In further proof that rampant inflation may not be as “transitory” as the Federal Reserve seems to believe, home prices have surged by the most since 2005, as a shortage of real estate further propels housings costs to astronomical levels.

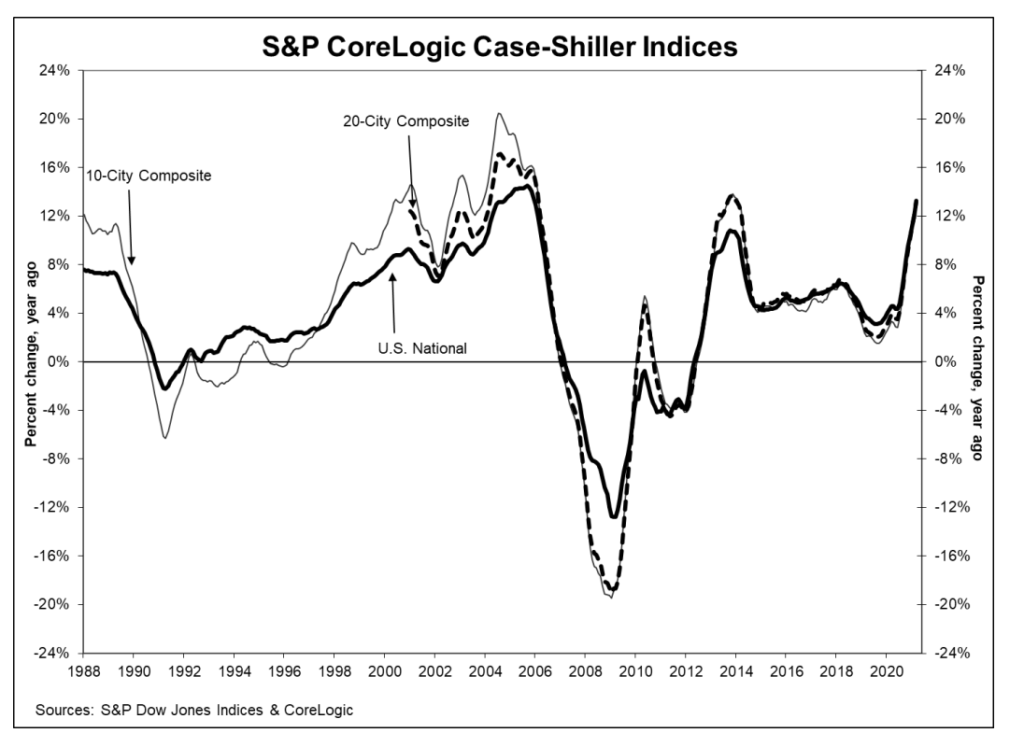

Despite the BLS March CPI print showing shelter costs increasing by a paltry 0.3% month-over-month, the S&P CoreLogic Case-Shiller index of property values surged 13.2% during the same month, marking the largest gain since December 2005. The latest jump follows yet a previous colossal reading of 12% in February.

Home prices across 20 major US cities have climbed 13.3%— the largest increase since December 2013, and significantly outpacing estimates put out by economists surveyed by Bloomberg. The US real estate market has been surging amid the Covid-19 pandemic, as Americans look to relocate from crowded metro areas to more spacious suburban and rural communities amid flexible remote work schedules.

“These data are consistent with the hypothesis that COVID-19 has encouraged potential buyers to move from urban apartments to suburban homes,” explained S&P Dow Jones Indices global head of index investment strategy Craig J. Lazzara. Historically-low mortgage rates have further helped speed up the rally, while dwindling housing supply levels push real estate prices even higher.

Mr. Powell, are you listening?

Information for this briefing was found via S&P Dow Jones Indices and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.