While markets spent much of the past two weeks fixated on the bond crisis in the UK, the inflation situation in the US hasn’t been faring too well. It appears the Fed’s hawkish tightening cycle has yet to have an impact on cooling surging consumer prices, and Joe Biden’s failed attempts at wooing OPEC will reinforce higher energy prices ahead of the midterms.

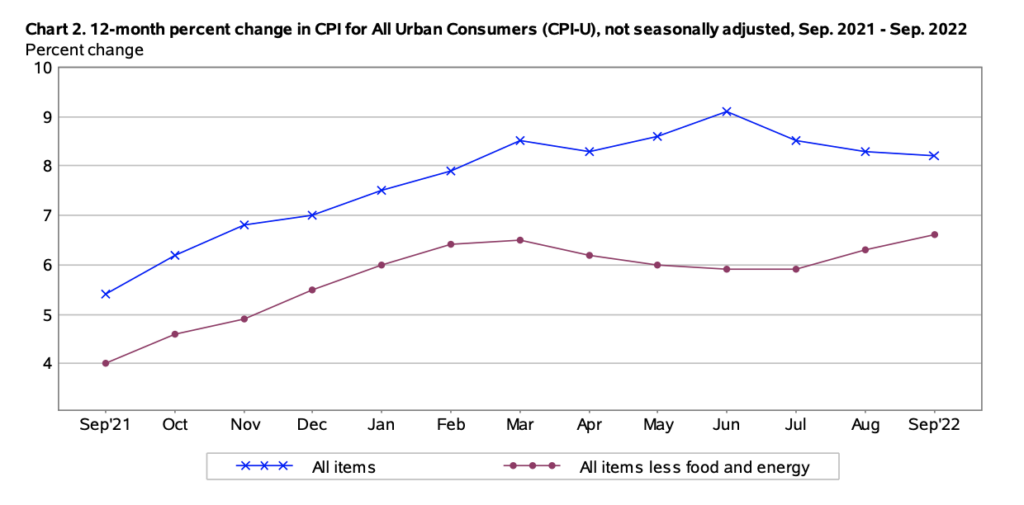

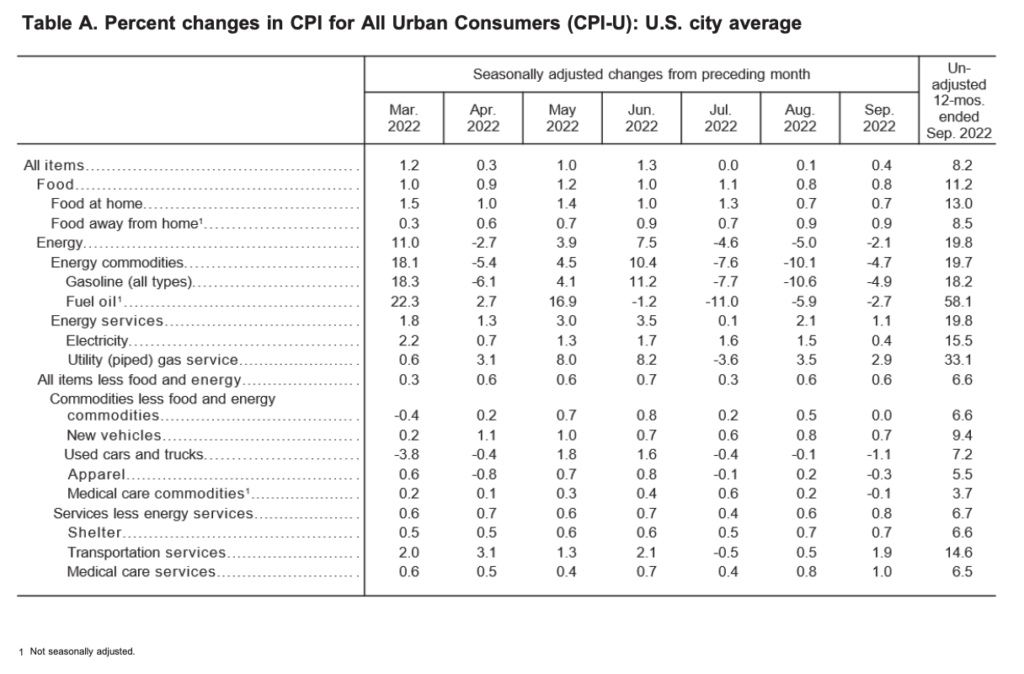

Latest data from the BLS showed headline inflation rise 0.4% from August and 8.2% from a year earlier, while core CPI, which does not account for volatile components such as food and energy, was up 0.6% in September, and 6.6% year-over-year. Sadly, both shot past consensus estimates calling for annual prints of 8.1% and 6.5%, respectively.

The food and shelter categories were responsible for much of September’s CPI increase, even against a temporary decline in energy prices. The owners’ equivalent rent index jumped 0.8% last month, marking the biggest monthly increase since June 1990. The food index continued to rise, up 0.8% month-over-month in September, and 11.2% from last year. Energy prices, meanwhile, receded 2.1% between August and September, but Americans still continued to pay 19.8% more compared to the same period one year ago.

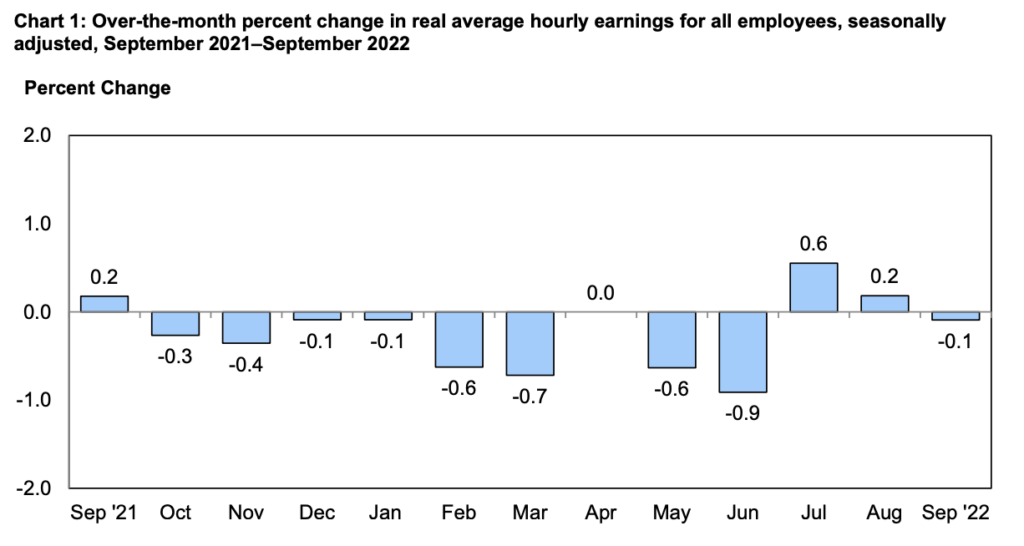

In the meantime, real wages were down for the 18th consecutive month, falling 0.1% from August to September and 3% over the past 12 months.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.