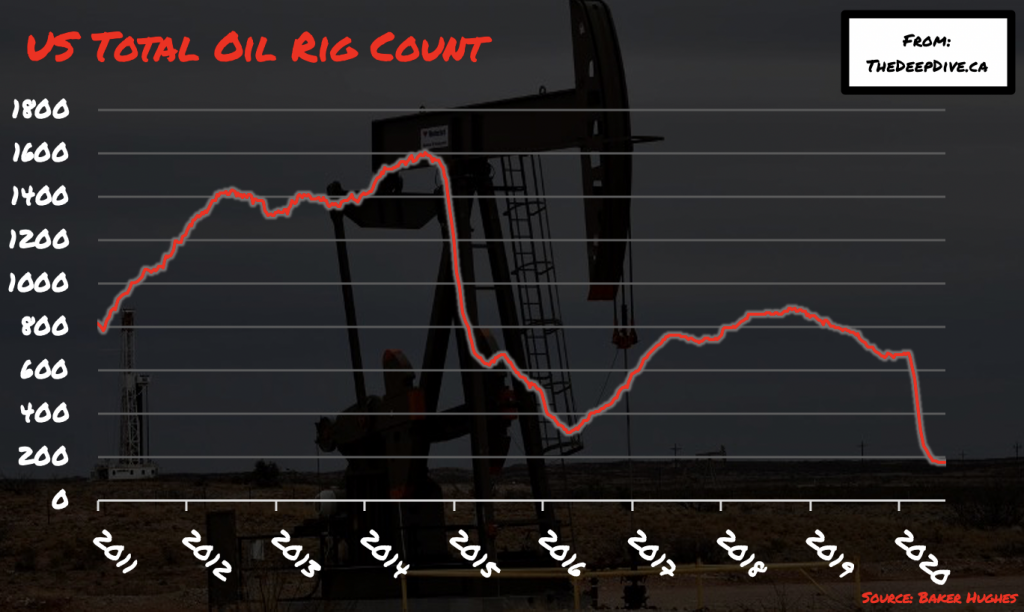

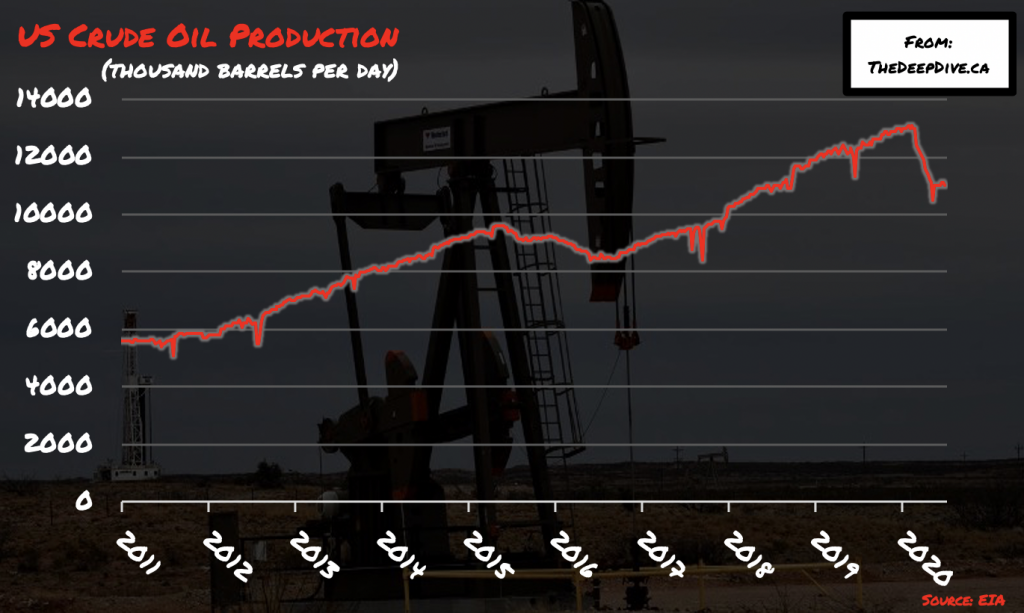

Although the recent slight increase in oil prices has prompted some US producers to begin drilling again, it appears that America’s oil industry still hasn’t reignited the recovery process

According to data compiled by Baker Hughes, the number of active oil rigs fell by another 4 this week, bringing the record-low to a total of 176. The alarming trend depicts a staggering decline from a total of 764 active rigs from the same period, only a year ago. The US oil rig count typically serves as an indicator of future production activity, and given the current market trends, many shale drillers are still not ready to return to the exponential growth momentum that was apparent before the collapse of oil prices.

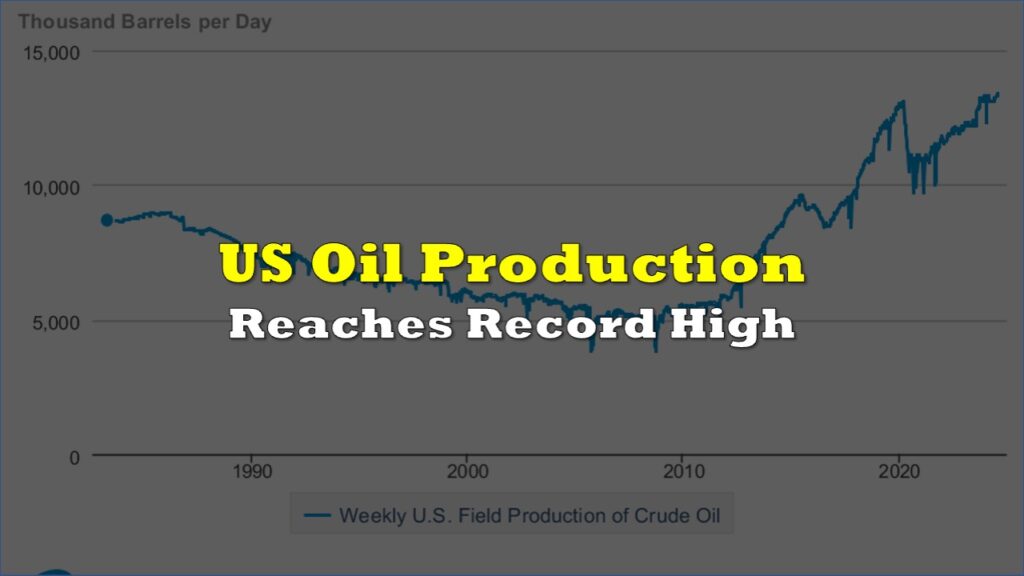

So far, oil production appears to be holding steady, as many producers are still pumping out oil; however, many have entered a survival mode and are only maintaining production with no further plans to reach pre-oil crash growth in the foreseeable future. Many US shale producers have no choice but to succumb to the damagingly-low market prices so as to not raise alarm among worried investors, and as a result are defaulting to minimum production maintenance.

Although both the EIA and the API recently announced that crude inventories have declined as some demand for fossil fuel has resumed, oil prices still remain below $50 per barrel. Given that the coronavirus pandemic is not showing any signs of going away, with cases continuously soaring across the US and much of the world, there is an increasing likelihood that such oil prices are here to stay for the time being.

With no recovery for global oil prices in sight, US shale producer’s production growth plans have certainly been set aside – some even discarded straight into the paper shredder. Instead, oil companies have been announcing massive layoffs, dividend reductions, and even bankruptcies. Even once prices do manage to somehow stagger back above $50, many will most likely not jump back to drilling new oil wells.

The collective debt for shale companies has reached a staggering $30 billion, which means that most will have a very hard time digging themselves out of the collapsing pit that is the coronavirus-induced oil crisis. As a result, those companies that do emerge out of this so-called oil price catastrophe, will need to reinvent themselves with business models that are more financially sustainable.

Information for this briefing was found via Baker Hughes, EIA, and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.