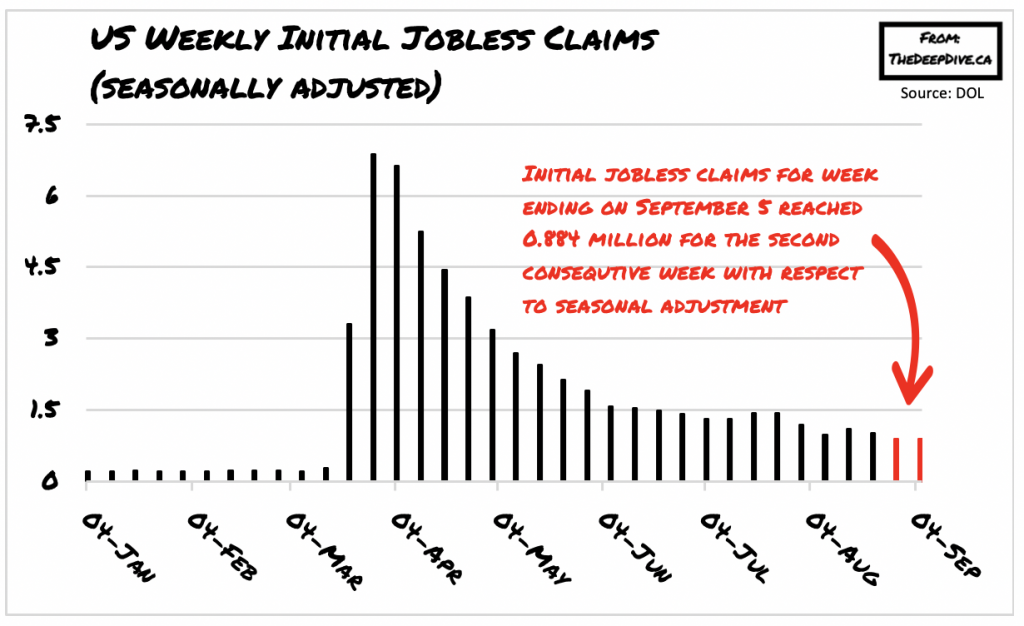

It appears that recent jobless claims painfully missed optimistic estimates, suggesting that the US labour market is struggling to get out of a now-stagnant recovery.

According to the latest Department of Labour data on weekly initial jobless claims, the week ending on September 5 was the subject of another week of 884,000 new claims, significantly surpassing Dow Jones estimates of 850,000. This brings the number of continuing claims to a total of 13.385 million, which amounts to a 93,000 increase since the prior week. This suggests that what seemed like a momentous job recovery over the summer is beginning to taper off as fall approaches.

However, it is very important to note that the Labour Department did change its methodology regarding its seasonal adjustment data calculations, so in reality (whatever reality that may be in this coronavirus-stricken economy) initial jobless claims actually increased from the prior week. Non-seasonally adjusted initial claims rose by 20,140 to a total of 857,148, with Texas and California seeing the largest of increases.

Moreover, the rise in unemployment claims is also predominantly attributed to the Pandemic Unemployment Assistance (PUA) program, which addresses those Americans that are either self-employed or are gig workers. Last week, there were a total of 840,000 PUA claims, which is a 92,000 increase compared to the prior week.

It is also worthwhile to note that a large portion of labour market gains have been for part-time employment – in fact, part-time employment has recovered by 68.1%, while full-time employment has only been regained by 47.9%. This implies that America’s job market still has a long road ahead before it gets back to pre-pandemic levels – if it even will.

Information for this briefing was found via US Department of Labour. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.