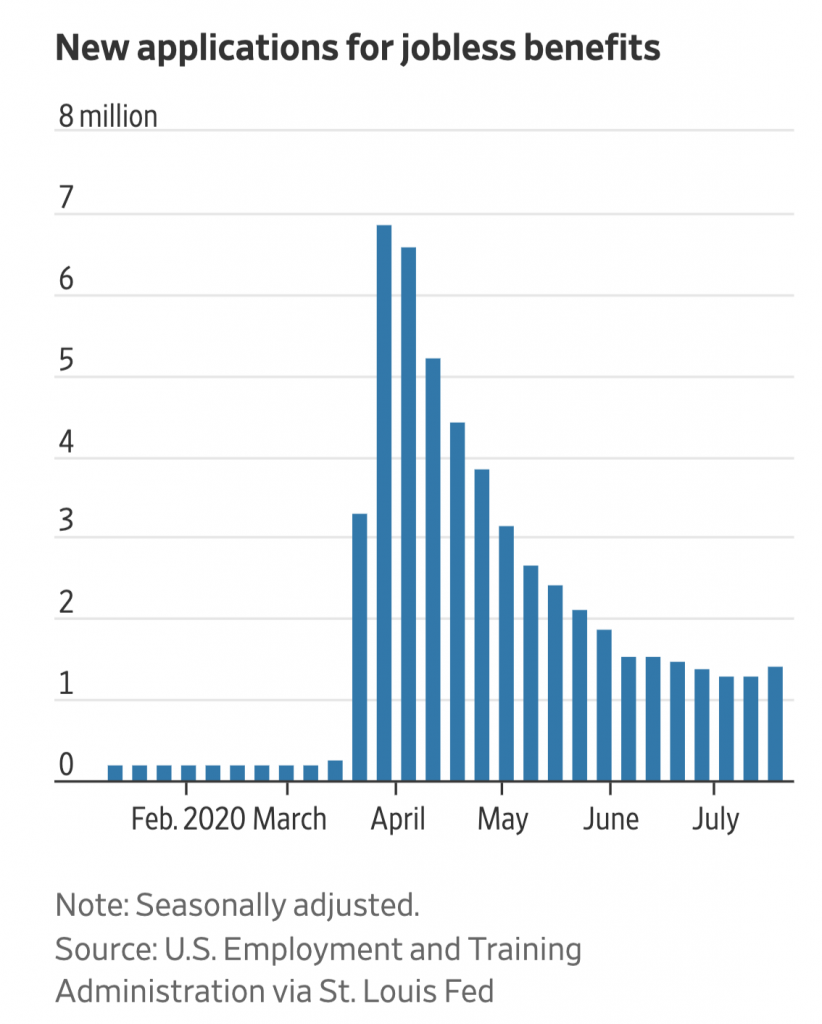

According to Moody’s Analytics, the US was initially on a path to a reduction in infections, but the rapid reopening and restriction-lifting has caused the pandemic to reignite. As a result, the initial jobless claims that fell sharply between May and June once again rose to over 2 million per week, with many more forthcoming job losses to ensue. As such, the alarming observations are certainly beginning to point to a W-shaped recession, and the $1.5 trillion in aid currently being contested among lawmakers may not be enough to offset the impending damages.

Information for this briefing was found via CNBC, RT News, and Moody’s Analytics. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

I think, it’s good for us, to see the US economy will break apart!!

When I as an American, can not benefit from it…

I hope to see it not crashed ONLY… But see it’s dusts on the wind ???