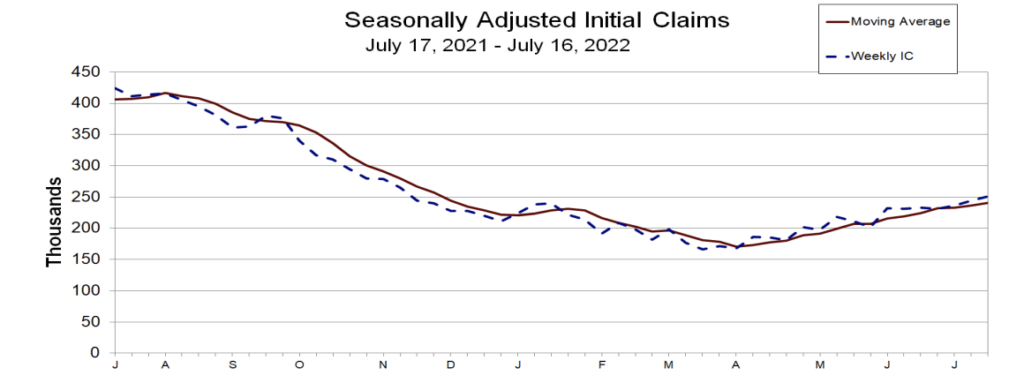

The number of Americans filing for first time unemployment benefits is on the rise again, suggesting that what appeared to be a robust labour market may be crumbling under the weight of inflation, rising interest rates, and subsequently, a looming recession.

Latest data from the Labour Department shows that initial jobless claims for the week ending on July 16 totalled 251,000, marking an increase of 7,000 claims from the prior week and modestly higher than the 240,000 forecast by economists polled by Dow Jones. Last week’s unemployment claims were also the highest level since November 13, 2021, implying that what was once a bright labour market is beginning to dissipate.

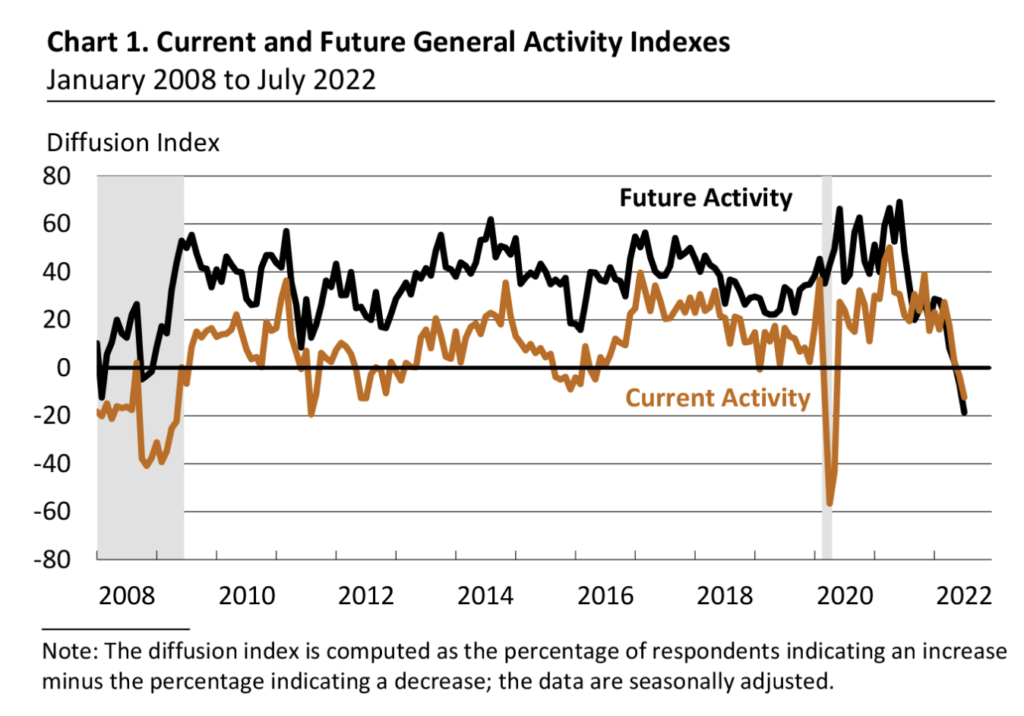

As such, there are now 1.384 million Americans collecting unemployment benefits, the highest since the week of April 23. But, judging by the Philadelphia Fed’s manufacturing index – which too, was released on Thursday – the gain in jobless claims may just be the tip of the iceberg that is the inception of a recession. The index dropped 9 points from the month prior to a reading of -12.3, which is substantially worse than the 1.6 forecast by Dow Jones.

More specifically, the Philadelphia Fed’s employment index also slid 9 points to 19.4, and although still indicating that companies are hiring, the figure is nonetheless the lowest since May 2021. Likewise, the average workweek reading stood at 6.4, marking the fourth straight month of declines. The survey’s results also showed that firms are paying out higher salaries, with 78.6% respondents reporting increased wages for their employees.

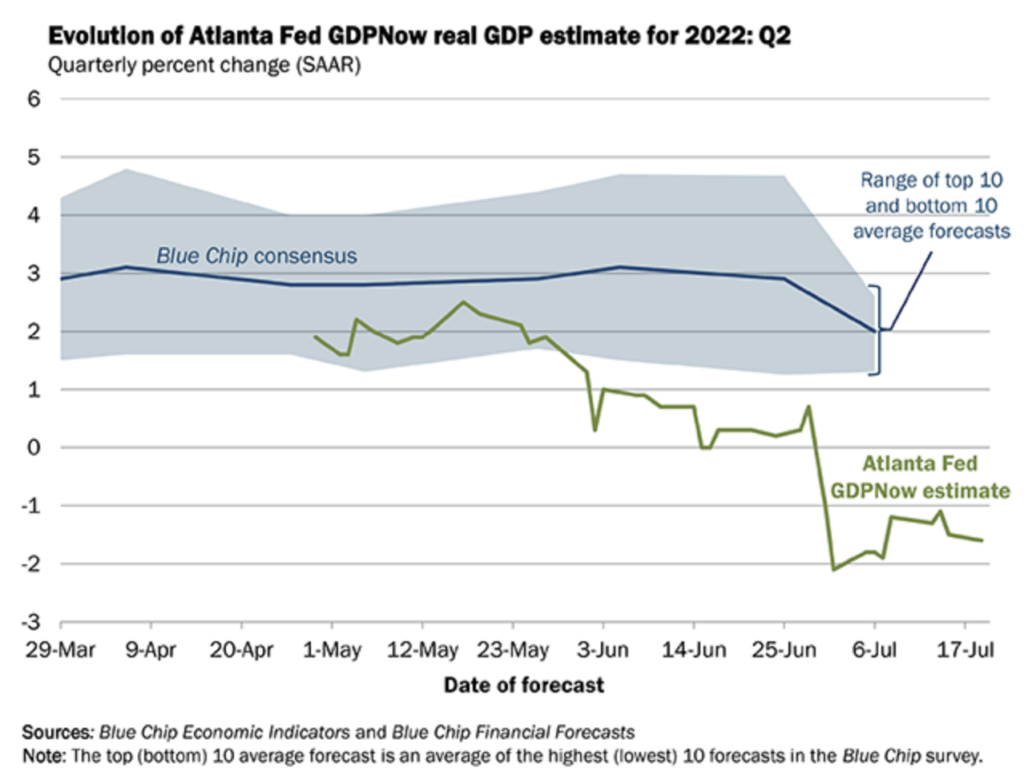

The worrisome data comes as markets and policy makers remain on edge over the direction America’s economy will take amid ongoing geopolitical uncertainty and persistent inflation. The US economy contracted 1.6% in the first quarter, and according to the Atlanta Federal Reserve, is set to fall by another 1.6% in the second quarter, thereby meeting the technical definition of a recession.

In the meantime, the Federal Reserve is forecast to raise borrowing costs by another 75 basis points, bringing the central bank’s overnight rate to a range between 2.25% and 2.50%.

Information for this briefing was found via the Labour Department and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.