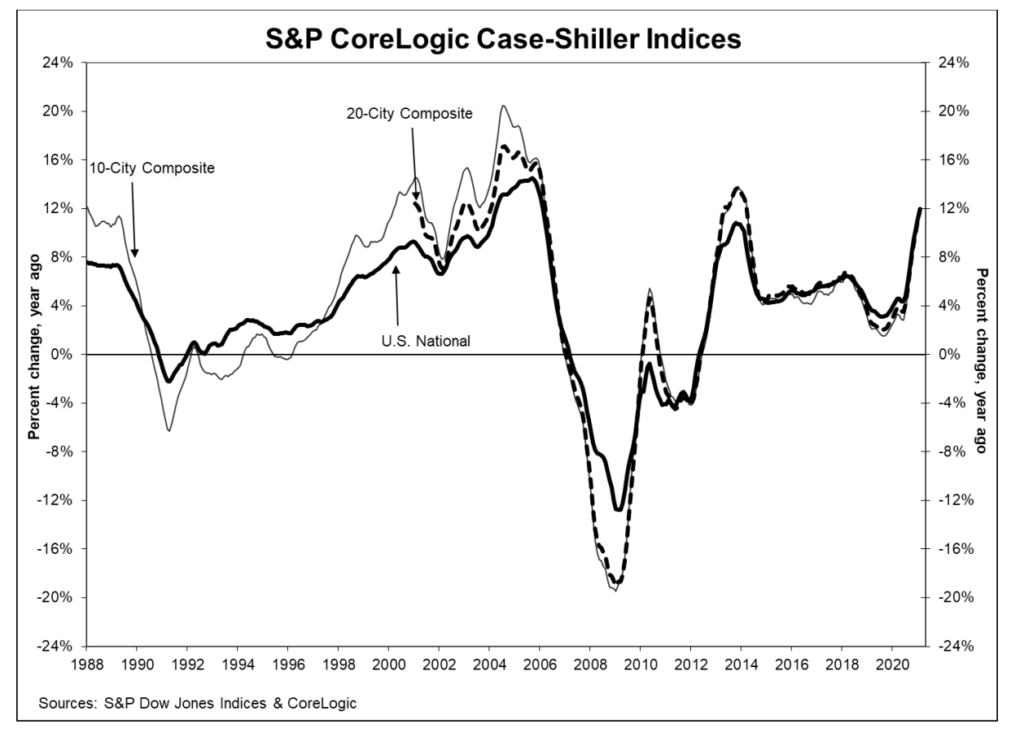

Home prices across the US rose by the most since 2006, as low mortgage rates and constrained supply continue to put added pressure on the housing market.

US housing prices jumped by 11.94% on a year-over-year basis in February, marking the eighth consecutive month of gains, following an increase of 11.2% in January. Record-low interest rates were the main driving factor behind the ongoing housing rally, as potential homeowners gained more purchasing power to upgrade their properties. The average rate on a 30-year mortgage dropped to 2.97% according to most recent data, falling closer in line to the record-low of 2.65% set in January.

Low interest rates, and remote work flexibility, have caught the attention of potential homebuyers, who flocked to the suburbs and rural areas in search of more spacious homes. The surge in demand— particularly for single-family homes— has put added pressure on the already-constrained housing supply, fuelling housing prices even higher.

Price appreciation was the highest in Phoenix and San Diego, but as noted below, the rate of inflation is multiples of the Federal Reserve’s mandate, with even the “cheapest” homes in America accelerating at 4x the inflation target. However, due to the lag in Case-Shiller’s data, the true impact of rising mortgage rates still remains unknown for the time being.

Information for this briefing was found via S&P Global. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.