Coming as a shocking surprise to markets on Friday, the latest payrolls report steamrolled well above forecasts, with the US economy adding four times as many jobs in January than expected, further solidifying the Federal Reserve’s hawkish plans to begin raising rates as early as next month.

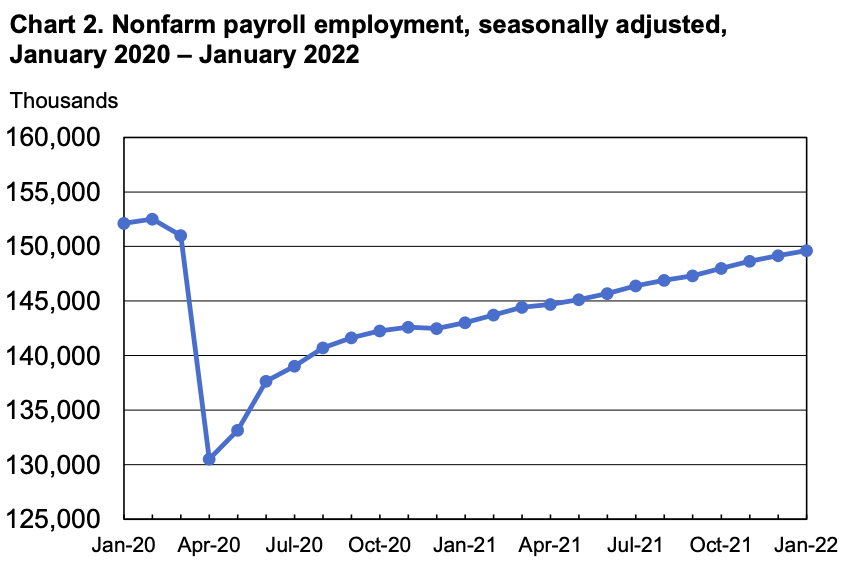

The Bureau of Labour Statistics revealed that nonfarm payrolls jumped 467,000 last month, substantially beating out nearly all forecasts, most of which predominantly called for an advance of around 125,000. To make the report even sweeter, though, the BLS also upwardly revised December’s payrolls from 199,000 to 510,000, while November was upgraded from 249,000 to 647,000.

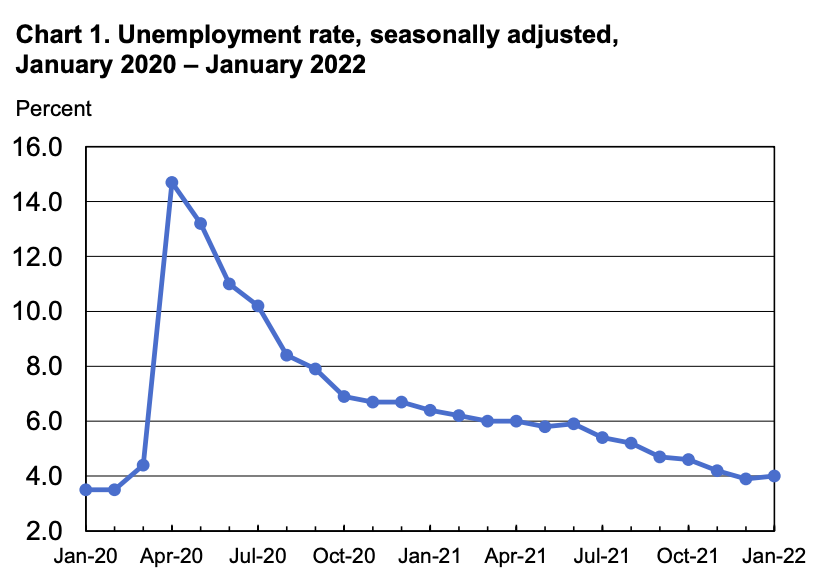

The better-than-expected jobs numbers put America’s unemployment rate at 4%— a modest increase from 3.9%, and above consensus estimates calling for an unchanged figure. Likewise, the labour participation rate also rose from 61.9% to 62.2%, surpassing expectations of no increase. The BLS also reported that average hourly earnings rose 0.7% from December and 5.7% from January 2021, further cementing concerns that inflation is still very well persistent.

But, even despite the optimistic jobs report, there were still about 3.6 million Americans employed but not working due to sickness, which is twice as many compared to December. At the same time, 6 million workers were unable to go to work because their place of employment either shut down or lost business due to Covid-19, which too, is twice as many from the month prior.

Treasury yields were sent soaring while US equities were mixed, as markets prepare for numerous interest rate increases throughout 2022. “This seals the deal for a March hike,” Moody’s Analytics head of monetary policy research Ryan Sweet told Bloomberg. “The Fed is going to take away from this that the economy is barreling toward full employment and this will make it more difficult for them to gracefully engineer a soft landing.”

Information for this briefing was found via BLS and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.