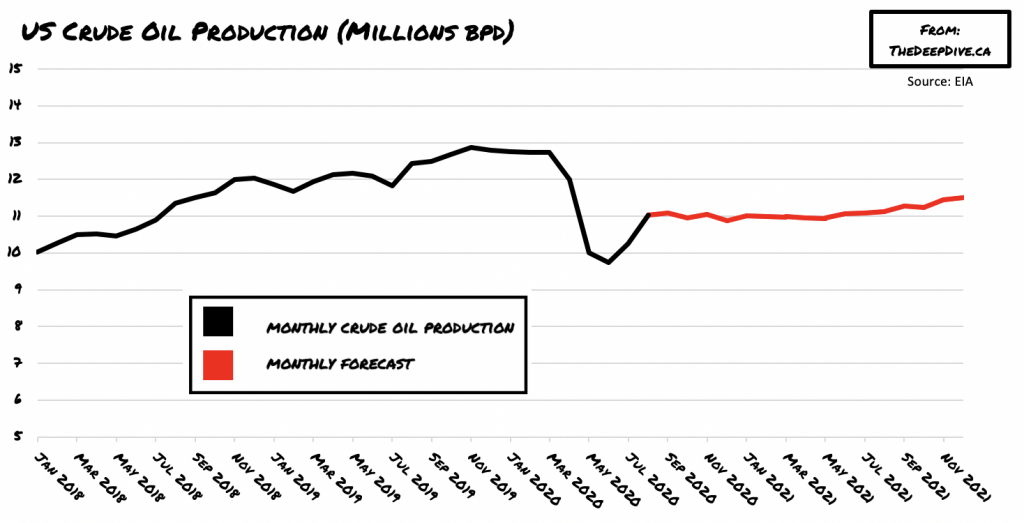

Back in July, the Energy Information Administration (EIA) had anticipated that crude oil production in the US would decline on average by 620,000 barrels per day for the current year. However, the EIA is now reassessing its estimate, and is projecting a rather more grim Short Term Energy Outlook (STEO) for August of 370,000 barrels less than originally anticipated.

The updated forecast calls for a reduction of 990,000 barrels per day, for an average production of 11.26 billion barrels per day for 2020. According to the EIA, the STEO for August is riddled with market uncertainties, given that current coronavirus mitigation efforts have been less than effective, shunning reopening efforts into contingency. The EIA based its current market assumptions on the IHS Markit’s macroeconomic forecasts, which postulate that in the first half of the year, GDP declined by 5.2%, but will be on the rise by the third quarter all the way through to 2021.

In July, monthly US crude oil production was at 10.26 million barrels per day, which is a reduction of nearly 20% since the beginning of the year. However, it is a slight improvement from June, which saw production dip to a low 9.75 million barrels per day. With the current short-term forecast however, monthly production is expected to rebound to near pre-pandemic levels, with the month of August potentially seeing oil production hit 11.03 million.

Moreover, the EIA also assumes that the accruing crude inventory levels, coupled with surplus production capacity will continue the downward drag on oil prices over the next several months. The EIA does however, estimate that oil production in the US will average approximately 11.14 million barrels per day in 2021, while US oil demand is expected to increase anywhere between 1.57 million and 20.03 million barrels per day.

Information for this briefing was found via the EIA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.