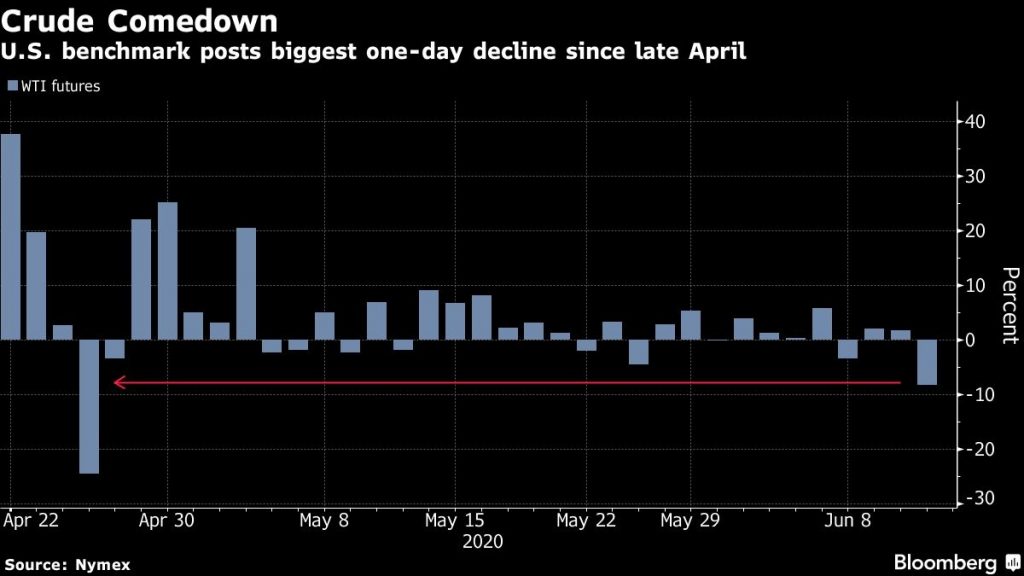

Back in April, crude oil saw a sudden and unprecedented decline as a result of the economic volatility brought on by the coronavirus pandemic. Since April however, the oil market began to slowly recover, as OPEC+ agreed on output reductions, while the demand for oil saw a positive shift in light of governments beginning to ease restrictions. Even though US crude was seemingly on a path to recovery, it has run into yet another hurdle.

The US oil market is currently experiencing a record increase in inventories, much of which can be attributed to the increasing potential of a second wave of the deadly coronavirus. Although the demand for oil was beginning to rebound as stay-at-home orders were lifted across many states, it appears consumer’s positive sentiment is starting to fade away. After oil prices began to rebound, some US oil producers decided to resume operations. As a result, inventories rose to a record 538.1 million barrels- the highest on records that date back to 1982 last week, according to the Energy Information Administration.

A drop in oil prices soon followed the sudden surge in inventories, much of which are fueled by the Federal Reserve’s pessimism regarding the state of the US economy, as well as the potential for a virus resurgence. Now that it is becoming more evident that US crude is unable to sustain a price over $40 per barrel, it will likely leave some US companies in deep financial trouble. Brent crude, which is slated for August delivery fell by $3.18 to a price of $38.55 per barrel, while WTI’s July delivery contract decreased by $3.26 to a total of $36.24.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.